- Admin

- #2,191

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The Investment Thread (4 Viewers)

- Thread starterSaint_Ward

- Start date

- Latest activity Latest activity:

Offline

Ha! Yeah, I have been looking for a time to get out, rode that last down turn. As soon as it started pulling back today, I dumped. Made $75.

Given where it was a few days ago, I'll take it.

dbridge

There's levels to this

- Joined

- Mar 4, 2004

- Messages

- 774

- Reaction score

- 639

Offline

Did anyone buy some TSLA? I came to this board a few months ago asking for thoughts on it but never got a response. I bought over a hundred shares and it has boomed in the last couple of days after releasing earnings.

dbridge

There's levels to this

- Joined

- Mar 4, 2004

- Messages

- 774

- Reaction score

- 639

Offline

Ward, I know you're invested in HEI. It has struggled the past couple of months. Any thoughts as to why. I was thinking about jumping in while it's under $120.

- Joined

- Oct 12, 2001

- Messages

- 8,400

- Reaction score

- 11,287

Offline

Amazon recovered nicely today.

Offline

GH and GWPH approaching earnings call in early Nov, starting to run up. I bought some of both earlier today. Not happy at all over basically the entire cannabinoid/marijuana industry stocks, but I think GWPH should make a nice run up and then I will dump it. I got slightly burned holding CGC and ACB earlier this year...

B4YOU

All-Pro

- Joined

- Mar 17, 2017

- Messages

- 6,327

- Reaction score

- 10,679

Online

To retire at 65, millennials will need to save nearly half of their paycheck

If you thought saving 15% of your paycheck was impossible, get ready for an even bigger hurdle. One retirement expert says millennials need to save much more.

“The economists at investing giant Vanguard predict that, over the next 10 years, annual U.S. stock market returns will likely average 3% to 5%. When you factor in inflation — which, luckily, Vanguard predicts will be below 2% — the real rate of return is expected to be under 3%.”

It seems like there are lots of 5% or less predictions for future returns. I’ve always run retirement numbers off of a 7% return with a 4% withdrawal rate. Things would be really sketchy sub 5%.

Online

I've held GWPh for over 14 months now. I'll wait for run too then probably get out.GH and GWPH approaching earnings call in early Nov, starting to run up. I bought some of both earlier today. Not happy at all over basically the entire cannabinoid/marijuana industry stocks, but I think GWPH should make a nice run up and then I will dump it. I got slightly burned holding CGC and ACB earlier this year...

- Admin

- #2,199

Offline

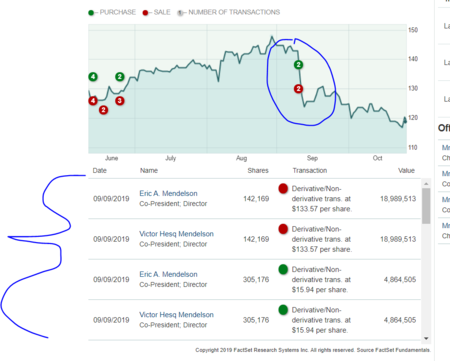

Honestly not sure.Ward, I know you're invested in HEI. It has struggled the past couple of months. Any thoughts as to why. I was thinking about jumping in while it's under $120.

If I were going to make an educated guess...

The china situation. Not much of a factor to HEI, other than general economic health, air travel, that I am aware of.

Premium P/E ratio. I think on our last call, either the CEO or a caller mentioned the premium P/E ratio. Obviously cash generation and future growth are baked into those numbers, so I think people thought it got a little too high. Personally I thought 140ish a share was crazy. HEI is still up a lot YTD, even with losing 20/share the last couple months. Lots of organic growth and healthy revenue. A lot from running lean. HEI could probably grow work force, and will always continue acquisitions on top of that.

Debt. I think net debt is about at 25%, which is the highest it has ever been. Again, cash flow is very strong, so they pay debt fast. So, not a concern. Might also become a consideration for slowing down acquisitions, but management doesnt seem to echo that idea.

The price popped so fast, then slowed down, I think big firms and corporate officers cashed out a bit to have $$ in hand, ad they prepare for a possible down turn. I mean, if I had more flexibility getting in and out, I'd have pulled some to lock in premium profits.

The two corp co presidents exercised some big options, worth many millions. Not sure how much that affected the price, but it was like 15-20M in value, I think. Need to look.

A few analyst downgrades, but not sure why.

- Admin

- #2,200

Offline

HEI end of the fiscal year ends this month. Think the results are released in mid to late Dec. So, we will know more. I expect some commentary.

I think there was a lot of shock in how much HEI popped up earlier in the year, and there is equal surprise to the drop. Short of asking the exec's (if they really know why), not sure.

What really shocked me is that there hasn't been a split. They used to split all the time if the price got too high. Not sure why they changed.

Gotta remember, up like 62% YTD even with the drop the last couple months.

EDIT: Adding the 3rd quarter transcripts.

www.fool.com

www.fool.com

One part near the end is basically their philosophy on what to do with their cash flow. And that is to grow the company. It's why HEI doesn't do stock re-purchases.

I think there was a lot of shock in how much HEI popped up earlier in the year, and there is equal surprise to the drop. Short of asking the exec's (if they really know why), not sure.

What really shocked me is that there hasn't been a split. They used to split all the time if the price got too high. Not sure why they changed.

Gotta remember, up like 62% YTD even with the drop the last couple months.

EDIT: Adding the 3rd quarter transcripts.

Heico Corp (HEI) Q2 2019 Earnings Call Transcript | The Motley Fool

HEI earnings call for the period ending July 31, 2019.

One part near the end is basically their philosophy on what to do with their cash flow. And that is to grow the company. It's why HEI doesn't do stock re-purchases.

Operator

We have a follow-up question for Gautam Khanna with Cowen. You're you're now live.

Gautam Khanna -- Cowen & Co. -- Analyst

Yes, thank you. Actually, just as a follow-up to the prior question. Have you guys ever contemplated just repurchasing A than either issuing more common, because that would just be an accretive move out of the gate [Indecipherable]?

Victor H. Mendelson -- Co-President and Director

Well, Gautam, the problem with that is the issue common, the buy Class A that we can do but the issue common of course is a process -- a laborious process and so on and that could potentially put pressure on the common by introducing more supply of the common stock. So I'm not so sure that the common holders would be thrilled to hear we were issuing common and buying in the Class A, and particularly, you have a lot of common holders saying while Class A holders have bought the stock, let's say, of late in the last few years added discount and then you're doing that to sort of push up the Class A at the potential of the expense of the common. So it's something we looked at and it's not the first time we've had the suggestion that we just don't think that that would be the right thing to do.

Eric A. Mendelson -- Co-President and Director

There is another thing too. We are in the mode to expand HEICO and make it a larger company, more profitable, more cash flow and you can't do that by buying in your shares and shrinking the Company. So it's really a choice that we want to spend money by buying shares were just suggesting by one and sell the other and what Victor would happen I believe is true, and that's also that to us sort of smacks of financial manipulation. We are not in the business of financial. We have never done financial manipulation with HEICO. Some companies do, we don't. And the market sets the price, and they buy the A, because it's 20% or 30% whatever it is less and we just let the free market set its own price. So all of those things go against the way we have decided to run the Company. I think it's more important for shareholders to look at the gains and the very significant gains on whatever shares they own rather than to be thinking about, oh, if they buy this in and sell that thing and do all this financial engineering. That's why we're buying HEICO because of financial engineering. We really want to run a very, very strong company and not be financial engineers.

Gautam Khanna -- Cowen & Co. -- Analyst

All right, thank you.

Last edited:

- Admin

- #2,201

Offline

dbridge

There's levels to this

- Joined

- Mar 4, 2004

- Messages

- 774

- Reaction score

- 639

Offline

Thanks for the info. According to earnings whisper, they report earnings at the end of November. I'll continue to research and decide whether to buy or not before that date.

- Admin

- #2,203

Offline

Late Nov they will announce when they will release financial data. Last year, the release was on Dec 17th.Thanks for the info. According to earnings whisper, they report earnings at the end of November. I'll continue to research and decide whether to buy or not before that date.

Year before it was dec 18th. Both mondays.

So, I'd estimate dec 16th, after market close.

- Admin

- #2,204

Offline

Do, overall market is positive again. What's the story?

I was dying for reasons to get out of BAC... and now I'm glad I hung on. Also that DFS bet has been good so far. Not sure how much longer I'll ride both. I like DFS more than BAC though.

I was dying for reasons to get out of BAC... and now I'm glad I hung on. Also that DFS bet has been good so far. Not sure how much longer I'll ride both. I like DFS more than BAC though.

Offline

Do, overall market is positive again. What's the story?

I was dying for reasons to get out of BAC... and now I'm glad I hung on. Also that DFS bet has been good so far. Not sure how much longer I'll ride both. I like DFS more than BAC though.

Earnings and trade optimism.

Users who are viewing this thread

Total: 3 (members: 0, guests: 3)