The Investment Thread

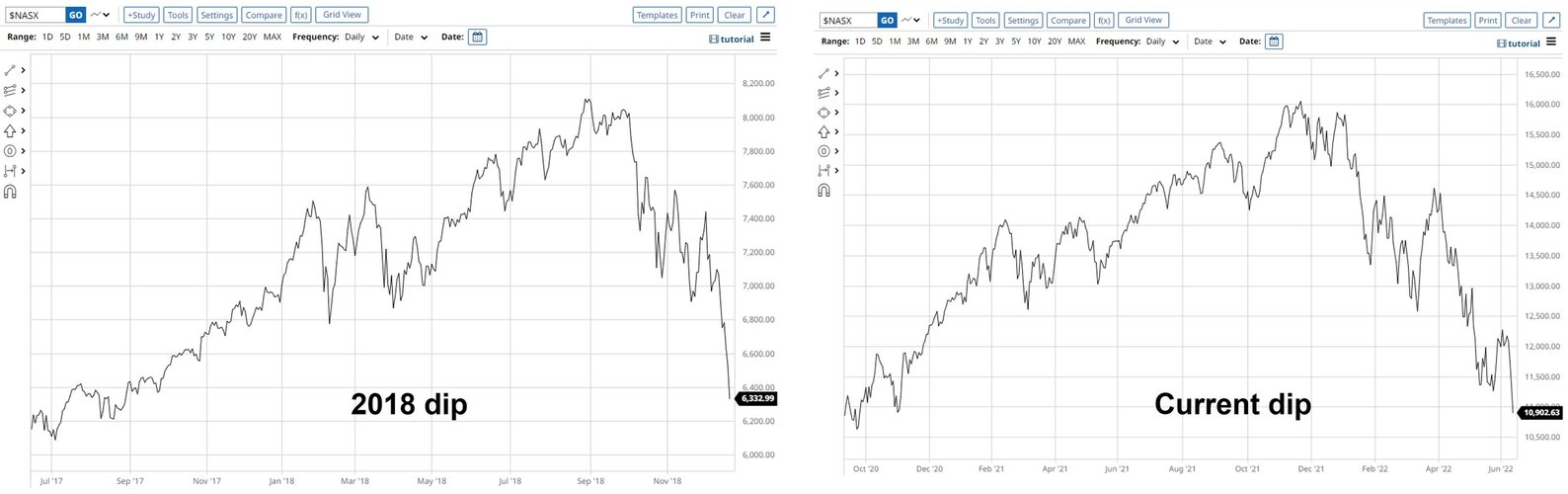

2018-

Fed Rate was near target rate of 2.5% after 4 consecutive rate hikes.

Inflation rate was below the target rate of 3%.

The economy was still expanding.

2022-

Fed Rate is not even half way to tightening.

Inflation is running almost triple the FED target rate.

The economy is slowing.

The 2018 dip was a 3 month correction. We are in month 6 so far of downtrend.

Could be we've hit bottom and will soar from here. Back to PE ratios, they are still high. 19 is still above historical norms. Still triple what they were the last time we had inflation and rate hikes.

I'll be very surprised if this time isn't different than most of the other market breakdowns in the last 23 years because we have been addicted to cheap money and government debt. If the market does turn down and a recession is coming then the FED will can't bail us out without stimulating inflation.

This is not covid related. It dates back to 20 years of really bad fiscal policy. I personally hope we suffer. Not because it is what is best for us now but it is what is best for us moving forward. Get rates up, get inflation down and let the markets work things out. Time to take our medicine, we are sick now. Let's not ignore the disease until it is fatal. It isn't political either. Bush spent far more than any president in history. Obama spent far more than Bush. Trump spent far more than Obama. Biden is on pace to spend more than Trump. In order for regimes to get reelected they have to spend a ton of money because we have a big bloated free market system addicted to free/easy money and that money isn't coming from any real source. If the elected regime doesn't spend like crazy then economy crashes and they don't get reelected.

This could be like 2018 and the markets and American consumer pull victory from the jaws of defeat but quite honestly, I hope it isn't or the bubble will just reinflate again.

A couple of key differences.

2018-

Fed Rate was near target rate of 2.5% after 4 consecutive rate hikes.

Inflation rate was below the target rate of 3%.

The economy was still expanding.

2022-

Fed Rate is not even half way to tightening.

Inflation is running almost triple the FED target rate.

The economy is slowing.

The 2018 dip was a 3 month correction. We are in month 6 so far of downtrend.

Could be we've hit bottom and will soar from here. Back to PE ratios, they are still high. 19 is still above historical norms. Still triple what they were the last time we had inflation and rate hikes.

I'll be very surprised if this time isn't different than most of the other market breakdowns in the last 23 years because we have been addicted to cheap money and government debt. If the market does turn down and a recession is coming then the FED will can't bail us out without stimulating inflation.

This is not covid related. It dates back to 20 years of really bad fiscal policy. I personally hope we suffer. Not because it is what is best for us now but it is what is best for us moving forward. Get rates up, get inflation down and let the markets work things out. Time to take our medicine, we are sick now. Let's not ignore the disease until it is fatal. It isn't political either. Bush spent far more than any president in history. Obama spent far more than Bush. Trump spent far more than Obama. Biden is on pace to spend more than Trump. In order for regimes to get reelected they have to spend a ton of money because we have a big bloated free market system addicted to free/easy money and that money isn't coming from any real source. If the elected regime doesn't spend like crazy then economy crashes and they don't get reelected.

This could be like 2018 and the markets and American consumer pull victory from the jaws of defeat but quite honestly, I hope it isn't or the bubble will just reinflate again.