jboss

All-Pro

- Joined

- Dec 2, 2008

- Messages

- 5,072

- Reaction score

- 6,276

Online

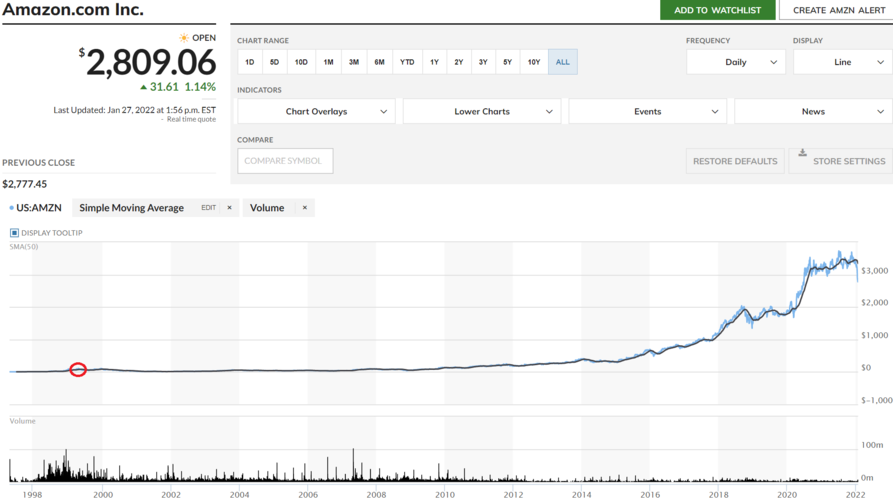

I like TSLA long term. I have a growth ETF in my retirement plan that's heavy on TSLA. My biggest concern with it is its current valuation. It's brightest days are yet to come but I just don't see enough growth potential to support its, IMO, overvaluation right now. A steady selloff or pullback would probably be a healthy signal for the broader market.Amazon hit all time high in 1999 during the dot com bubble. During that time it wasn't profitable. When the bubble finally popped it started a string of 8 consecutive quarters of big beats across the board and was blowing up. Price fell all the way to the single digits. It took a decade to recover all time highs.

As bad as that sounds though, this is what that all time high looks like on a chart.