I still don’t understand why white collar financial crimes are almost exclusively civil fines, but if I broke into a bank undetected and got caught stealing….it would be a criminal prosecution.$2million... what's that in relation to the benefit they derived from this scheme? Another slap on the pinkie?

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The Investment Thread (1 Viewer)

- Thread starterSaint_Ward

- Start date

- Latest activity Latest activity:

Second tweet in as many nights about shorts.

I believe Cohen had direct conversations with the SEC and DOJ over the past year about GameStop being illegally sold short. Wouldn’t shock me if RC ended the discussions with a warning.

That warning seems to have been conveyed to a degree. For example - The active DOJ probe into short sellers and the SEC putting everyone on blast yesterday for “risk management” and “concentrated positions”.

bclemms

More than 15K posts served!

Offline

My straddle plays about to pay off big. Bought TSLA calls 3/18 expiration calls at $840, puts at $660 for about a $1 each. Will open on the edge of the money.

Bought a ton of AA $16 calls and $12 puts for pennies. They are opening in the money. Basically was buying 12:1 odds on each side expecting big movement.

Grabbed a ton of EJR $15 calls for next week for a penny, those have tripled in price but the stock hasn't bounced like I was expecting yet.

Dumping the call positions at the bell and holding the puts. Still have plenty of call options on airlines that expire in May.

Bought a ton of AA $16 calls and $12 puts for pennies. They are opening in the money. Basically was buying 12:1 odds on each side expecting big movement.

Grabbed a ton of EJR $15 calls for next week for a penny, those have tripled in price but the stock hasn't bounced like I was expecting yet.

Dumping the call positions at the bell and holding the puts. Still have plenty of call options on airlines that expire in May.

bclemms

More than 15K posts served!

Offline

AMC seems so prime for a huge run. I can't imagine having short positions and not closing them out when the price bounced off the neckline of it's original big run twice. I really can't imagine holding with the idea it will go back to $2.

jboss

All-Pro

- Joined

- Dec 2, 2008

- Messages

- 5,077

- Reaction score

- 6,287

Offline

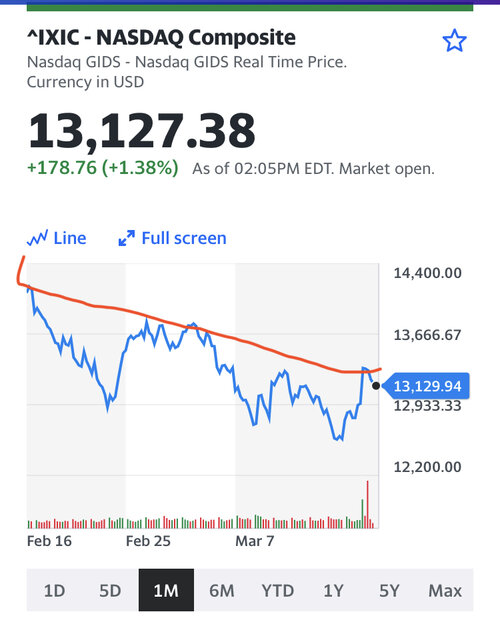

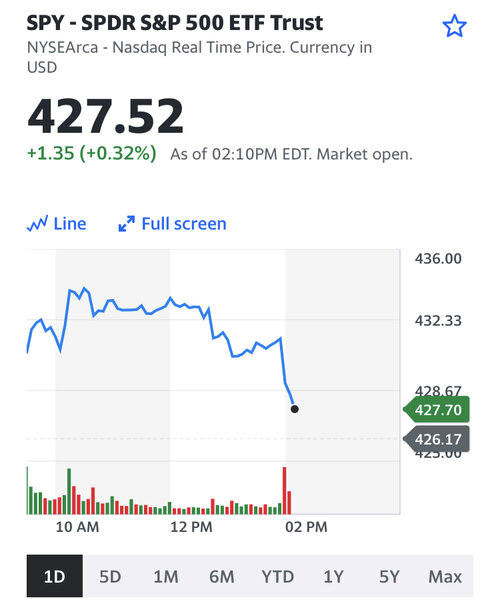

Seems like the jump today, especially in NASDAQ, is due to the announcement. Investors reacting to the priced in .25% hike. Hopefully enough to eventually reverse the downtrend.

The Nasdaq jumped more than 400 pts in the last 90 minutes of trading today. That was a serious end of day rally.Seems like the jump today, especially in NASDAQ, is due to the announcement. Investors reacting to the priced in .25% hike. Hopefully enough to eventually reverse the downtrend.

bclemms

More than 15K posts served!

Offline

Yeah, the market has just been waiting for some clarity. The markets can overlook a global shutdown and biggest pandemic in 100 years but it can't handle uncertainty. lolThe Nasdaq jumped more than 400 pts in the last 90 minutes of trading today. That was a serious end of day rally.

It was primed for a massive move either way. It had been sitting on major support levels and testing them the last week so it was either going to break through or turn really bullish and it was all setting up on the Fed's meeting. I made a ton on call options today even though I ended the day with a bunch of puts that are worthless. It was the perfect straddle opportunity. Just needed big movement either way to make money and got it.

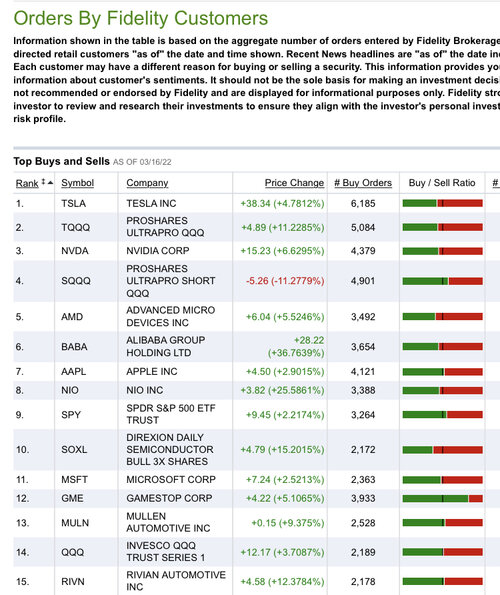

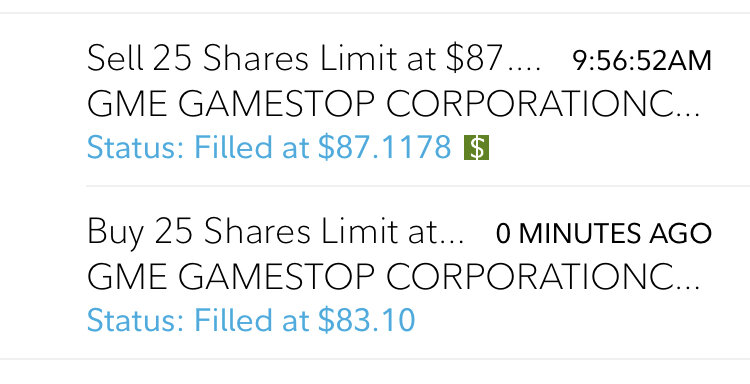

I also anticipated some volatility. I did something dirty today. Will probably have to bathe myself clean of my sins. I day traded some of my brokerage shares of GME.Yeah, the market has just been waiting for some clarity. The markets can overlook a global shutdown and biggest pandemic in 100 years but it can't handle uncertainty. lol

It was primed for a massive move either way. It had been sitting on major support levels and testing them the last week so it was either going to break through or turn really bullish and it was all setting up on the Fed's meeting. I made a ton on call options today even though I ended the day with a bunch of puts that are worthless. It was the perfect straddle opportunity. Just needed big movement either way to make money and got it.

Ended up swiping $100 to buy a “free” GME share. Last time I tried this I lost money.

- Moderator

- #8,038

Online

Nice job. I figured you'd be in the money on your straddle bets.Yeah, the market has just been waiting for some clarity. The markets can overlook a global shutdown and biggest pandemic in 100 years but it can't handle uncertainty. lol

It was primed for a massive move either way. It had been sitting on major support levels and testing them the last week so it was either going to break through or turn really bullish and it was all setting up on the Fed's meeting. I made a ton on call options today even though I ended the day with a bunch of puts that are worthless. It was the perfect straddle opportunity. Just needed big movement either way to make money and got it.

bclemms

More than 15K posts served!

Offline

Thanks. Should have held those TSLA calls. They've tripled in value since I sold and could easily double again with just a small move up. Oh well.Nice job. I figured you'd be in the money on your straddle bets.

- Moderator

- #8,040

Online

Ouch, yeah, that's a bummer. Can't win 'em all. Heh.Thanks. Should have held those TSLA calls. They've tripled in value since I sold and could easily double again with just a small move up. Oh well.

Users who are viewing this thread

Total: 2 (members: 0, guests: 2)