Minor victory here.

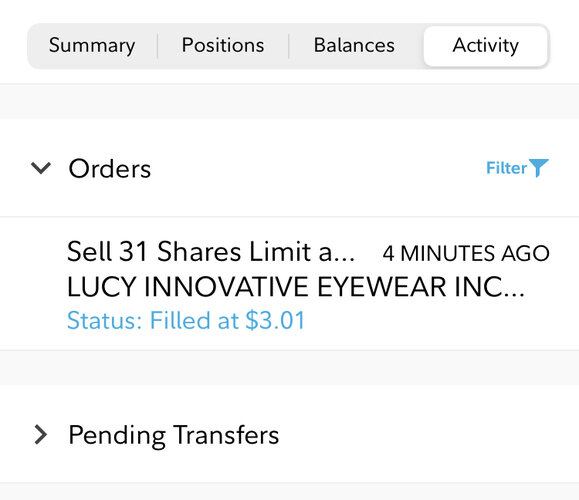

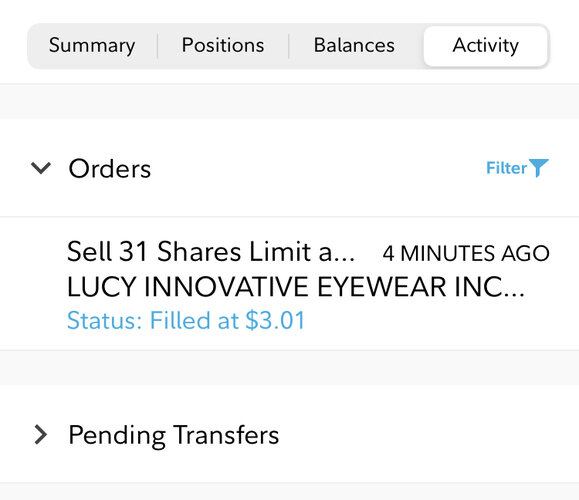

Bought 31 shares of LUCY at $1.61 last week and sold today for $3.01 in premarket. 90% swing.

Edit: The DD I used to pick this stock was to drink a few beers, smoke a little, and then listen to the Beatles.

This song stuck in my head the following morning. Found out LUCY was a ticker. Bought $50 worth.

Bought 31 shares of LUCY at $1.61 last week and sold today for $3.01 in premarket. 90% swing.

Edit: The DD I used to pick this stock was to drink a few beers, smoke a little, and then listen to the Beatles.

This song stuck in my head the following morning. Found out LUCY was a ticker. Bought $50 worth.

Last edited: