Offline

yes I have a good friend in family law in NOLA. But dad had all the legal contacts I could want right here. I will seek out that advice today. Thanks for your time my friend.

Good luck brother.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: this_feature_currently_requires_accessing_site_using_safari

yes I have a good friend in family law in NOLA. But dad had all the legal contacts I could want right here. I will seek out that advice today. Thanks for your time my friend.

Please allow me to threadjack here, as I also have a (much simpler) question about succession that doesn't warrant its own thread.

My father passed last year. No will, but only heirs is his wife (my Mother) and myself. There is nothing to contest as I am happy for her to have everything. We completed a simple succession.

The only assets were their house and some minor savings/investments. Nowhere near the minimum threshhold for inheritance tax in Louisiana.

We sold their house in December (Mom now in assisted living center). I was considered half owner since the succession. Half of the cash went to her and half to myself, along with a 1099 for taxes. I plan on giving the cash back to her for her living expenses.

My question is: Is not the house considered part of the inheritance? If so then I should be able to avoid the tax on the sale, right? Or is real estate exempt from the inheritance tax protection?

www.realtor.com

www.realtor.com

My question is: Is not the house considered part of the inheritance? If so then I should be able to avoid the tax on the sale, right? Or is real estate exempt from the inheritance tax protection?

Everyone reading this post needs to have a will, powers of attorney, and guardianship documents (if you have kids). It doesn't matter how old you are . . . and if your parents or older loved ones don't have these things, encourage them to do it right away. Waiting only invites trouble - you can't expect to get them done from a hospital room.

6 Estate Planning Must-Haves

What you need to know in your estate planning even if you do not have significant assets. Here are six key ideas for a successful asset transfer.www.investopedia.com

Interesting that you bring this up. I was just talking to my nephew last night who is in the Navy. His dad (my brother) is dead and he has no relationship with his mom. He was telling me that his base has some group of lawyers going to be there this week to help them all set up wills free of charge. In this conversation he told me that if he dies, I'll get $200k. I was like thanks for letting me know but I'd rather not have the $200K and you just stay alive.

Just last week, I was talking to the guy I've been dating about this same thing and how his company every year during open enrollment stresses to people to please reconfirm and pay attention to who they have left their life insurance policies to (even just the 1x annual salary policy that their company pays out regardless if you buy additional) because they've had several people who have died and forgot to take an ex girlfriend or whatever off their policy and have married/re-married and then their wives don't get the money.

I think this is more of a tax question than a successions/estate question.

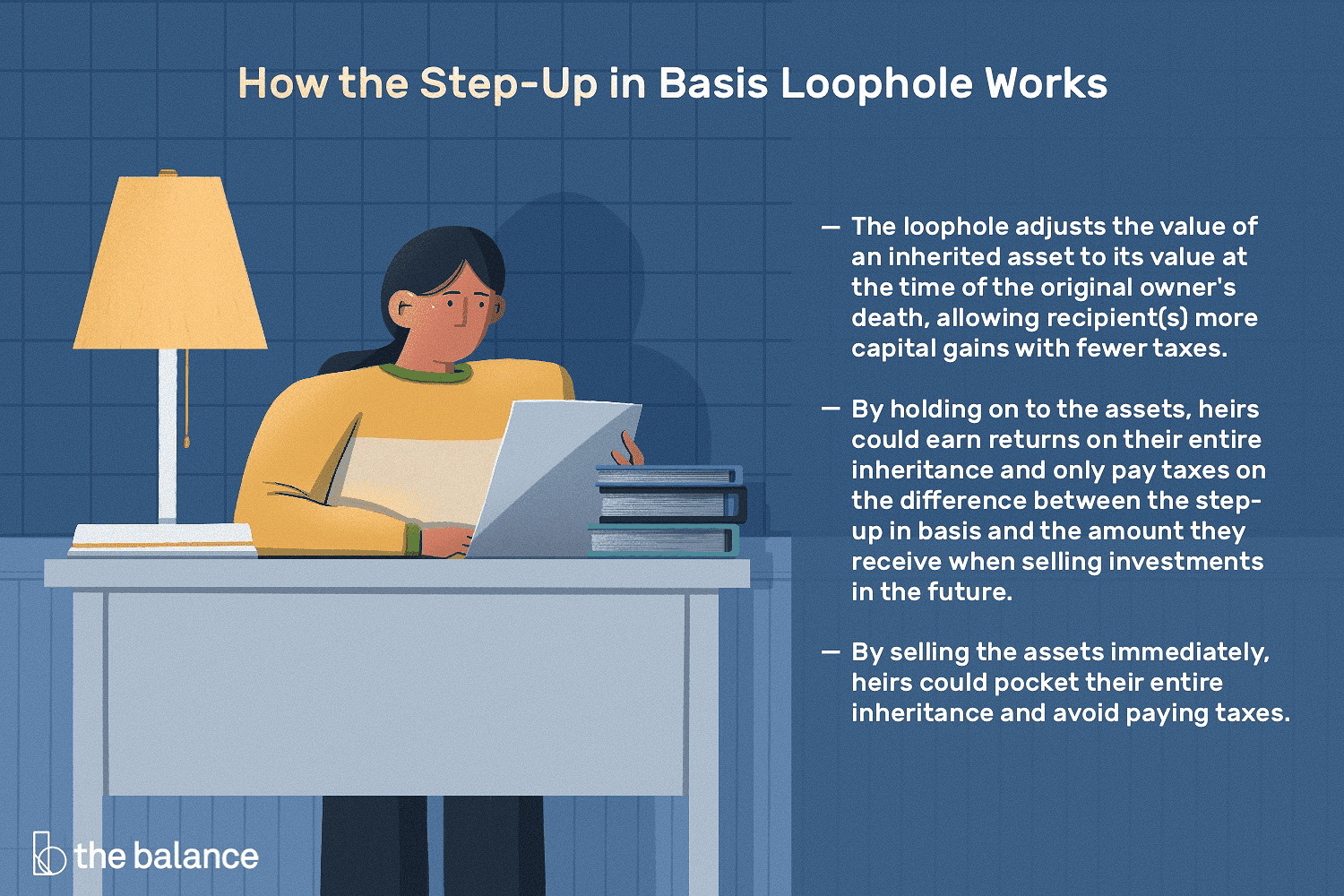

The succession transfers the house, not the value of the house, so if the house is subsequently sold, that's a taxable event. And the tax is on a capital asset, so it is a capital gain. But I think the basis for the gain of an inherited house is "stepped up" to the value of the asset at the time of the owner's death. If that was recent, it probably means there is no gain.

If You Inherit a House and Sell It, How Are the Profits Taxed?

If you sell a house that you have inherited, you will be taxed on the profits, also referred to as your "capitol gains."www.realtor.com

What Is a Step-Up in Basis?

The step-up in basis loophole allows people who inherit property to enjoy low capital gains taxes. Learn what it is and how it works.www.thebalance.com

**note: not a lawyer

Inheriting is the trigger for inheritance taxes. That has already happened (and you didn't pay tax). When you sell it, you potentially trigger capital gains taxes. However, when you inherited the property, you basis became the fair market value of the house. Although that number is arguable, if you are selling it shortly after inheriting it, there shouldn't be significant change in that value, so you shouldn't owe any tax.

Or, what chuck said.

You aint kidding my wife has a money hungry sister who wants anything she can get her hands on. for instance when my wife's father died her sister got all the nice things. She turned around and sold it.Yeah, that's just an awful situation, I can't imagine. I think Optimus was in a similar situation with his mother last year (though perhaps without the step-parent).

This just shows us all why it's so important to have the will and appointment documents done when we're not facing a life-threatening illness or situation. The emotions and challenges become so much greater.

Everyone reading this post needs to have a will, powers of attorney, and guardianship documents (if you have kids). It doesn't matter how old you are . . . and if your parents or older loved ones don't have these things, encourage them to do it right away. Waiting only invites trouble - you can't expect to get them done from a hospital room.

6 Estate Planning Must-Haves

What you need to know in your estate planning even if you do not have significant assets. Here are six key ideas for a successful asset transfer.www.investopedia.com

not ready to lawyer up but I do want to educate myself here.

As some picked up on in another thread my Dad passed last night. It was a long hard fight with the Big C. In the midst of his battle, My step mother refused to be his caregiver during his last resort (stem cell transplant has to have someone designated) It was the last straw so after the transplant he began divorce discussions and they agreed to the legal splits on most items.

Here is the tricky part. Though dad was a divorce attorney himself, he didn’t have a will in place. Toward the end, we would ask him about his wishes but we could see that it distressed him so we never pushed. What he told us about La law is that without a will, his property flows to the children. But he also told us that if she decides to stay in the house that constituting what is half is the tricky part.

Things are extremely volatile with my step mother because at the end, whenever he would get out of the hospital, he would go home and get sick again. He would become unresponsive to texts and she would refuse to help us get him medical attention, including refusing to help his doctors get in touch with him even though she was in the same house with him. Ill stop short of saying exactly what I think she was trying to do but his doctors advised that it was elder abuse. And she refused to let anyone come to the house, even explicitly telling me and my sibling we were not welcome at the house. I’m not pursuing criminal at this time; we count our blessings that he got himself to the hospital that last time. I say all that just to show that this isn’t a pretty relationship.

Dad had a lot of stuff that was sentimental for us. He was an antique collector since we were children. I’m not so much interested in trying to get his things right now because I don’t want to get that emotionally invested in a fight. I am, however, very interested in what we can do as far as documenting what is in the house. I have a mental image of her just selling all that stuff off and us not knowing.

I wanted a trusted place to learn about our options as far as Louisiana law is concerned. Like is there a way to get the home inventoried.