Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The Investment Thread (3 Viewers)

- Thread starterSaint_Ward

- Start date

- Latest activity Latest activity:

Since November 4th

Nov 4: Bought FNKO ($1,135)

Nov 7: Sold FNKO ($1,402)

Nov 9: Bought GME ($1,390)

Nov 17: Sold GME ($1,666)

Nov 17: Bought BBBY ($1,682)

Nov 23: Sold BBBY ($1,779)

Nov 29: Bought APE ($1,772)

Dec 1: Sold APE ($1,868)

Dec 2: Bought THCH ($1,858)

Dec 5: Sold THCH ($1,927)

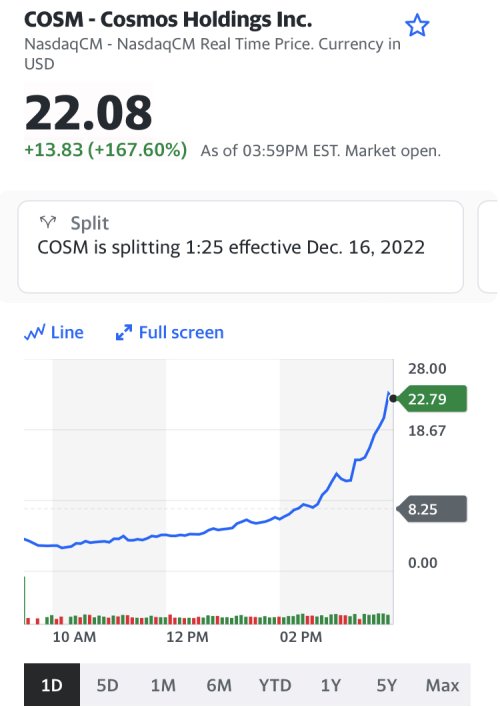

Dec 8: Bought GME ($1,935) - bought in PM at $21.99

Dec 8: Sold GME ($2,138)

Since Nov 4:

APE is down 47%

GME is down 6.5%

BBBY is down 16%

THCH is up 8.5%

FNKO is up 21%

I’m up 88%

Nov 4: Bought FNKO ($1,135)

Nov 7: Sold FNKO ($1,402)

Nov 9: Bought GME ($1,390)

Nov 17: Sold GME ($1,666)

Nov 17: Bought BBBY ($1,682)

Nov 23: Sold BBBY ($1,779)

Nov 29: Bought APE ($1,772)

Dec 1: Sold APE ($1,868)

Dec 2: Bought THCH ($1,858)

Dec 5: Sold THCH ($1,927)

Dec 8: Bought GME ($1,935) - bought in PM at $21.99

Dec 8: Sold GME ($2,138)

Since Nov 4:

APE is down 47%

GME is down 6.5%

BBBY is down 16%

THCH is up 8.5%

FNKO is up 21%

I’m up 88%

Offline

Lot to unpack here. Especially for those people that choose not to believe how much corruption is in the market.

What is YOUR main take away from that video?

Well. One is the idea of naked shorting was absolutely forbidden to say on a news network just 18 months ago. It’s now commonly said, and it is a reality in our market. The small to mid cap stocks are most vulnerable to the abuse.What is YOUR main take away from that video?

Two is FINRA said that MMTLP would be traded until EOD on Monday. But the ticker was permanently halted on Thursday.

There was a large group of people that new that abusive naked shorting on that ticker was happening (well beyond the legal type of naked shorting (i.e. for liquidity purposes).

This company was going private and all the naked shorters were going to be exposed. They got caught. And a mega 2 day short squeeze was imminent.

Then FINRA (probably under pressure from unknown sources) permanently halted it under code 3. Which is used to describe “extraordinary events”. They did this two days early.

My main takeaway is the amount of white collar crime in the financial markets needs to be taken down. And, people need to direct register there shares. The tsunami of “bank runs” that may hit crypto and stock brokerages is coming. Very very few people have shares or coins in there name and do not bother to read fine print.

Things that I read about just 18 months ago is no longer tin foil speculation. It’s a reality.

Offline

i bonds. i bonds. i bonds. i just made 4 cents.

wanna see me do it again?

wanna see me do it again?

Offline

Insufferable Influencers Who Boasted of Making Millions Are Indicted

The crew of hard-partying, money-flaunting stock traders were indicted Wednesday for an alleged $114 million “pump and dump” scheme.

www.thedailybeast.com

Anyone who has spent any time on stock trading twitter has run across these guys - with Zack Morris probably being the most well known. The SEC has filed charges against them for basically running a massive pump and dump scheme, the most central of them relating to Atlas Trading.

DOJ has filed arrest warrants. Wow.

- Moderator

- #9,234

Offline

Insufferable Influencers Who Boasted of Making Millions Are Indicted

The crew of hard-partying, money-flaunting stock traders were indicted Wednesday for an alleged $114 million “pump and dump” scheme.www.thedailybeast.com

Anyone who has spent any time on stock trading twitter has run across these guys - with Zack Morris probably being the most well known. The SEC has filed charges against them for basically running a massive pump and dump scheme, the most central of them relating to Atlas Trading.

DOJ has filed arrest warrants. Wow.

Lmao, took long enough.

B4YOU

All-Pro

- Joined

- Mar 17, 2017

- Messages

- 7,113

- Reaction score

- 12,352

Offline

i bonds. i bonds. i bonds. i just made 4 cents.

wanna see me do it again?

They pay out semiannually.

Offline

i can wait.They pay out semiannually.

jboss

All-Pro

- Joined

- Dec 2, 2008

- Messages

- 5,108

- Reaction score

- 6,353

Online

I have a Capital One 360 savings account that's at 3.3% right now. Sold out of most of my remaining stocks on that last pop (at a whopping 2.1% capital gain!) and put it in there. I still don't think the bleeding is over so at least I'll be gaining a little until there are better market signals.

Users who are viewing this thread

Total: 4 (members: 0, guests: 4)