Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The Investment Thread (3 Viewers)

- Thread starterSaint_Ward

- Start date

- Latest activity Latest activity:

- Joined

- Jul 8, 2000

- Messages

- 27,398

- Reaction score

- 58,468

- Age

- 45

Online

Odd day. Felt like a big bullish run was coming for several tickers, then things just sort of stagnated.

EVGO continues to quietly chug along for me, and SPCE is starting to do its thing; now I just need SOFI to wake up.

EVGO continues to quietly chug along for me, and SPCE is starting to do its thing; now I just need SOFI to wake up.

- Joined

- Jul 8, 2000

- Messages

- 27,398

- Reaction score

- 58,468

- Age

- 45

Online

2.3 billion volume candle on the Nasdaq earlier today. Plunge protection team doing gods work I suppose.

SMH

Yep, another classic "Oh someone said something we already knew for over a year, but this time they mean it FA REAL for real" shakeout dip. Figures.

- Joined

- Jul 8, 2000

- Messages

- 27,398

- Reaction score

- 58,468

- Age

- 45

Online

He tried to warn us.

- Joined

- Jul 8, 2000

- Messages

- 27,398

- Reaction score

- 58,468

- Age

- 45

Online

- Joined

- Jul 8, 2000

- Messages

- 27,398

- Reaction score

- 58,468

- Age

- 45

Online

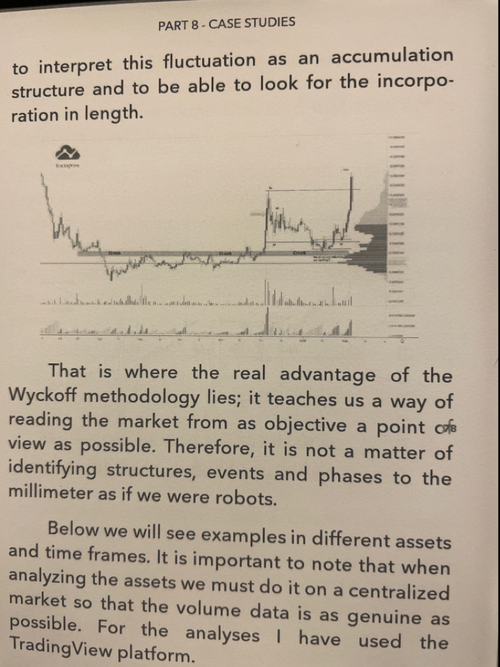

I have said it before and will say it again...The whole damn stock market has turned into a game of "Find the Algo Pattern." Virtually every single stock is on either a Wyckoff Accumulation, Wyckoff Distribution, or Parabolic Arc pattern, especially the heavily-retailed owned stocks; you just have to find the time frame it's on.

AMC, Weekly:

AMC, Weekly:

- Admin

- #8,138

Offline

So... anyone got any old school, like, healthy bottom line, market share gain, future state type investing news or thoughts?

I've never been big on the 'technicals' and sure aren't hooking up with the Meme stocks (no hate to y'all who are, just not my type of risk play).

I don't mind standing still with my funds, but it feels like I need to shake it up a bit.

I've never been big on the 'technicals' and sure aren't hooking up with the Meme stocks (no hate to y'all who are, just not my type of risk play).

I don't mind standing still with my funds, but it feels like I need to shake it up a bit.

I continue to put a little more in where I can. Especially in stocks that have boatloads of future buyers and companies that are now not going to go bankrupt.I have said it before and will say it again...The whole damn stock market has turned into a game of "Find the Algo Pattern." Virtually every single stock is on either a Wyckoff Accumulation, Wyckoff Distribution, or Parabolic Arc pattern, especially the heavily-retailed owned stocks; you just have to find the time frame it's on.

AMC, Weekly:

Random question. Have you looked into PLBY?

- Joined

- Jul 8, 2000

- Messages

- 27,398

- Reaction score

- 58,468

- Age

- 45

Online

So... anyone got any old school, like, healthy bottom line, market share gain, future state type investing news or thoughts?

I've never been big on the 'technicals' and sure aren't hooking up with the Meme stocks (no hate to y'all who are, just not my type of risk play).

I don't mind standing still with my funds, but it feels like I need to shake it up a bit.

I believe EVGO offers the best of both worlds. Emerging sector and profitable, so the fundamentals are there...and it is 100% shorted.

One of my top 2 or 3 plays right now since February; and it's just getting started.

- Joined

- Jul 8, 2000

- Messages

- 27,398

- Reaction score

- 58,468

- Age

- 45

Online

I continue to put a little more in where I can. Especially in stocks that have boatloads of future buyers and companies that are now not going to go bankrupt.

Random question. Have you looked into PLBY?

No, not familiar with that one. I'll have to give it a look in the AM.

- Joined

- Jul 8, 2000

- Messages

- 27,398

- Reaction score

- 58,468

- Age

- 45

Online

So... anyone got any old school, like, healthy bottom line, market share gain, future state type investing news or thoughts?

I've never been big on the 'technicals' and sure aren't hooking up with the Meme stocks (no hate to y'all who are, just not my type of risk play).

I don't mind standing still with my funds, but it feels like I need to shake it up a bit.

I should add - This is exactly why they have indoctrinated the term "mEME sTOCKS" into people's vocabulary. They want to make it seem like a play involving a bunch of kids trying to manipulate the stock market, when in reality, large institutions are buying and holding just as much as retail is right now (not saying you believe this, per se, but I am sure it's a part of the overall mental exercise for why you have been against buying these for over year now).

They're all over-leveraged shorted stocks in which hedge funds went way over-aggressive in shorting during the pandemic. Framing them as "mEME sTOCKS" is one of the many ways they deter people from educating themselves on the subject and keeping them away from the plays.

Truth is, if you're patient and can deal with the ups and downs without freaking out, they're the safest swing plays on the market, because the (eventual) buying pressure is already there in the form of short positions, total return swaps, and FTDs, assuming you buy stock in a company that's actually not going to go bankrupt. When factoring in T+2 and T+6, the quarterly expiry time periods are virtually guaranteed gains at this point.

- Joined

- Jul 8, 2000

- Messages

- 27,398

- Reaction score

- 58,468

- Age

- 45

Online

bclemms

More than 15K posts served!

Offline

Brutally honest question.Textbook chart pattern...literally.

AMC, Daily:

If you have the pattern figured out why not play it? If it's that obvious the HODL pattern may not be the best way. I sold everything except my ERJ calls. They are getting hammered. I also bought TSLA puts and they are up 150% in just the last two days offsetting the ERJ calls. The brutally honest question for me, why did I hold the ERJ calls? Brutally honest answer, I forked up.

- Joined

- Jul 8, 2000

- Messages

- 27,398

- Reaction score

- 58,468

- Age

- 45

Online

Brutally honest question.

If you have the pattern figured out why not play it? If it's that obvious the HODL pattern may not be the best way. I sold everything except my ERJ calls. They are getting hammered. I also bought TSLA puts and they are up 150% in just the last two days offsetting the ERJ calls. The brutally honest question for me, why did I hold the ERJ calls? Brutally honest answer, I forked up.

Who says I'm not? I'm not going back in heavy until the quarterlies, but keep an amount in there that would satisfy should the "MOASS" occur during an odd time.

Users who are viewing this thread

Total: 4 (members: 0, guests: 4)