bclemms

More than 15K posts served!

Offline

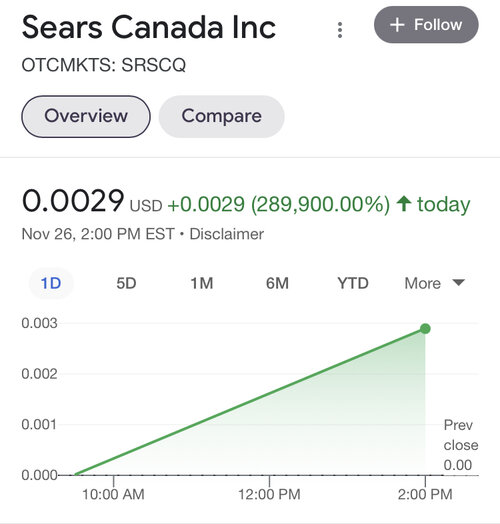

I don't think today's sell off is purely covid related, it's just the excuse.

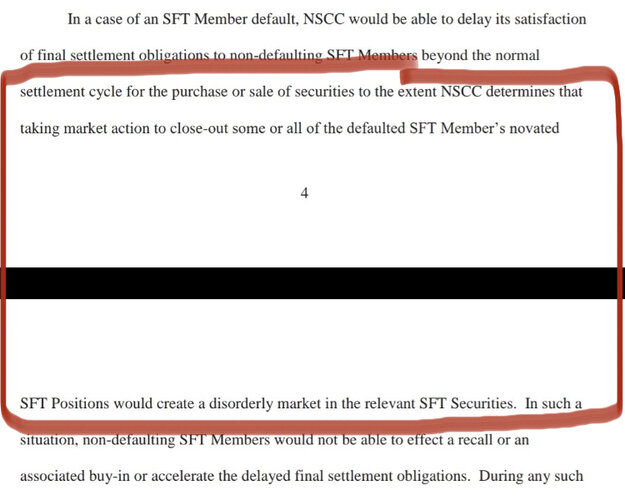

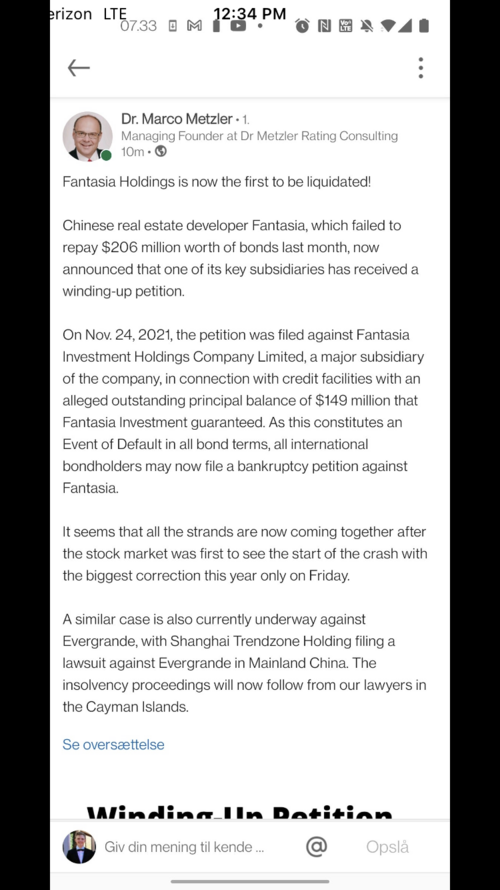

Lot of different risks and a lot of news today. China credit issues, inflation, Fed saying they are ready to increase rates to curb inflation and all this coming on the tail of a long and really hot rally. Reports that China is asking Didi to delist on the NYSE is also something that really doesn't sit well on Wall St. I think all the risks were piling up and it was just time for a correction and the covid news was just the catalyst. The markets have overlooked all kinds of covid news the past year. From some of the technical people I follow, they were expecting a correction and aren't worries as long as S&P holds 4550. Apparently that is the support level that will make or break the technical pattern longer term.

Glad I'm on the right side of today's moves but I'm still in the red from the big run the markets had over the last month.

Lot of different risks and a lot of news today. China credit issues, inflation, Fed saying they are ready to increase rates to curb inflation and all this coming on the tail of a long and really hot rally. Reports that China is asking Didi to delist on the NYSE is also something that really doesn't sit well on Wall St. I think all the risks were piling up and it was just time for a correction and the covid news was just the catalyst. The markets have overlooked all kinds of covid news the past year. From some of the technical people I follow, they were expecting a correction and aren't worries as long as S&P holds 4550. Apparently that is the support level that will make or break the technical pattern longer term.

Glad I'm on the right side of today's moves but I'm still in the red from the big run the markets had over the last month.

Last edited: