Snakehead

Hall-of-Famer

Offline

What sites are y'all using to by cryptocurrency? Coinbase, Gemini, Kraken, etc?

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: this_feature_currently_requires_accessing_site_using_safari

I was listening to Jim Rogers on a podcast and he was saying he isn't on board with Bitcoin for multiple reasons. The main reason being the government can make it illegal at anytime and then the value would crash. Amusingly he said he was investing in Chinese wine.

Jim Rogers - Wikipedia

en.wikipedia.org

I was listening to Jim Rogers on a podcast and he was saying he isn't on board with Bitcoin for multiple reasons. The main reason being the government can make it illegal at anytime and then the value would crash. Amusingly he said he was investing in Chinese wine.

Jim Rogers - Wikipedia

en.wikipedia.org

I think there's a greater chance of Chinese wine becoming illegal than bitcoin.

If Bitcoin was ever to even remotely appear to be a threat to the dollar hegemony, the state would make it illegal and cite something stupid like terrorism or organized crime. They already hint at such things with Bitcoin.

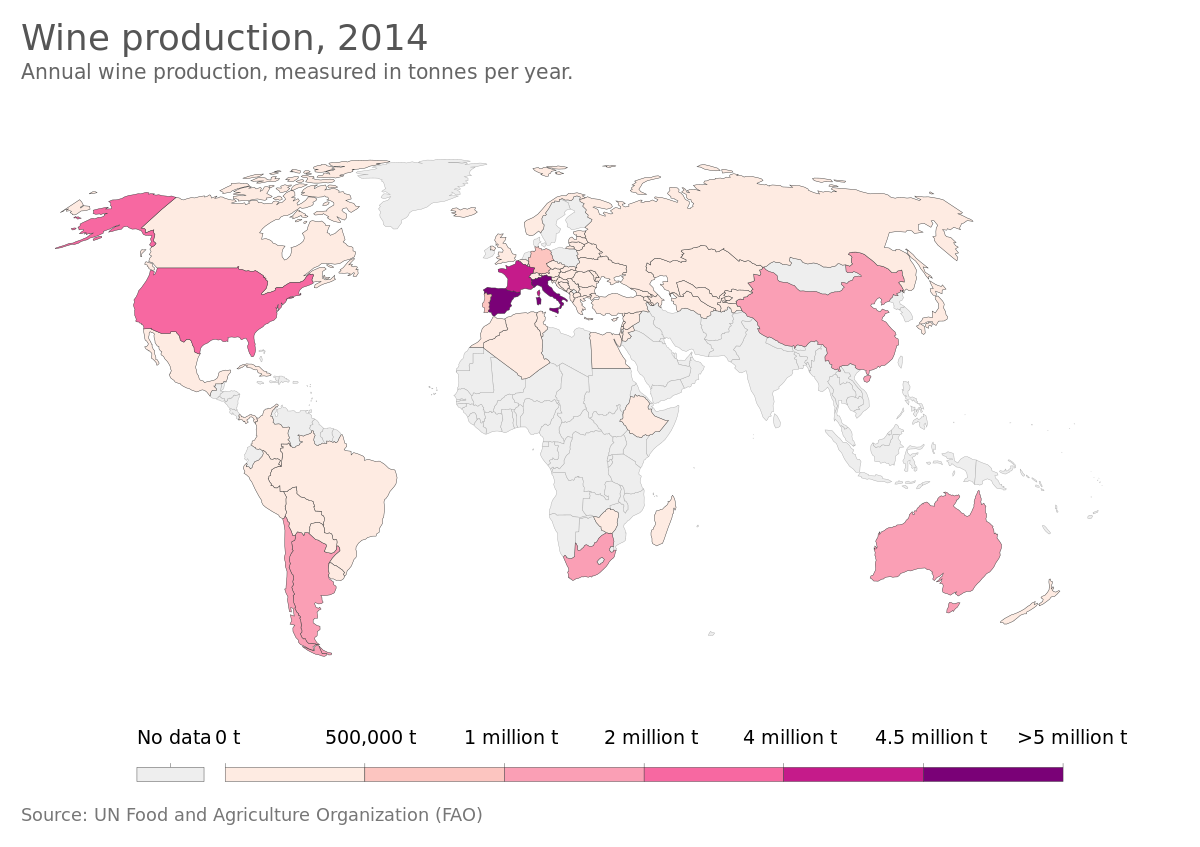

Also China is currently 5th in wine production and growing.List of wine-producing regions - Wikipedia

en.wikipedia.org

If Bitcoin was ever to even remotely appear to be a threat to the dollar hegemony, the state would make it illegal and cite something stupid like terrorism or organized crime. They already hint at such things with Bitcoin.

Also China is currently 5th in wine production and growing.List of wine-producing regions - Wikipedia

en.wikipedia.org

I bet he buys the heck out of it on the dipI was listening to Jim Rogers on a podcast and he was saying he isn't on board with Bitcoin for multiple reasons. The main reason being the government can make it illegal at anytime and then the value would crash. Amusingly he said he was investing in Chinese wine.

Jim Rogers - Wikipedia

en.wikipedia.org

If the US ever made it illegal, they would have to bail out the industry. People are getting paid salaries in Bitcoin now. I don't think it's going anywhere.

Contracts also used to be payable in gold, and FDR made that illegal.

All my contracts mandate I be paid in cadmium. Its the real currency of the future.