The Investment Thread

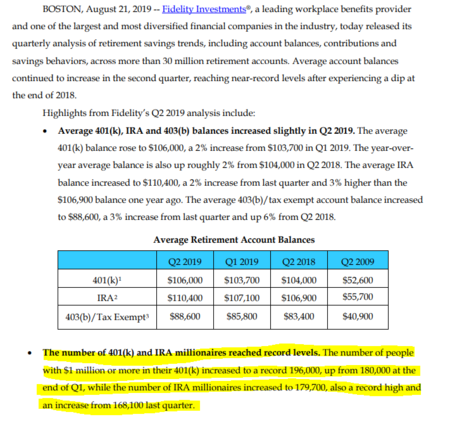

The most useful data from this is the savings rate. Fidelity is including balances but I'm skeptical about how accurate those numbers would be for a person like myself who has accounts with multiple service providers. So age 20-40 are saving 7.4% which is 1-2% above match on average, Gen-X is saving about 9%, and age 60-70 are saving 11.2% in their "oh no I didn't save enough" years.

I think the TransAmerica survey is interesting. Millennials are saving 10% of their salary and started at age 24. Gen-X is saving 8% and started at age 30. Boomers started saving at 35 and are saving 10%. Almost 1/3 of Millenials and Gen-X have taken a withdrawal from their retirement account. Boomers will benefit from pensions and higher SSA rates.

These savings rates for Gen-X are scary. This group should be at a 13-15% rate. They are going to struggle if during their peak years they can only put aside 8%.

The most useful data from this is the savings rate. Fidelity is including balances but I'm skeptical about how accurate those numbers would be for a person like myself who has accounts with multiple service providers. So age 20-40 are saving 7.4% which is 1-2% above match on average, Gen-X is saving about 9%, and age 60-70 are saving 11.2% in their "oh no I didn't save enough" years.

I think the TransAmerica survey is interesting. Millennials are saving 10% of their salary and started at age 24. Gen-X is saving 8% and started at age 30. Boomers started saving at 35 and are saving 10%. Almost 1/3 of Millenials and Gen-X have taken a withdrawal from their retirement account. Boomers will benefit from pensions and higher SSA rates.

These savings rates for Gen-X are scary. This group should be at a 13-15% rate. They are going to struggle if during their peak years they can only put aside 8%.