The Investment Thread

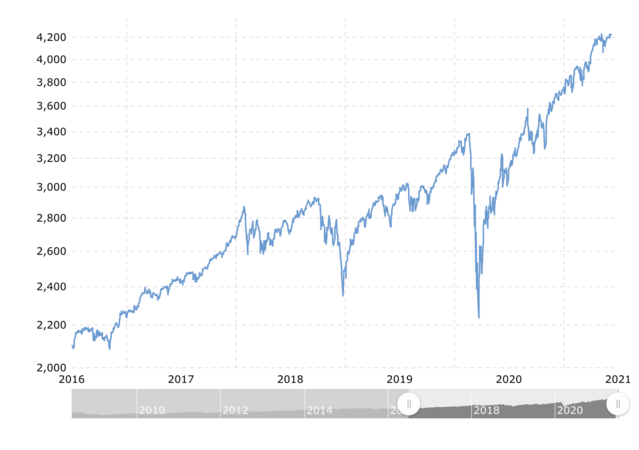

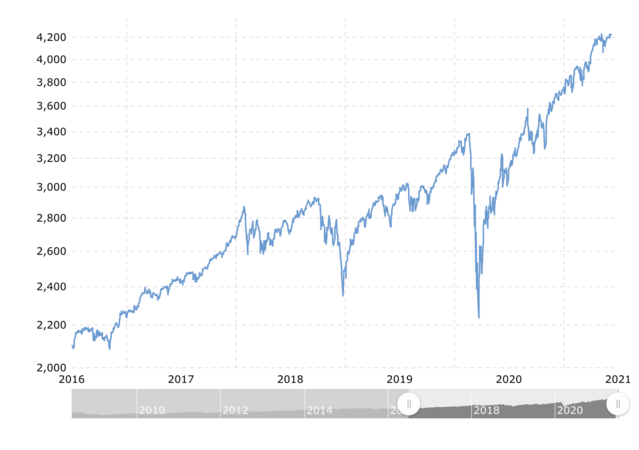

It’s interesting but the chart isn’t necessarily demonstrative. Margin is a function of total asset value, so a raw number in billions isn’t as meaningful as margin/total. Lay the S&P over that chart and you can get a sense of whether they’re in sync. But it does look like the margin chart takes a higher trajectory at the end on the right (current) so the premise could still be true.

It’s interesting but the chart isn’t necessarily demonstrative. Margin is a function of total asset value, so a raw number in billions isn’t as meaningful as margin/total. Lay the S&P over that chart and you can get a sense of whether they’re in sync. But it does look like the margin chart takes a higher trajectory at the end on the right (current) so the premise could still be true.