bclemms

More than 15K posts served!

Online

Credibility not required. I miss the days when blogs were called blogs and bots were called bots. Now we have blog bots running big twitter accounts and websites trying to pass off as news pages.Read articles from Simply Wallstreet or simply wallet. Whatever it is on the iPhone investment app. They're terrible articles that may not be full on Bot, but clearly written by someone who doesn't always know what they're writing about.

So I'm looking a side by side kind of as a family xmas present. Something basic and while looking over different options I start reading reveiws on Massimo. They make a ton of crap (pun implied). Their products look the part on the outside but the price tells me that it's trash. So I start reading the reviews and they aren't bad from multiple sites. In fact, they are so good I don't know how Honda, Can-Am, Yamaha and Polaris aren't bankrupt. At this point it's pretty obvious but now I'm curious enough to keep reading.

Massimo UTV Review – Reliablecounter.com

www.reliablecounter.com

ATV Reviews Archives | All ATV Rreviews

The ATV Reviews category will lay down all that you need to know about ATVs and their features as well as what to check when buying one.

allatvreviews.com

allatvreviews.comThen I see they are sold at Tractor Supply, Wal-Mart and some are listed on Amazon. The reviews on all the websites are repetitive and obviously bots. On Massimo's own page the reviews are heavily scrubbed.

Finally found some real reviews after a while and was exactly what I expected. Batteries die after a week, don't honor warranty, can't get in touch with customer service, things like top speeds are slightly exxagerated (doubled), lots of complaints they wont make it up small hills, 2000lb tow hitch advertised doesn't actually exist at all. You know, little things.

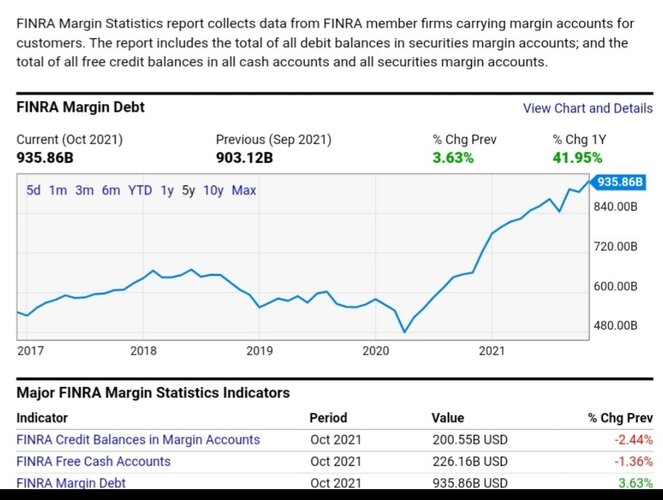

If some small off brand company in Tx is managing that I can only imagine what is really going on under the sheets on these Trillion dollar market caps.