The Investment Thread

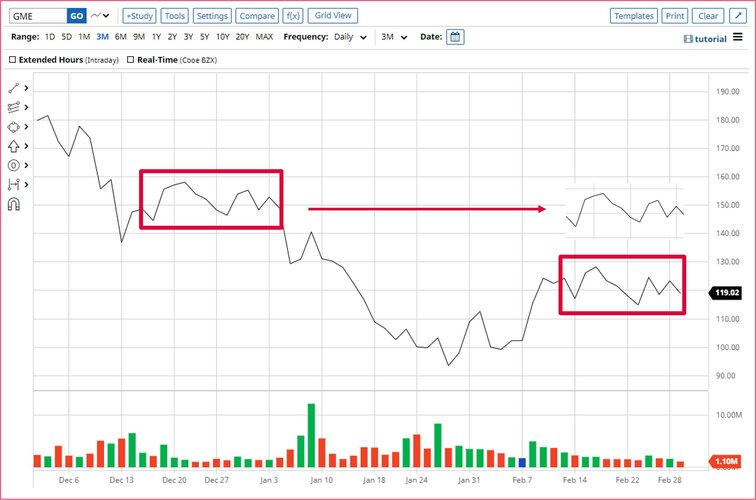

I am fully convinced at this point that virtually every stock on the market is in the midst of a Wyckoff Accumulation Pattern in some form or fashion. Whether it's intraday, hourly, weekly, monthly, or in some cases, yearly.

This is what our stock market has become. Institutions using algorithms to shake out retail from securities everyone knows are way oversold, using phony "catalysts" as narratives for run-ups and "bad news" for dumps they fully control.

Whether it is a Wyckoff Accumulation, Wyckoff Distribution, or Parabolic Arc, the day to day price action is intended to a.) get you to buy in when they want you to, for their benefit, and b.) get you to sell when they want you to, for their benefit.

And therein lies why they hate the "HODLers" so much, because we are not following the behavioral response norms that the system was designed to elicit, thus taking away their profits they figure they should already have in the bag if we were to sell when they want us to.

I am fully convinced at this point that virtually every stock on the market is in the midst of a Wyckoff Accumulation Pattern in some form or fashion. Whether it's intraday, hourly, weekly, monthly, or in some cases, yearly.

This is what our stock market has become. Institutions using algorithms to shake out retail from securities everyone knows are way oversold, using phony "catalysts" as narratives for run-ups and "bad news" for dumps they fully control.

Whether it is a Wyckoff Accumulation, Wyckoff Distribution, or Parabolic Arc, the day to day price action is intended to a.) get you to buy in when they want you to, for their benefit, and b.) get you to sell when they want you to, for their benefit.

And therein lies why they hate the "HODLers" so much, because we are not following the behavioral response norms that the system was designed to elicit, thus taking away their profits they figure they should already have in the bag if we were to sell when they want us to.