baarbogast

Hall-of-Famer

- Joined

- Jan 30, 2002

- Messages

- 17,656

- Reaction score

- 20,931

- Age

- 58

Online

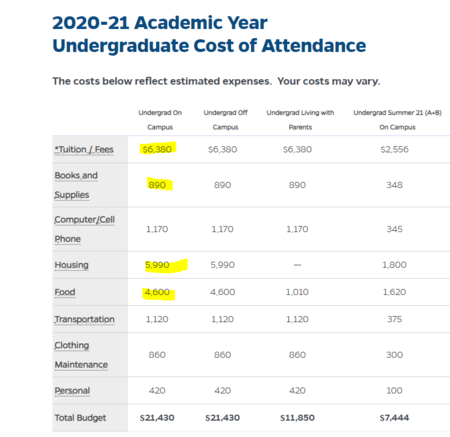

Ohio used to be 100% for state schools and they would pay $600/yr or a % of your loans annually. You could also get drill pay, GI Bill , some sort of a kicker.If I remember correctly it’s only about 18,000 overt 4 years.