Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The Investment Thread (4 Viewers)

- Thread starterSaint_Ward

- Start date

- Latest activity Latest activity:

- Joined

- Jul 8, 2000

- Messages

- 27,421

- Reaction score

- 58,565

- Age

- 45

Online

SOFI trying to pop.

Needs to breakthrough to $6.6. Certainly seems like it wants it.

- Joined

- Jul 8, 2000

- Messages

- 27,421

- Reaction score

- 58,565

- Age

- 45

Online

My understanding is today marks the start of the T-35 settlement period from the March quarterlies, so we may see some bullish market action here these next few days across the board.

SaintInBucLand

Veteran Starter

- Joined

- Jun 30, 2014

- Messages

- 2,562

- Reaction score

- 3,329

Offline

SKYH

Sky Harbour Group popping again today after a big jump yesterday

Sky Harbour Group popping again today after a big jump yesterday

- Joined

- Jul 8, 2000

- Messages

- 27,421

- Reaction score

- 58,565

- Age

- 45

Online

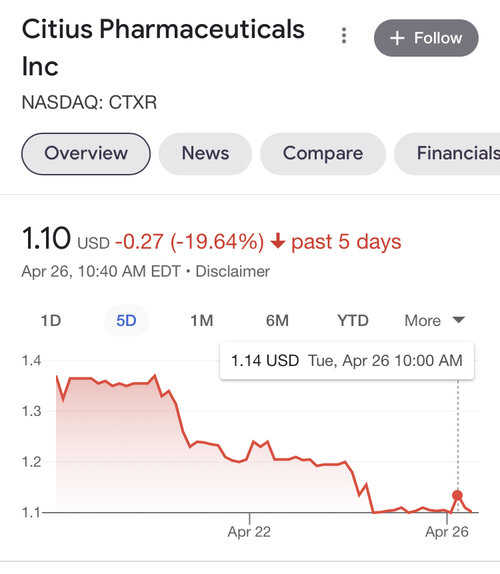

Rough start...the bear market continues. When does the bleeding end?

SaintInBucLand

Veteran Starter

- Joined

- Jun 30, 2014

- Messages

- 2,562

- Reaction score

- 3,329

Offline

So what companies benefit the most if there is massive student loan forgiveness?

- Joined

- Jul 8, 2000

- Messages

- 27,421

- Reaction score

- 58,565

- Age

- 45

Online

So what companies benefit the most if there is massive student loan forgiveness?

Great question!

Offline

I don't know which companies or how it affect the stock market but the economy would definitely benefit.

bclemms

More than 15K posts served!

Offline

Just did some buying. Could still go a lot lower but will buy more.

This is a great question. So what are the ramifications.So what companies benefit the most if there is massive student loan forgiveness?

Could it actually be credit cards and banks? Those liabilities (student loans) have to be affecting their approvals on other (unrelated) loans. Those that weren’t even able to pay prior to the forgiveness program had likely see their credit score tank. Thus again affecting their ability to get other unrelated credit/loans.,

- Joined

- Jul 8, 2000

- Messages

- 27,421

- Reaction score

- 58,565

- Age

- 45

Online

Just did some buying. Could still go a lot lower but will buy more.

Took a small position on the ATER dip today that seems to be paying off well, but outside of that, this has been a brutal outing. I am shocked at how perpetual this market dip has become, across the board. The dips just keep dipping.

Users who are viewing this thread

Total: 5 (members: 0, guests: 5)