Inflation here? gas/grocery prices just continue to climb

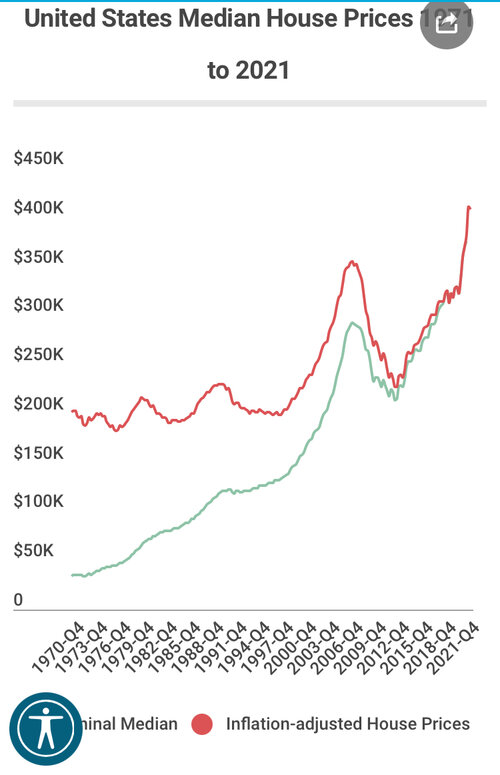

When you factor in lower interest rates, that cushions the blow somewhat. The problem is that when the low interest gravy train runs out, the rapid price increases will very rapidly become unsustainable and we'll be in a pickle then. The fed doesn't have a lot of room to increase interest rates to cool the markets without outsized demand destruction of housing. Another 1-2% higher and you'll see demand drop dramatically. Borrowing $1 million at 3.5% for 30 years is miles different than 6%.