- Joined

- Aug 1, 1997

- Messages

- 23,700

- Reaction score

- 20,905

- Age

- 53

- Location

- The People's Republic of Indianastan

Offline

An article about this very thing

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: this_feature_currently_requires_accessing_site_using_safari

Yes. I foresee a full blown crisis. As much as I do not like government intrusion into our lives, I think the federal gov't will have to play some sort of role in this. The biggest hurdle is a small subset of the country is impacted by hurricanes. Lawmakers in the 40 states that aren't affected by these systems will balk at any financial help. Only hope is to tie in various natural disasters all into one (hurricanes, earthquakes, freezes, etc.). This will not be an easy fix.Most people's insurance is paid through there mortgage. So what happens when thousands or more people can't afford the $200-$300 per month increase on their mortgage payments. Or new home sales, with higher interest rates and insurance increases your monthly note on a modest house just increased $500+. This is going to hurt a lot of people.

Yes. I foresee a full blown crisis. As much as I do not like government intrusion into our lives, I think the federal gov't will have to play some sort of role in this. The biggest hurdle is a small subset of the country is impacted by hurricanes. Lawmakers in the 40 states that aren't affected by these systems will balk at any financial help. Only hope is to tie in various natural disasters all into one (hurricanes, earthquakes, freezes, etc.). This will not be an easy fix.

I dropped USAA insurance several years ago because they were jacking up rates like crazy in NC.Sue their arses. Run up the costs they're going to pay as a way to make them atone for the damages they're shirking.

How a company with member satisfaction went from the only company I'd ever recommend to looking up a mile at the dirty underbelly of Allstate is beyond me.

They are really the absolute worst.

How do you delineate that line? So someone 100 ft back of you can get, but you can't? That would cause some issues I'm sure. And with ever changing topography, how often does the governing body redo maps?How about those who build within a 15 foot storm surge not carry insurance? I quit carrying home owners insurance after Dennis.

If you're going to build in an area that will incur significant damage from, just say a Cat.1 storm, then you take on the risks of losing what's inside.

When I was growing up, Pensacola Beach had only one or two story concrete homes with concrete floors.

I dropped them for auto and will for homeowners at renewal time. They don’t cover me for wind damage. I didn’t catch that at last renewal. The coverage I do have is a little expensive for what I have and seems to be protecting me for fire damage, if a tornado comes along they have said that I’m on my own.I dropped USAA insurance several years ago because they were jacking up rates like crazy in NC.

Seems like when I started seeing their advertisements and such everywhere (instead of them being more of a word of mouth kind of company) that they started declining. I still use them for banking, but nothing else. And they used to be the best of the best. So sad to see such a great company seemingly get greedy and put profits above service.

I am at a conference in Nashville this week and when people learn that I am from La they feel the need to tell me how bad they have it in their State. An agent from Virginia told that he had trouble writing property insurance 10 miles from their coastal area. I told him that I was having trouble writing property insurance south of Shreveport. When he googled Shreveport he realized how his complaint sounded.

I have had a few promising conversations with several carrier reps.

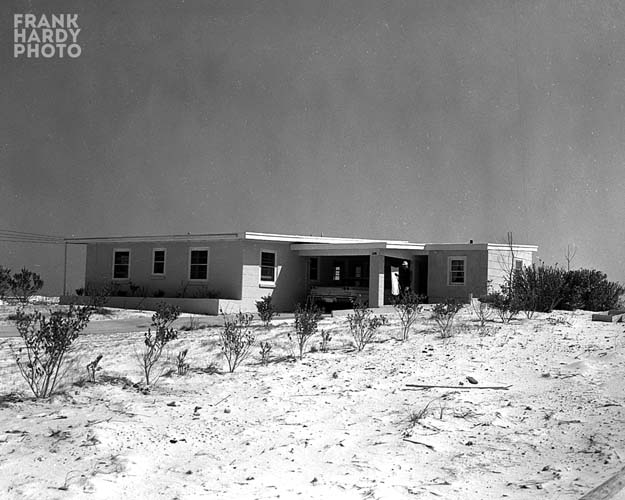

Is that 305 Panferio?How about those who build within a 15 foot storm surge not carry insurance? I quit carrying home owners insurance after Dennis.

If you're going to build in an area that will incur significant damage from, just say a Cat.1 storm, then you take on the risks of losing what's inside.

When I was growing up, Pensacola Beach had only one or two story concrete homes with concrete floors.

I dropped them for auto and will for homeowners at renewal time. They don’t cover me for wind damage. I didn’t catch that at last renewal. The coverage I do have is a little expensive for what I have and seems to be protecting me for fire damage, if a tornado comes along they have said that I’m on my own.

It says nothing about named storms. Im not on the coast. I’m about 21 miles south (as the crow flies) of Meridian, MS.When did tornadoes become named wind storms?

Whatever the case, screw USAA.

I'm going to take every expert case against them I can gather and may even do some pro bono just because I hate so much what they've become.