The Investment Thread

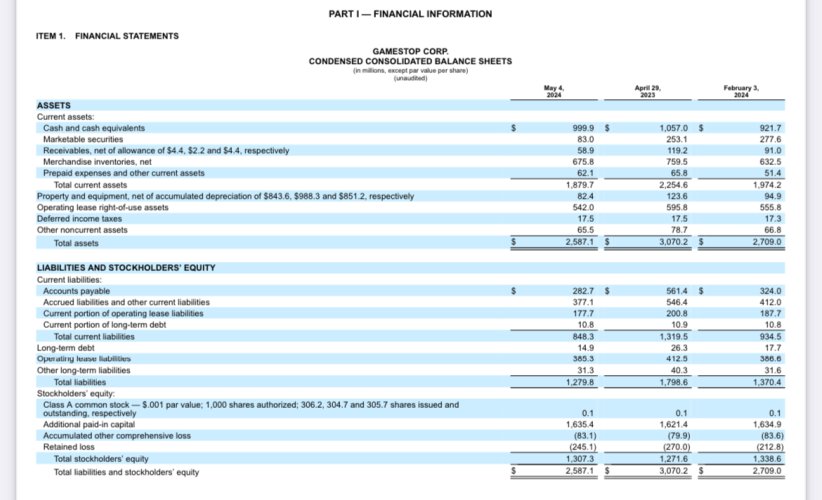

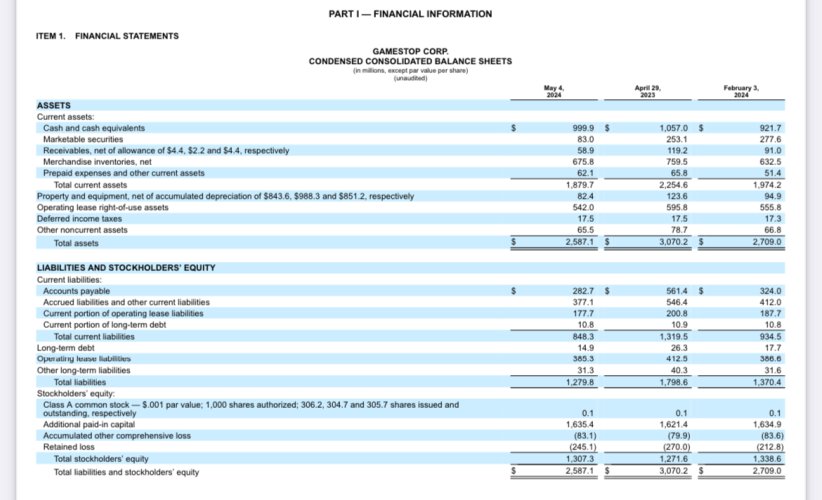

But really their “debt” on their balance sheet is $14.9 million. Which is from a low interest French loan relating to the Covid pandemic.

They obviously have other liabilities, but in terms of debt it’s $14.9 million.

This was published today in the 10Q, it does not include the 3 billion they just raised in the past few weeks.

The company continues to face extreme challenges in terms of finding new revenue sources. I was reading the annual reports of Electronic Arts and Activision last weekend. I went on quite the deep dive.

Fiscal year 2012 for Activision: sec.gov link

Fiscal year 2012 for Electronic Arts:cloudfront link

In the PDFs, you can use Ctrl+F and type "GameStop" to find relevant information.

From 2007 to 2015, GameStop accounted for 13% of all net revenue for Electronic Arts, averaging $511 million per year. Similar trends were observed for Activision, with GameStop accounting for 12% of their revenue in 2012, which represented $362 million. Combined, the sales of Electronic Arts and Activision games contributed $870 million in revenue for GameStop annually.

In 2012:

Latest annual report filings reveal the following revenue breakdown:

Currently, GameStop does not disclose the distribution of its sales between packaged goods and digital sales.

I fully understand the bear thesis.

I’m definitely drinking the Kool-Aid. Their marketcap right now is definitely not based on fundamentals. It has much more to do with years of accumulated shorting and cellar boxing. Plus the gamma pressure that DFV is doing. I suspect he sold his $20 calls and bought $25 or $30 calls. He is building a gamma ramp on his own.

But really their “debt” on their balance sheet is $14.9 million. Which is from a low interest French loan relating to the Covid pandemic.

They obviously have other liabilities, but in terms of debt it’s $14.9 million.

This was published today in the 10Q, it does not include the 3 billion they just raised in the past few weeks.

The company continues to face extreme challenges in terms of finding new revenue sources. I was reading the annual reports of Electronic Arts and Activision last weekend. I went on quite the deep dive.

Fiscal year 2012 for Activision: sec.gov link

Fiscal year 2012 for Electronic Arts:cloudfront link

In the PDFs, you can use Ctrl+F and type "GameStop" to find relevant information.

From 2007 to 2015, GameStop accounted for 13% of all net revenue for Electronic Arts, averaging $511 million per year. Similar trends were observed for Activision, with GameStop accounting for 12% of their revenue in 2012, which represented $362 million. Combined, the sales of Electronic Arts and Activision games contributed $870 million in revenue for GameStop annually.

In 2012:

- EA had a total net revenue of $4.1 billion, with $2.7 billion from packaged goods sold at retailers and $1.4 billion from digital/online sales.

- Activision had a net revenue of $4.5 billion, with $3.0 billion from packaged goods and $1.5 billion from digital/online sales.

Latest annual report filings reveal the following revenue breakdown:

- In 2022, Activision reported $7.5 billion in net revenue, with only $230 million from packaged goods (3% of total sales).

- In 2023, Electronic Arts reported $7.56 billion in net revenue, with $672 million from packaged goods (8.8% of total sales).

Currently, GameStop does not disclose the distribution of its sales between packaged goods and digital sales.

I fully understand the bear thesis.