- Joined

- Jul 8, 2000

- Messages

- 27,634

- Reaction score

- 59,163

- Age

- 45

Offline

Mods, please excuse the language on this tweet, but if this is true, it is game over for the hedge funds.

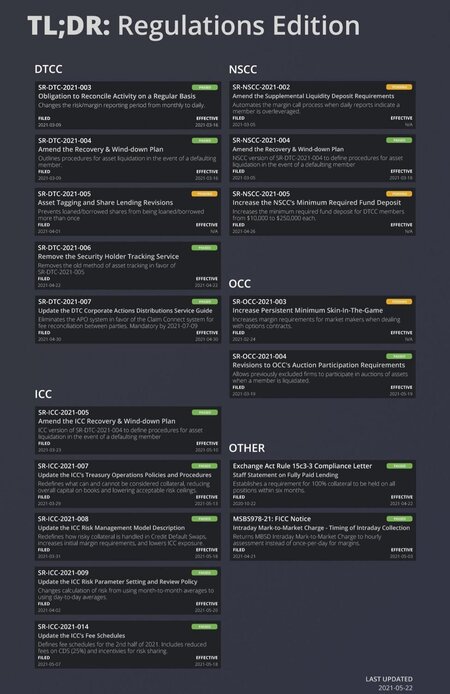

This ruling essentially allows the DTCC to force margin calls on over-leveraged hedge funds, or leads us to that point.The mere fact that they expedited this ruling from Monday to today says a lot in my opinion.

Now we just need 002 kicked in, and we are golden.

This ruling essentially allows the DTCC to force margin calls on over-leveraged hedge funds, or leads us to that point.The mere fact that they expedited this ruling from Monday to today says a lot in my opinion.

Now we just need 002 kicked in, and we are golden.