Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The Investment Thread (3 Viewers)

- Thread starterSaint_Ward

- Start date

- Latest activity Latest activity:

bclemms

More than 15K posts served!

Online

I really don't understand his line of thinking. Basically he thinks that rate hikes will destroy the world markets and thinks inflation will destroy the lower and middle class but ignores the conundrum with his vague and cryptic tweet.

Meanwhile, I can't find a much simpler way to hedge inflation than buying bulk ammo which is basically just a mix of a few hard commodities as a floor with a very high theoretical ceiling.

Even his most spelled out tweets are even cryptic. Hard to understand.I really don't understand his line of thinking. Basically he thinks that rate hikes will destroy the world markets and thinks inflation will destroy the lower and middle class but ignores the conundrum with his vague and cryptic tweet.

Meanwhile, I can't find a much simpler way to hedge inflation than buying bulk ammo which is basically just a mix of a few hard commodities as a floor with a very high theoretical ceiling.

It’s also hard to figure out exactly what he’s doing. There is something in the background that Cohen is doing….which may not even involve GameStop at all. The guy has done zero interviews since 2020.

jboss

All-Pro

- Joined

- Dec 2, 2008

- Messages

- 5,073

- Reaction score

- 6,280

Offline

Looks like a big jump coming at open with news of a Russian troop pullback.

- Joined

- Jul 8, 2000

- Messages

- 27,338

- Reaction score

- 58,233

- Age

- 45

Offline

So yeah, I kind of did a crazy thing on Friday/Monday with SPCE, buying $5k worth of OTM weeklies for pennies (2,000 contracts, using a portion of my BKKT gains from doing something similar last week on that one).

Virtually never play weeklies, but felt great about the play after learning about the ticket on-sale for Wednesday, knowing it is leading into earnings.

Sold some at $.50 to recoup my investment, sold more at $1.20, and have a good chunk left for tomorrow, but that $5k has already turned into well over six figures in realized gains.

Plan to pocket half, and throw the rest into AMC, ATER, BKKT, OCGN calls, all several weeks out, although those $0.19 calls for OCGN next week at the $4 strike are calling my name I must say. lol

YOLO! (not financial advice)

bclemms

More than 15K posts served!

Online

Nice haul indeed! I closed out all of my long positions on the bounce today. Just have too much on my plate and don't have time to sit here with options.

So yeah, I kind of did a crazy thing on Friday/Monday with SPCE, buying $5k worth of OTM weeklies for pennies (2,000 contracts, using a portion of my BKKT gains from doing something similar last week on that one).

Virtually never play weeklies, but felt great about the play after learning about the ticket on-sale for Wednesday, knowing it is leading into earnings.

Sold some at $.50 to recoup my investment, sold more at $1.20, and have a good chunk left for tomorrow, but that $5k has already turned into well over six figures in realized gains.

Plan to pocket half, and throw the rest into AMC, ATER, BKKT, OCGN calls, all several weeks out, although those $0.19 calls for OCGN next week at the $4 strike are calling my name I must say. lol

YOLO! (not financial advice)

- Moderator

- #7,885

Offline

2 peas in a pod. Lol.

It’s insane. GME diehards are acting like GME is some unicorn out there. It’s not. It’s moving along with the rest of many memes.2 peas in a pod. Lol.

And this coming from a GME diehard.

- Admin

- #7,887

Offline

Glad to see AAL get back like Monday never happened. haha.

- Joined

- Jul 8, 2000

- Messages

- 27,338

- Reaction score

- 58,233

- Age

- 45

Offline

Nice haul indeed! I closed out all of my long positions on the bounce today. Just have too much on my plate and don't have time to sit here with options.

Yes, it definitely is a full-time job and then some. An incredible amount of time and effort is required for each and every play, especially when deciding to do one like that, and a lot of tough decisions have to be made on the fly when the bullets are flying from every direction.

Many weekends and nights spent just pouring over data - short interest, utilization, cost to borrow, days to cover, charting/fractal pattern analysis, figuring out what institutions own the stock and how they tend to run based on so called potential “catalysts,” etc., and of course, figuring out how you want to divvy up your money into each play and at what strikes. A lot of work, but it pays well.

I am almost exclusively into taking advantage of the heavily-shorted securities’ cyclical nature with aggressive options plays at this stage. So many of them are telegraphed, especially leading into the quarterly rollover periods (the next futures rollover deadline is 03/10, and that’s why this basket of stocks is starting to run right about now).

They have aggressively shorted the SPY over the last two months, using flimsy news like Omicron and now this “war,” all to justify it and get retail consumers that don’t fully have a grasp of the manipulation occurring out, so now all that built up short pressure is starting to get released, in addition to what was already there.

Here is my current list I am in with aggressive positions since early February, based on my analysis of that heavily-shorted security world (I DESPISE the term “meme stocks,” which is meant to make people fear and/or not want to partake in taking advantage of this set of massive institutional errors of shorting over-aggressiveness during the height of the pandemic):

AMC (been in since early last year, with a massive/reckless call position that paid off, swing-trading it with far-dated calls at this point, but it has been very elusive)

ATER

BBIG

BLNK

BKKT

BTBT

GME

OCGN

PHUN

SPCE

TTCF

- Joined

- Jul 8, 2000

- Messages

- 27,338

- Reaction score

- 58,233

- Age

- 45

Offline

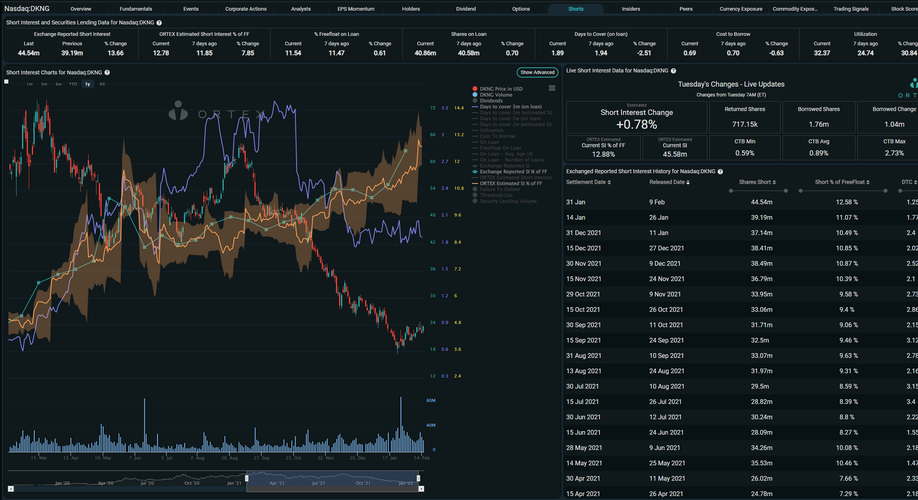

DraftKings looks like a potentially nice Friday morning straddle (pre-market earnings).

May hop in with about twenty near the money calls for 02/25 at some point today, and straddle it with ten 02/25 near the money puts on Thursday around market close.

This one has been in a downtrend, however the short interest appears to be steadily rising, indicating that it is being short-attacked aggressively (45 million shares short).

Very low I.V. on this one, which makes the premiums very cheap relative to its theta with earnings on the horizon.

Not a licensed advisor (yet), this is not financial advice.

May hop in with about twenty near the money calls for 02/25 at some point today, and straddle it with ten 02/25 near the money puts on Thursday around market close.

This one has been in a downtrend, however the short interest appears to be steadily rising, indicating that it is being short-attacked aggressively (45 million shares short).

Very low I.V. on this one, which makes the premiums very cheap relative to its theta with earnings on the horizon.

Not a licensed advisor (yet), this is not financial advice.

Attachments

In your list, I really like ATERYes, it definitely is a full-time job and then some. An incredible amount of time and effort is required for each and every play, especially when deciding to do one like that, and a lot of tough decisions have to be made on the fly when the bullets are flying from every direction.

Many weekends and nights spent just pouring over data - short interest, utilization, cost to borrow, days to cover, charting/fractal pattern analysis, figuring out what institutions own the stock and how they tend to run based on so called potential “catalysts,” etc., and of course, figuring out how you want to divvy up your money into each play and at what strikes. A lot of work, but it pays well.

I am almost exclusively into taking advantage of the heavily-shorted securities’ cyclical nature with aggressive options plays at this stage. So many of them are telegraphed, especially leading into the quarterly rollover periods (the next futures rollover deadline is 03/10, and that’s why this basket of stocks is starting to run right about now).

They have aggressively shorted the SPY over the last two months, using flimsy news like Omicron and now this “war,” all to justify it and get retail consumers that don’t fully have a grasp of the manipulation occurring out, so now all that built up short pressure is starting to get released, in addition to what was already there.

Here is my current list I am in with aggressive positions since early February, based on my analysis of that heavily-shorted security world (I DESPISE the term “meme stocks,” which is meant to make people fear and/or not want to partake in taking advantage of this set of massive institutional errors of shorting over-aggressiveness during the height of the pandemic):

AMC (been in since early last year, with a massive/reckless call position that paid off, swing-trading it with far-dated calls at this point, but it has been very elusive)

ATER

BBIG

BLNK

BKKT

BTBT

GME

OCGN

PHUN

SPCE

TTCF

Users who are viewing this thread

Total: 3 (members: 0, guests: 3)