Online

Anyone familiar with Titan?

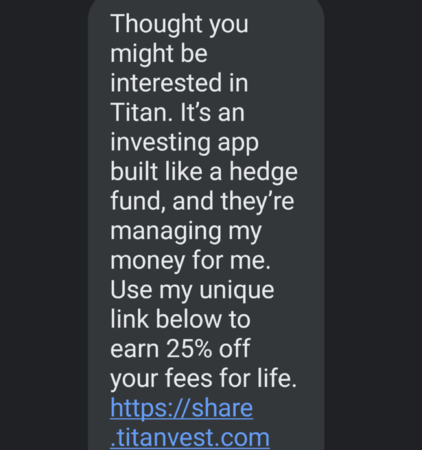

Got a friend who knows how to read markets pretty well and he's started using them and recommended since I don't fancy myself a savvy investor. They tout really good returns for low fee's, but I like to get multiple opinions.

TIA

Titan — Low Effort. High Yield.

Cash management, investing, and retirement planning. With Smart Cash, you automatically move money to our highest rate and outsmart taxes.investors.titanvest.com

Haven't heard of them. Looks like annual 1% fee, which is pretty standard I think.