- Joined

- Jan 1, 2012

- Messages

- 17,370

- Reaction score

- 20,840

Online

Tesla earnings tomorrow after close. Powell gives us an update tomorrow. Apple earnings on Thursday. Hopefully the market settles down a bit after this crazy week is over.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

Tesla earnings tomorrow after close. Powell gives us an update tomorrow. Apple earnings on Thursday. Hopefully the market settles down a bit after this crazy week is over.

Looks like Microsoft recovered and green now. I have high hope for Tesla tomorrow. May YOLO some calls.Microsoft beat earnings in a pretty big way. Proceeded to shed 5%. I have a feeling tech has a long way to go still and those PE ratios are about to start meaning something again.

It sure looks like retail is buying the dips during the day and the big money is selling it off overnight. Another week like the last two and retail is going to start panic selling.

Yeah, was just showing how irrational the market is behaving. AAL also had a beat with optimistic guidance and a debt reduction plan that looks quite good. Fell 15% since then.Looks like Microsoft recovered and green now. I have high hope for Tesla tomorrow. May YOLO some calls.

Pretty much. GME up 17% on no news and then crashes right back down on no news. Sometimes I think these are volatility pumps to make options more pricey.this market is bi polar.

Its like watching Gameday board- SP calls a Taysom run play over left side with option for TD...MARKET GOES WILD.

Next play from scrimmage calls for Taysom play action on 2nd a 1 and he throws interception- MARKET TANKS.

TSLA had a record quarter, big time beat on revenue and earnings. Increased cash position, reduced debt, increased margins and also increased deliveries. It was a beat from top to bottom.

It's down 7% today.

I'm pretty much just playing around to keep me interested in the market until it crashes and I can move all in. I've been 95% cash since January 2020 and the other 5% went all towards short positions until it crashed. Took money off the table to stay around the 5% level. Now I'm losing money in cash and not making any in the market. I'm positioned very well for the past two weeks and a crash if it does happen. I'm positioned very poorly for any other scenario and don't see a logical way of fixing that. I look around and just see an everything bubble.this kinda movement is usually reserved for 3rd Q earnings.

its happening in 1stQ

i have no idea how to even begin to plan for 2022 strategies, other than to simply sit tight, buckle in and hold on.

Yup. The yolo call I bought yesterday worth about tree fiddy.TSLA had a record quarter, big time beat on revenue and earnings. Increased cash position, reduced debt, increased margins and also increased deliveries. It was a beat from top to bottom.

It's down 7% today.

Sucks because it was the right call based on the numbers. As soon as I watched what happened with TSLA I dumped my apple calls at a small profit because even if Apple smashes it doesn't mean much.Yup. The yolo call I bought yesterday worth about tree fiddy.

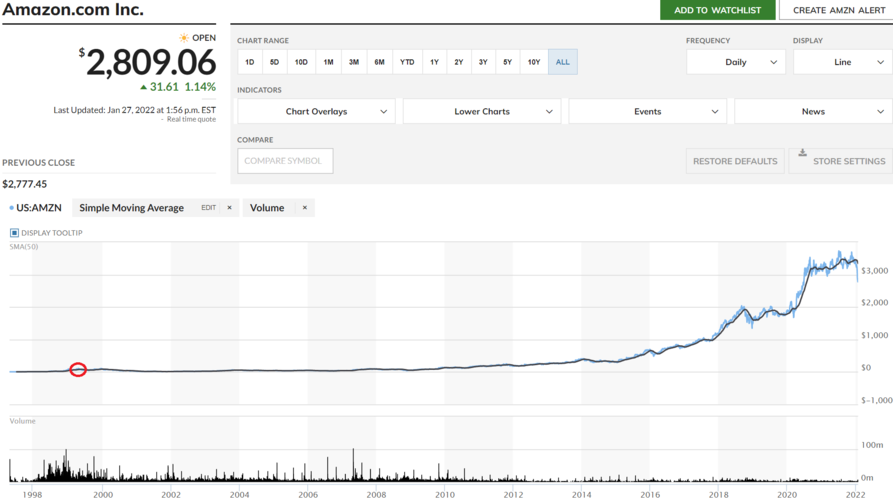

Can't stress how much TSLA looks like the new amazon from the dot com era.

Amazon stock soared during the dot com boom and then crashed when the bubble burst. But it was still a good long term investment.What does this mean? I legit don't understand.

Amazon hit all time high in 1999 during the dot com bubble. During that time it wasn't profitable. When the bubble finally popped it started a string of 8 consecutive quarters of big beats across the board and was blowing up. Stock price fell all the way to the single digits losing 90% of it's value. It took a decade to recover all time highs.What does this mean? I legit don't understand.