- Joined

- Oct 12, 2001

- Messages

- 8,600

- Reaction score

- 11,660

Online

People dip into their saving and save less of inflation and the end of Covid stimulus.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

Yeah, I had been thinking about why markets act the way they do and you're hitting on something that I think contributes to why things don't go as expected. The markets are anticipating and trying to be the first to capitalize on information and data being disseminated and its creating scenarios where the reaction has the opposite effect on an announcement.Looks like the stock market is finally understanding the Fed can't cut rates if they say they are going to cut rates and everyone starts running up the market and hiring in expectation of rate cuts.

That soft landing was super easy but the wheels never touched down. Still in a far better place than we were a year ago but slowing inflation that last 50% is going to be impossible while advertising rate cates.

I think it's brilliant by the fed. They know what they're doing. They can't cut rates because inflation is still too high, too sticky and would come raging back. They also can't keep cranking rates up or even sitting still. Just whisper rate cuts to the market and let them do the heavy lifting fueling a mega rally while not having to actually cut rates. It doesn't solve the consumer debt problem or commercial real estate problem but it does allow inflation to come down while the economy chugs along. Problem is, at some point the markets are going to quit rallying to calls for rate cuts. I still think there has to be some pain for gain and there is no such thing as a truly soft landing but I've been wrong since the covid rally so might as well keep the streak going. lolYeah, I had been thinking about why markets act the way they do and you're hitting on something that I think contributes to why things don't go as expected. The markets are anticipating and trying to be the first to capitalize on information and data being disseminated and its creating scenarios where the reaction has the opposite effect on an announcement.

I do think the Fed needs to be a bit more guarded in how they announce what they expect to do so that you get a bit more oeganic changes in the markets rather than these artificial pump and eventual dumps in the markets.

Makes good sense. It's definitely a balancing act and I can't really fault the Fed for any recent moves they've made. They've certainly been cautious and taking a go slow approach, which is ultimately probably the most prudent strategy.I think it's brilliant by the fed. They know what they're doing. They can't cut rates because inflation is still too high, too sticky and would come raging back. They also can't keep cranking rates up or even sitting still. Just whisper rate cuts to the market and let them do the heavy lifting fueling a mega rally while not having to actually cut rates. It doesn't solve the consumer debt problem or commercial real estate problem but it does allow inflation to come down while the economy chugs along. Problem is, at some point the markets are going to quit rallying to calls for rate cuts. I still think there has to be some pain for gain and there is no such thing as a truly soft landing but I've been wrong since the covid rally so might as well keep the streak going. lol

The narrative is that the market tanked because of Iran's threats to Israel. We got Putin threatening nukes and we've entered a hot cold war via proxy with Russia and the market shrugged that off so I don't buy the Israel/Iran thing even being a driving factor for the day. It's all about the Fed.

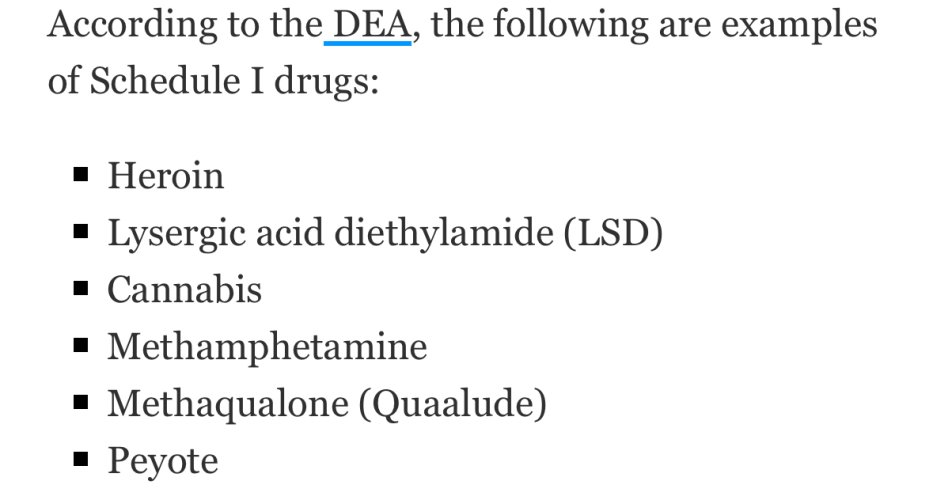

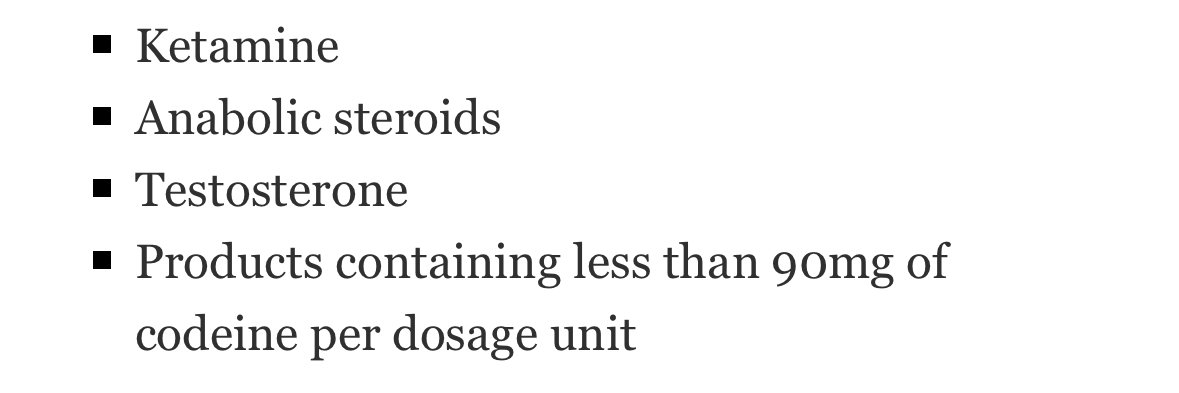

Currently schedule 1:Without clicking on the link- what is Schedule III ? Is that like Benadryl or something ?