Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

The Investment Thread (8 Viewers)

- Thread starterSaint_Ward

- Start date

- Latest activity Latest activity:

Offline

Might be a good time to get in. Hard to know. I went from being up 250% to only being up 48% today. i don't need that money anytime soon so i'll just hold.

Online

I think the story is simply one of multiple compression. China sales aren’t going as planned (and the China consumer story isn’t positive). The EV market in the rest of the world and especially US is getting more and more competitive and some of Tesla’s shortcomings are more and more evident. Does the battery and other tech story justify a re-inflation of the multiple? Or is Tesla a car manufacturer with growing headwinds both of which support the declining level from a multiple standpoint? Then you add legitimate questions about the focus of the company’s leadership and it seems hard to me to think there’s going to be some kind of a bounce. Level off maybe.

But I’m wrong about this kind of stuff all the time.

The real answer is whatever I do will cause the opposite. If I get it, it will continue to plummet, if I stay on the sidelines, it'll bounce. Just science.I think the story is simply one of multiple compression. China sales aren’t going as planned (and the China consumer story isn’t positive). The EV market in the rest of the world and especially US is getting more and more competitive and some of Tesla’s shortcomings are more and more evident. Does the battery and other tech story justify a re-inflation of the multiple? Or is Tesla a car manufacturer with growing headwinds both of which support the declining level from a multiple standpoint? Then you add legitimate questions about the focus of the company’s leadership and it seems hard to me to think there’s going to be some kind of a bounce. Level off maybe.

But I’m wrong about this kind of stuff all the time.

bclemms

More than 15K posts served!

Offline

Insufferable Influencers Who Boasted of Making Millions Are Indicted

The crew of hard-partying, money-flaunting stock traders were indicted Wednesday for an alleged $114 million “pump and dump” scheme.www.thedailybeast.com

Anyone who has spent any time on stock trading twitter has run across these guys - with Zack Morris probably being the most well known. The SEC has filed charges against them for basically running a massive pump and dump scheme, the most central of them relating to Atlas Trading.

DOJ has filed arrest warrants. Wow.

I used to follow him on Twitter until the option prices on anything he pumped got too expensive to buy puts.

dbridge

There's levels to this

- Joined

- Mar 4, 2004

- Messages

- 780

- Reaction score

- 664

Offline

Yeah I'm like you. Don't need the money anytime soon so I'll just continue to hold. Still up like 700%.Might be a good time to get in. Hard to know. I went from being up 250% to only being up 48% today. i don't need that money anytime soon so i'll just hold.

bclemms

More than 15K posts served!

Offline

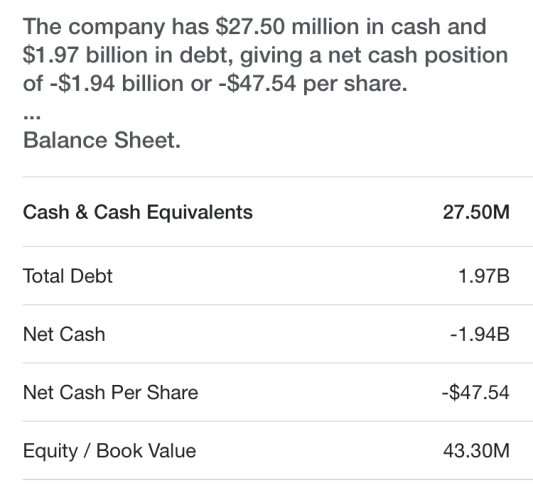

PE ratios says TSLA still needs to be cut in half or the revenue needs to double. I’m guessing these two will meet in the middle in the coming months. After my experience with Starlink and Elon on Twitter I’ve lost confidence in anything he touches.

jboss

All-Pro

- Joined

- Dec 2, 2008

- Messages

- 5,192

- Reaction score

- 6,548

Online

And then what happened?TSLA reeks of a 10-15% up day in the very near future. Kinda when Credit Suisse was tanking, and tanking some more until it got attention for tanking….then it went up like 20% for no fundamental reason at all.

It kept tanking.And then what happened?

jboss

All-Pro

- Joined

- Dec 2, 2008

- Messages

- 5,192

- Reaction score

- 6,548

Online

I really hope we're getting to a point of more "sober" investing. TSLA's selloff, to me, is a good sign to start for markets broadly. It's been massively overvalued for quite some time. I think we're in for more bleeding next year but hopefully good opportunities for retail investors to start buying in low on great investments.It kept tanking.

Online

I really hope we're getting to a point of more "sober" investing. TSLA's selloff, to me, is a good sign to start for markets broadly. It's been massively overvalued for quite some time. I think we're in for more bleeding next year but hopefully good opportunities for retail investors to start buying in low on great investments.

Traders gonna trade

Users who are viewing this thread

Total: 5 (members: 0, guests: 5)