- Joined

- Jul 8, 2000

- Messages

- 26,934

- Reaction score

- 56,980

- Age

- 45

Online

Big week ahead...

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

Came across this video early this morning. I’m usually not a YouTube rabbit hole guy, but this guy’s analysis seems very solid and points towards the possibility that institutions are preparing themselves for some type of major market-crashing event in the very near future, or at a minimal, betting a significant stake on it being likely to occur.

I looked at his work for myself, and everything checks out. The video is geared towards AMC/GME holders, however I think this is good info across the markets as a whole for people to be aware of:

Interesting the Google analytics show the Citadel working late Friday night.

This is interesting...

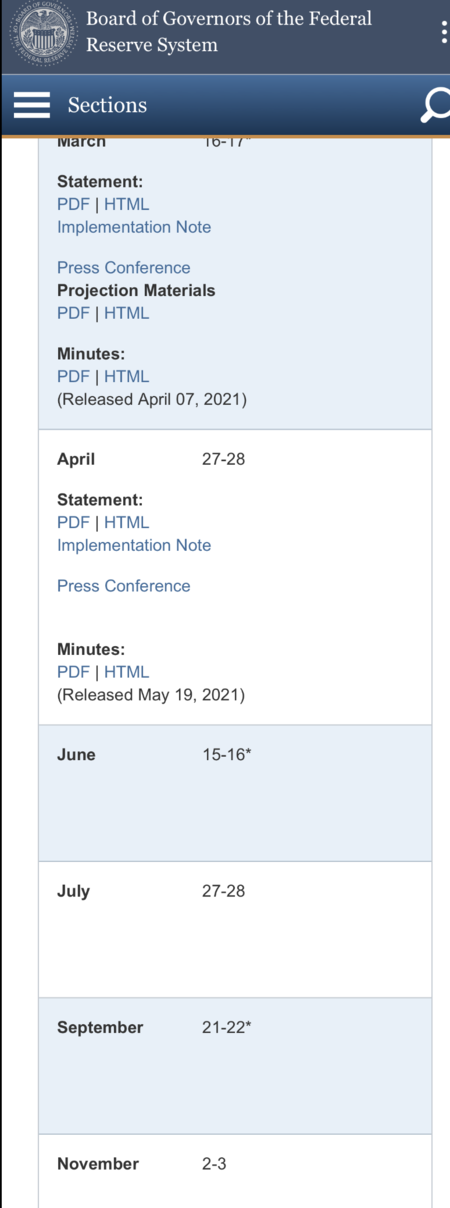

June 15, 2021 -- Closed Board Meeting

The Federal Reserve Board of Governors in Washington DC.www.federalreserve.gov

Came across this video early this morning. I’m usually not a YouTube rabbit hole guy, but this guy’s analysis seems very solid and points towards the possibility that institutions are preparing themselves for some type of major market-crashing event in the very near future, or at a minimal, betting a significant stake on it being likely to occur.

I looked at his work for myself, and everything checks out. The video is geared towards AMC/GME holders, however I think this is good info across the markets as a whole for people to be aware of:

This just grinds my gears. Venting at the dynamics and not your post.

Meeting calendars and information

The Federal Reserve Board of Governors in Washington DC.www.federalreserve.gov

I meant on the DTCC. David Inggs, who is Global Head of Operations at Citadel and Citadel Securities is also a Board Member of the DTCC.Pretty sure there isn’t a current Fed Board member running Citadel.

So now the regular Fed Reserve Board monetary policy meeting is also directly related to the hedge funds and GameStop?

There was also a G7 meeting this weekend. Literally 7 of the world's largest economies and the Federal Reserve all having meetings trying to stop GME and AMC for the Citadel.Pretty sure there isn’t a current Fed Board member running Citadel.

So now the regular Fed Reserve Board monetary policy meeting is also directly related to the hedge funds and GameStop?

There was also a G7 meeting this weekend. Literally 7 of the world's largest economies and the Federal Reserve all having meetings trying to stop GME and AMC for the Citadel.

Easy to question the reasoning but hard to deny the results.

My $8 GME July puts are going to be my favorite though.

Like I said, hard to deny the results.Glad to see you follow up your first comedy hit with more strong material

Scheduled board meeting I believe, nothing unusual.

Meeting calendars and information

The Federal Reserve Board of Governors in Washington DC.www.federalreserve.gov