Offline

Another thing I can’t explain. In mid March someone bought millions of short term call options at $800 for GME.

The theory on that one is it was Hedge Funds

I sort of understand some of that (but still not most of it) - but I don't see how anyone can do anything with buying 173K calls on June 3 with a June 4 expiry and a strike price at 3x share price other than be betting on a big jump. If the idea is derivative value, I would think you would need some bit of time to make those dynamics work - not just one freakin' day.

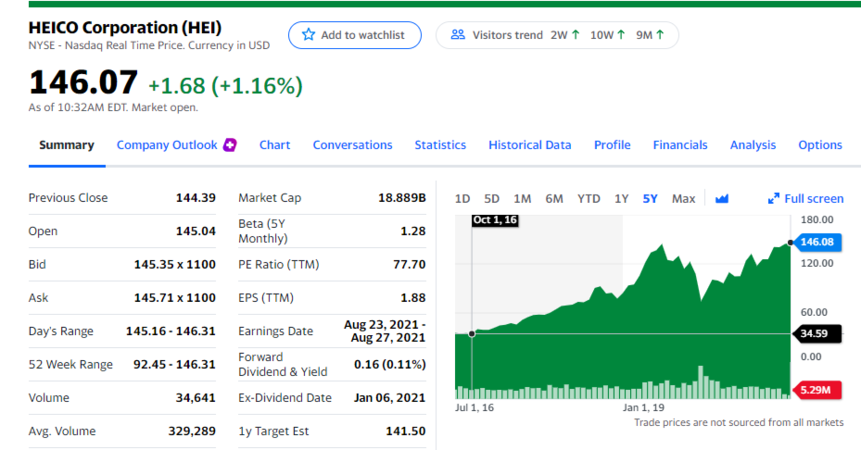

I don't think it's a coincidence that $145 is the highest strike on the main platform chains (I don't know enough about whether higher strike price is available but those are the ones that display). And you make money on the option price not the strike, so as long as the option price is going up, you make money if you sell . . . it doesn't mean they think the stock will trade at $145, it just means that they think its going to go up enough that some trader out there thinks $145 is possible or at least possible enough to get another buyer as the day moves on.

But it just seems like huge gamble ($2.1 million to be exact) that there will even be a buyer - unless there really is a very big jump in the share price (without a buyer, your call is worth dick unless you plan on holding those shares you have the right to buy at a massive premium). To have $2M worth of confidence in that without knowledge of something seems unrealistic - but it's amazing how much leeway some of these spec traders have (b/c the payouts on the rare times they come through are enough to support all the times they don't).

Or maybe they do plan on exercising and buying those shares to then contract to short? But why $145?