Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The Investment Thread (12 Viewers)

- Thread starterSaint_Ward

- Start date

- Latest activity Latest activity:

bclemms

More than 15K posts served!

Offline

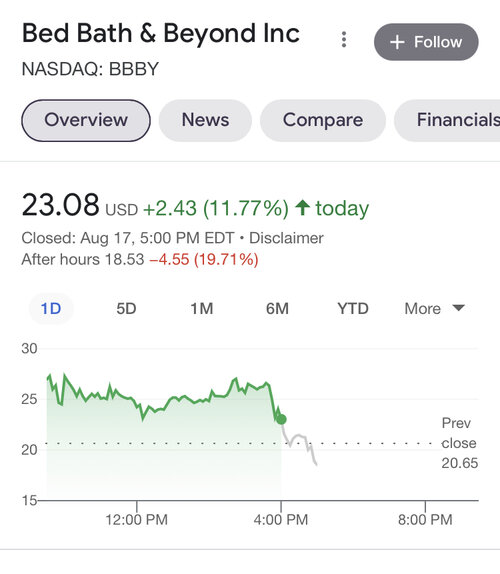

I bought and sold more than 100k shares today. I never held more than 5k shares.BBBY has about 80 million shares. 97% of which is owned by insiders and institutions.

It had a trade volume of 387 million today.

I managed to get in the early run for a 30% gain. The rest of tge day I was flipping 2% trades. At one point I bought 5k shares and sold it for a 3% gain in less than 20 seconds. Then put my limit buy in, had it triggered and sold for 2% gain before I could even set my stop. Im sure there were thousands more like me trading the ultra short term technical patterns and bounces.

I believe it. I also think something happened today. Maybe BBBY lifted the meme basket just enough and caused an algo frenzy. I say that because Bbby and Gme halted at the same time. Both because of upwards movement.I bought and sold more than 100k shares today. I never held more than 5k shares.

I managed to get in the early run for a 30% gain. The rest of tge day I was flipping 2% trades. At one point I bought 5k shares and sold it for a 3% gain in less than 20 seconds. Then put my limit buy in, had it triggered and sold for 2% gain before I could even set my stop. Im sure there were thousands more like me trading the ultra short term technical patterns and bounces.

Today GME had a 5-minute candle of 6 million. Which is greater than each of the past 4 trading days.

bclemms

More than 15K posts served!

Offline

So I mentioned it a few pages back about 3 weeks ago that BBBY was about to hit all time lows and formed a bottom. That is the perfect exit point for a bear that has been short on a stock that has seen a ton of volatility. Then the stock was cheap which makes it attractive for retail and pumps. That is when I bought the $10 calls that were basically pennies. I sold them too early but was thrilled with the profit. I've been watching it for a breakout run to flip since then but I had zero interest in holding the stock. They could easily file bankruptcy or dilute the stock at any given moment.I believe it. I also think something happened today. Maybe BBBY lifted the meme basket just enough and caused an algo frenzy. I say that because Bbby and Gme halted at the same time. Both because of upwards movement.

Today GME had a 5-minute candle of 6 million. Which is greater than each of the past 4 trading days.

It may not be done either, it has been holding Fib levels even with the massive drop this afternoon. I was watching the level 2 data and the book orders were really struggling to fill in after the double top and it was pretty obvious it was going to have a short term technical crash so I bought puts. It recovered a lot going into the bell. The good news, there is still a fair amount of short interest. The bad news, a whole lot has already been covered and much of the short interest are fresh shorts that entered this afternoon so I'm not too sure how much squeeze is left. If I had to guess the top is in but all it takes is one more cycle of a hot run and shorts panic closing and if it breaks $28.04 then it's going to make a run for $40. If it does that then the attention it will get could keep it going for some time. Unlike GME, it's not going to hold value and will come crashing back down in a hurry as well.

I'm likely done with it. It was pretty scary watching how fast the order book filled on the sell side and the buy side went ghost. If I had bailed 30 seconds later it would have cost me a ton of money when it made the drop from $26 to $18 in just a couple of minutes. I had a migraine this afternoon from staring at the screen today, you literally can't blink when scalping volatility like that.

It's also worth noting that a few crazy days of short squeezes last time really sent the market screaming down. That mid afternoon sell off was crazy fast in the SP and held the close below a really key resistance level. If SP doesn't break and hold above $430 then the rejection could be something fierce.

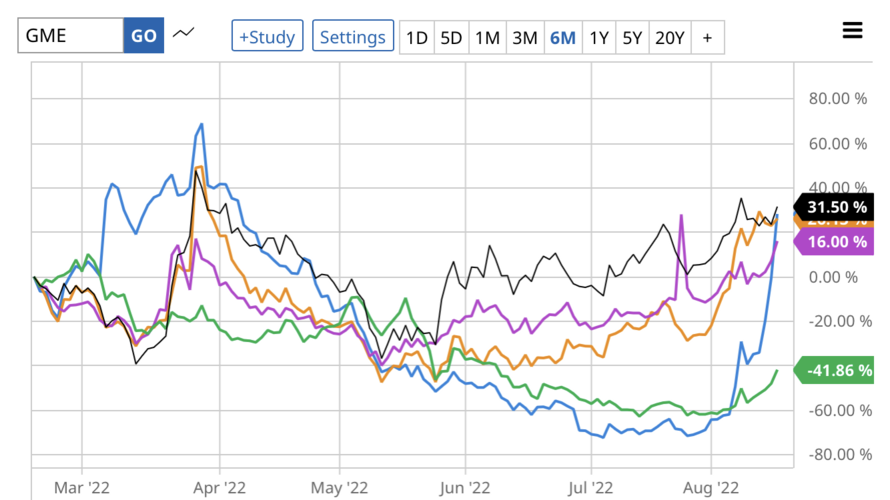

These are 5 of the memes that sneezed in January 21. GME, Koss, AMC, BBBY, and EXPR. This is a percent stock price change chart since Late February 2022.

EXPR is the green one. Based on how BBBY caught up to GME, Koss, and AMC. I wouldn’t be surprised if EXPR starts to get more attention real quick.

bclemms

More than 15K posts served!

Offline

I sold at $26.88, bought back in at $19.43. Oops. Now I'm playing with fire in after hours.

bclemms

More than 15K posts served!

Offline

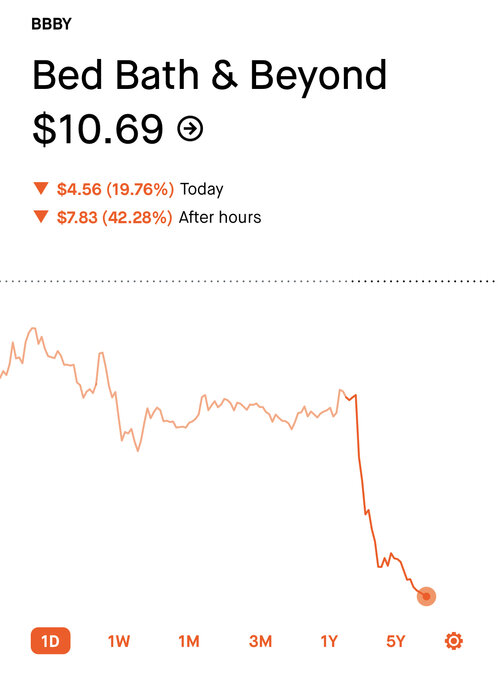

So bought a giant pile of $2 January puts on BBBY this afternoon. Then this happened. Now Im getting greedy and looking for an entry point to scalp. Ryan Cohen helped pump and then took a huge sheet on everyone’s head and is selling his entire position.

Attachments

Great call on the puts. I don’t have skin in bbby but I’m still trying to process what’s happening.So bought a giant pile of $2 January puts on BBBY this afternoon. Then this happened. Now Im getting greedy and looking for an entry point to scalp. Ryan Cohen helped pump and then took a huge sheet on everyone’s head and is selling his entire position.

bclemms

More than 15K posts served!

Offline

I can sum it up. Cohen didnt believe the lie he was selling. Got the short squeeze and dumped his entire position. Legally, highly questionable. Ethically, really crappy but I was expecting it. Next I expect BBBY to dilute shares to raise capital in order to stay afloat a little longer.Great call on the puts. I don’t have skin in bbby but I’m still trying to process what’s happening.

I’m gonna sit back on this one. I wouldn’t be surprised if there is a greater play that will unfold. Maybe some type of 4D chess. Am I confident enough to toss a few thousand on it? Nope.I can sum it up. Cohen didnt believe the lie he was selling. Got the short squeeze and dumped his entire position. Legally, highly questionable. Ethically, really crappy but I was expecting it. Next I expect BBBY to dilute shares to raise capital in order to stay afloat a little longer.

From what I understand he cashed out at about 39.4 million, taking a $19.5 million dollar profit and had to pay 19.9 million back to BBBY. Had he waited until 9/2 he wouldn’t have had to pay any money back to BBBY, so everyone is scratching their head at what the hell is going on.

bclemms

More than 15K posts served!

Offline

They could easily file bankruptcy or dilute the stock at any given moment.

The bad news, a whole lot has already been covered and much of the short interest are fresh shorts that entered this afternoon so I'm not too sure how much squeeze is left. Unlike GME, it's not going to hold value and will come crashing back down in a hurry as well.

Seriously, Tuesday afternoon a friend and I were talking about this exact scenario. If Cohen jumped in BBBY because he knew people would follow him in, named a couple of board members in anticipation of the short squeeze pump and dump. Started pumping the stock on Twitter and then when the squeeze play happened, dumped all of his stock it would be brilliant, mostly legal and shady AF. I even expected there to be some sort of sucker announcement along the way. You can't really blame BBBY, if not for Cohen then they would have already filed bankruptcy. All the accounting says they wont make it past Christmas. I bought the January puts in anticipation that they file bankruptcy right after black Friday but was questioning how they would make it that long. My only answer was to dilute shares and I was expecting that. I still think it will be the next shoe to drop. It's so obvious they are teetering on the brink that Cohen can dump all of his stock after pumping it on Twitter for months, they file bankruptcy next week and it would still be difficult to get him for insider trading since it is so well known they are in serious trouble. I find it extremely hard to believe that he held BBBY for that long, got the squeeze to $28.04, then when the next high fell short at $27 and a bearish pattern showed up that it was that moment he decided to sell his entire position by chance. To top that off, hours after he finished closing his position, this news dropped.I’m gonna sit back on this one. I wouldn’t be surprised if there is a greater play that will unfold. Maybe some type of 4D chess. Am I confident enough to toss a few thousand on it? Nope.

Bed Bath & Beyond Taps Kirkland & Ellis for Help Addressing Debt Load

Cohen's excuse is probably going to be that everyone who followed him were able to get out at a higher price and when he sold it left the institutional traders as the bag holders which will only have an element of truth to it.

That's my take. As you can see from my post on Tuesday, it did not surprise me one bit. It's why I wouldn't hold any position more than about 10 minutes when scalping.

FWIW, I am thankful for Cohen. When I can get that kind of volatility following the drum of technicals then it's paradise. I was able to make a year's salary over the past few days. Usually when there is that much volatility the technical patterns do not hold up. It may have been the best swing trade opportunity I've ever seen. It's even sweeter knowing things weren't adding up yesterday afternoon when the order books suddenly went void of large bids and these huge positions started showing up on the sell side so I stopped trading and bought a ton of puts. I did buy some in after hours yesterday to play the bounce this morning but that was a much smaller position. I'm not sure tomorrow gets a bounce and fully expect to find out BBBY is diluting.

Last edited:

bclemms

More than 15K posts served!

Offline

I don't think that includes options which would have been a lot more than $19M.From what I understand he cashed out at about 39.4 million, taking a $19.5 million dollar profit and had to pay 19.9 million back to BBBY. Had he waited until 9/2 he wouldn’t have had to pay any money back to BBBY, so everyone is scratching their head at what the hell is going on.

bclemms

More than 15K posts served!

Offline

While all of the short squeezing was taking place, Michael Burry literally closed out every position in his fund except for a company out of Florida that does nothing but prisons and mental health facilities. His high conviction trade? Everyone's lost their forking mind and civil unrest is going to pack the jailhouse. lol

Users who are viewing this thread

Total: 3 (members: 0, guests: 3)