- Admin

- #2,131

Offline

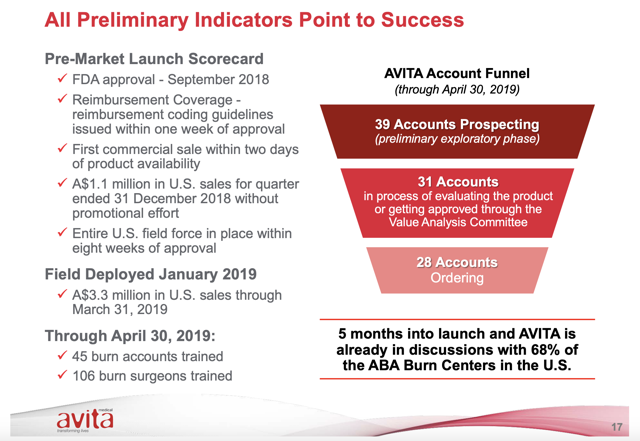

You've mentioned them before. It's positive they are on the NASDAQ now. But, many, that operations loss better start to turn around...Get some RCEL. Just recently uplisted to the NASDAQ.. Sitting currently at about $7.29. Do some research. You guys may be surprised. UMC were in on the clinical trials. Got FDA approval last year. Was previously an OTC stock. It was used on a local fireman that was burned in a response to a house fire in Metairie. Like I said. Do some research.

Hot Potential For Avita Burn Regeneration Device

Avita's FDA premarket approval for its RECELL severe burn treatment device makes it a serious contender for medical device-related risk capital. Avita is someth

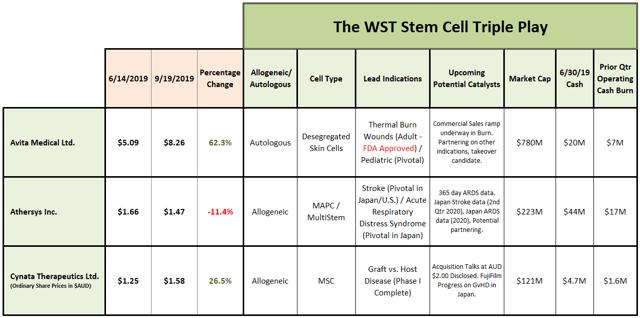

The Stem Cell Triple Play Revisited

We review significant developments in the last three months in our the stem cell triple play and how they create value moving forward. Avita Medical's better mo

Last edited: