Snakehead

Hall-of-Famer

Online

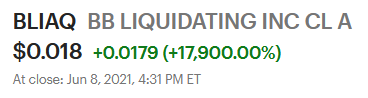

Reddit Retail Investors = New School Baseball - Swinging 3-0 and Bat Flipping.

Traditional Investors = Old School Baseball - Better follow the unwritten rules.

If there's any indication, the new school baseballers are walking off the old school baseballers.