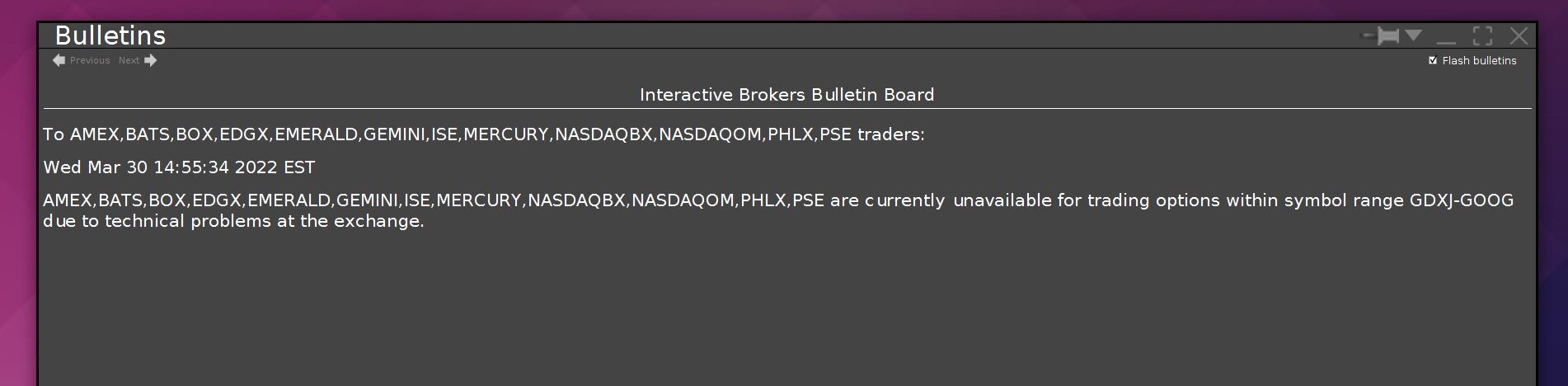

Man. Something absolutely super weird happened today. Wasn’t as obvious as the buy button removal but there was fudgery in the morning. The system literally broke for a few minutes.

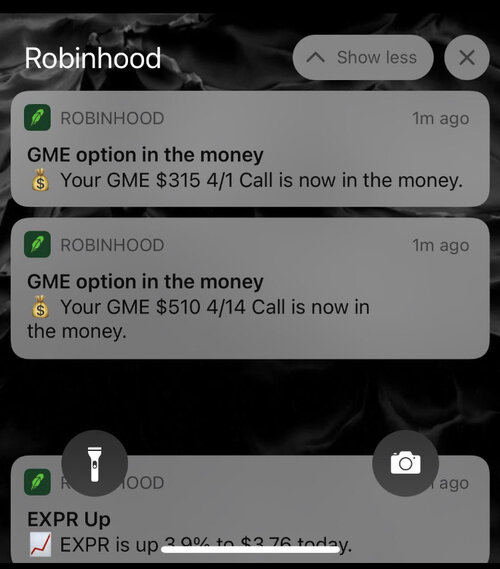

All those calls being exercised. GME apes directly registering about 200K shares a day.

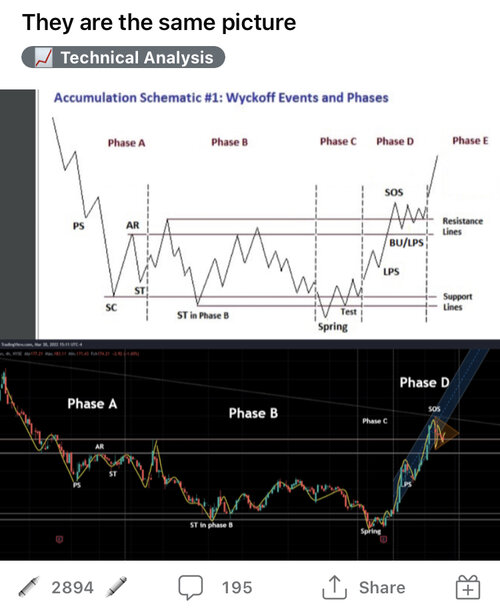

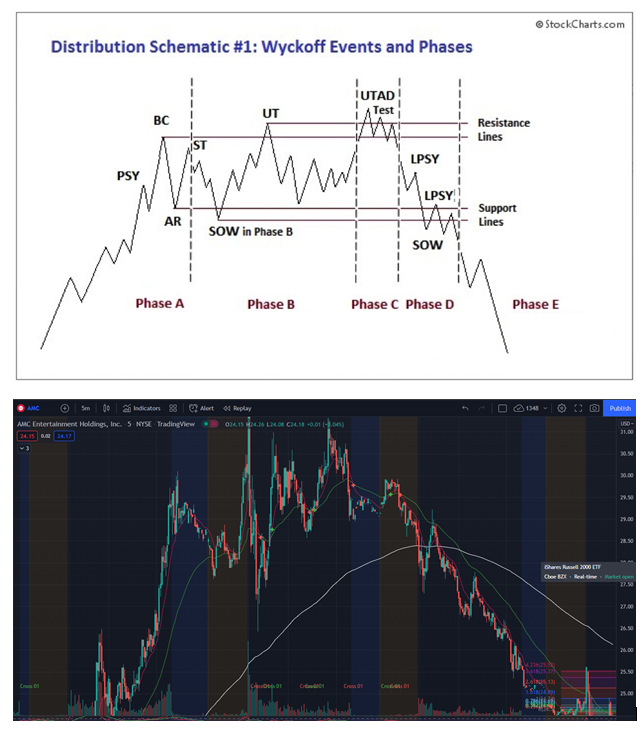

GME hit 500+. Trades wiped off. But broker screenshots show incredible sales. And then a halt for GME and AMC (at the exact same time!!) when they were down 7%.

ALL of this today.

The circuits got tripped today.

All those calls being exercised. GME apes directly registering about 200K shares a day.

GME hit 500+. Trades wiped off. But broker screenshots show incredible sales. And then a halt for GME and AMC (at the exact same time!!) when they were down 7%.

ALL of this today.

The circuits got tripped today.