Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The Investment Thread (4 Viewers)

- Thread starterSaint_Ward

- Start date

- Latest activity Latest activity:

What’s something to monitor is that leadership question is starting to enter the conversation with Apple and Google too.So much working against it at this point. Demand much softer. Competition much stronger. Nothing in the near term pipeline. Substantial leadership questions.

NVDA really is propping up some of the indexes now. Microsoft too to a lesser extent.

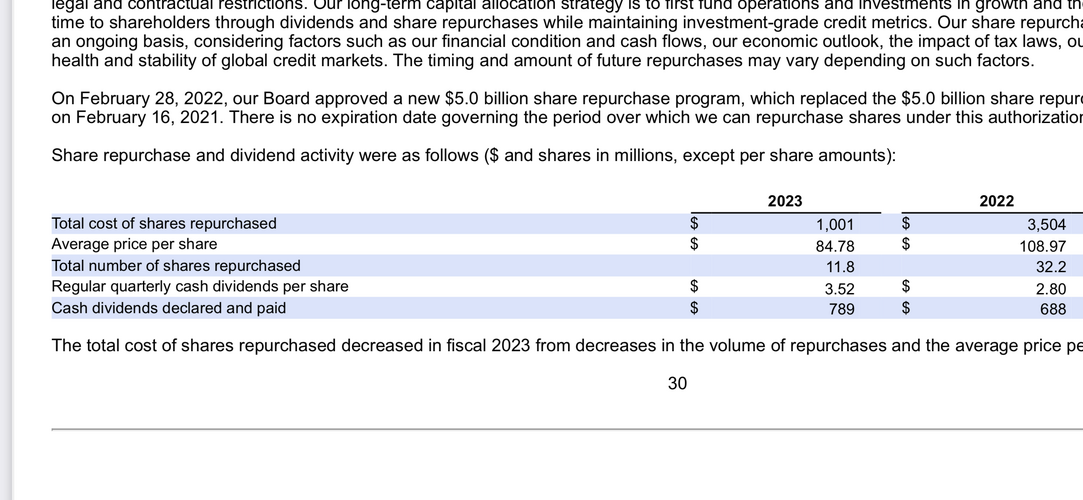

With Bed Bath and Beyond there was clearly a time you could look at the financial reports and scratch your head on why they were paying our billions in dividends and share repurchases. They were doing all of that with revenue that was in decline for several consecutive years. And they spent $$$ remodeling the stores. All without addressing long term debt.

With Bed Bath and Beyond there was clearly a time you could look at the financial reports and scratch your head on why they were paying our billions in dividends and share repurchases. They were doing all of that with revenue that was in decline for several consecutive years. And they spent $$$ remodeling the stores. All without addressing long term debt.Now I see this company Best Buy. Falling revenues. Planned store remodels. Over a billion in long term debt. And they just forked over $6,000,000,000 in just 2022 + 2023 combined for share repurchases and dividends.

Online

Federal Reserve holds interest rates steady, maintains forecast for 3 rate cuts in 2024

The Fed left interest rates unchanged on Wednesday and signaled it would still need to cut rates three times this year.

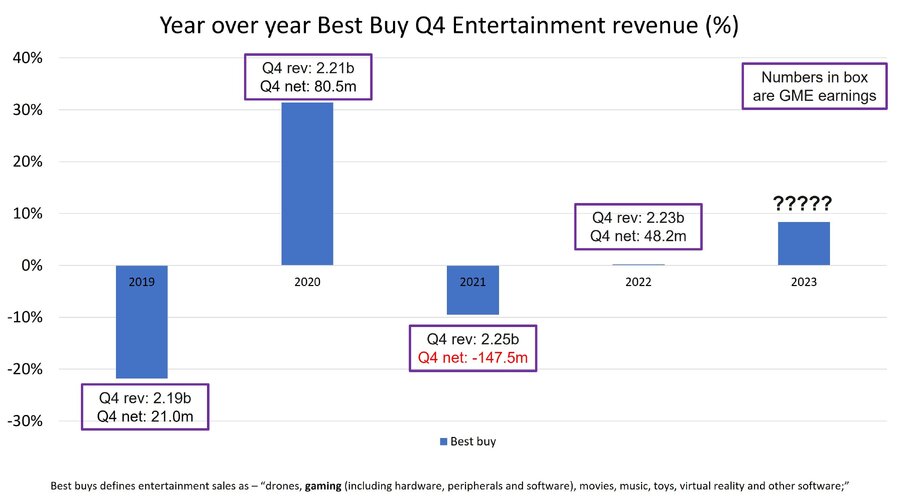

Best Buy breaks down their revenue into several sub categories. Phones, consumer electronics, appliances, services, and entertainment. Overall their revenue in Q4 2023 was down compared to Q4 2022. But, they were actually up in one important category. ENTERTAINMENT.

Best Buy defines entertainment as “drones, gaming(including hardware, peripherals and software), movies, music, toys, virtual reality and other software”.

When we look at Best Buys entertainment sales (by percentage growth year over year) we can see than when entertainment is up year over year that Gamestop has higher net revenue year over year.

For example, in Q4 2020, Best Buy had a 31% increase in entertainment sales compared Q4 2019. The net revenue for Gamestop went up from $21 million in Q4 2019 to $80.5 million in Q4 2020.

In 2021, Best Buy in Q4 2021 saw a 9.5% drop in entertainment sales compared to Q4 2020. During this time, Gamestop saw their net revenue drop from $80.5 million in 2020 to negative $147.5 in Q4 2021.

In Q4 2022, Best Buy experienced a growth of 0.2% in entertainment sales compared to Q4 2021. During this time Gamestop became profitable again with a net revenue of $48.2 million.

Most recently in Q4 2023, Best Buy saw a surge in entertainment sales. Going up 8.4% growth compared to Q4 2023. If Gamestop was profitable when Best Buy saw just a 0.2% growth in entertainment in Q4 2022, what do you think will happen in Q4 2023??? We are going UP.

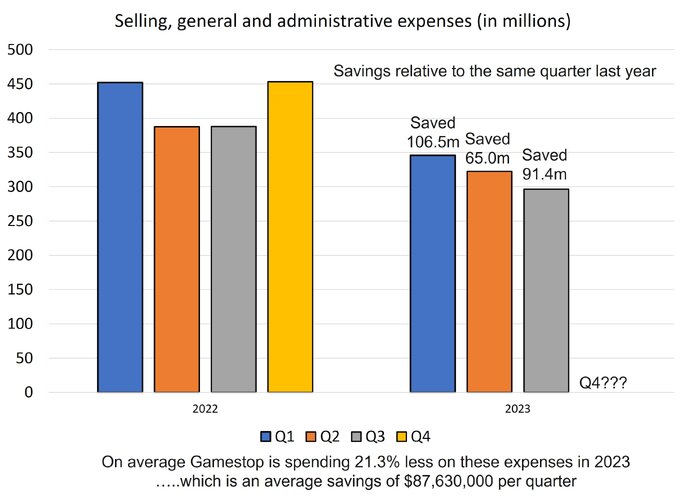

But that is only half of it. The other half is predicting how much savings we can have. So I looked at expenses related to “Selling, general and administrative expenses” in 2022 vs 2023.

Gamestop is spending on average 21.3% LESS in 2023 vs 2022 when looking at comparable quarters. This is an average savings of $87.6 million each quarter.

Lets put it together. Sales of Gamestop tracks sales of Best Buy in their entertainment category. And Best Buy was way up in Q4. We are now saving on average of $85 million or so in each quarter in 2023 compared to the comparable quarter last year.

If sales are UP in Q4 and we continue to SAVE similar amounts…….boom.

I’m predicting $100+ million in net income for GameStop in Q4 on Tuesday.

Did a bunch of research that I really think was NOT priced in by the market. And also to convince my wife to do a swing trade yolo on GME.

Best Buy breaks down their revenue into several sub categories. Phones, consumer electronics, appliances, services, and entertainment. Overall their revenue in Q4 2023 was down compared to Q4 2022. But, they were actually up in one important category. ENTERTAINMENT.

Best Buy defines entertainment as “drones, gaming(including hardware, peripherals and software), movies, music, toys, virtual reality and other software”.

When we look at Best Buys entertainment sales (by percentage growth year over year) we can see than when entertainment is up year over year that Gamestop has higher net revenue year over year.

For example, in Q4 2020, Best Buy had a 31% increase in entertainment sales compared Q4 2019. The net revenue for Gamestop went up from $21 million in Q4 2019 to $80.5 million in Q4 2020.

In 2021, Best Buy in Q4 2021 saw a 9.5% drop in entertainment sales compared to Q4 2020. During this time, Gamestop saw their net revenue drop from $80.5 million in 2020 to negative $147.5 in Q4 2021.

In Q4 2022, Best Buy experienced a growth of 0.2% in entertainment sales compared to Q4 2021. During this time Gamestop became profitable again with a net revenue of $48.2 million.

Most recently in Q4 2023, Best Buy saw a surge in entertainment sales. Going up 8.4% growth compared to Q4 2023. If Gamestop was profitable when Best Buy saw just a 0.2% growth in entertainment in Q4 2022, what do you think will happen in Q4 2023??? We are going UP.

But that is only half of it. The other half is predicting how much savings we can have. So I looked at expenses related to “Selling, general and administrative expenses” in 2022 vs 2023.

Gamestop is spending on average 21.3% LESS in 2023 vs 2022 when looking at comparable quarters. This is an average savings of $87.6 million each quarter.

Lets put it together. Sales of Gamestop tracks sales of Best Buy in their entertainment category. And Best Buy was way up in Q4. We are now saving on average of $85 million or so in each quarter in 2023 compared to the comparable quarter last year.

If sales are UP in Q4 and we continue to SAVE similar amounts…….boom.

I’m predicting $100+ million in net income for GameStop in Q4 on Tuesday.

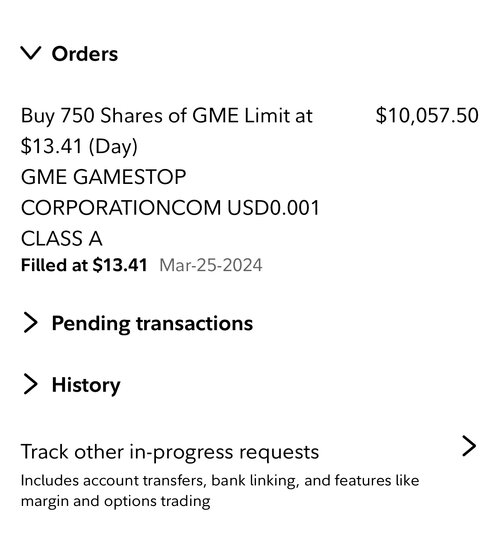

I bought 750 shares in premarket this morning.

This was to get ahead of earnings Tuesday.

I didn’t expect a Monday intraday run like this.

I’m expecting a dip tomorrow, and then for GameStop to beat expectations in after hours on the bottom line with flat top line growth.

Hoping for a 30% pop. If Cohen drops an EPS north of 0.40 EPS then there is upside that all hell could break loose.

Obscure Stock Pumps $1,000% After Firm Touts $1.7 Billion Bitcoin Buy—Is It Legit? - Decrypt

As over-the-counter NILA shares exploded, the press release disappeared from the Nasdaq website.

I'm not going to, but someone might be interested.

Snakehead

Hall-of-Famer

Online

Obscure Stock Pumps $1,000% After Firm Touts $1.7 Billion Bitcoin Buy—Is It Legit? - Decrypt

As over-the-counter NILA shares exploded, the press release disappeared from the Nasdaq website.decrypt.co

I'm not going to, but someone might be interested.

I tried, can't buy it on E-Trade.

Not investigated the report. Did see another reputable crypto site say the activity was flagged. Wouldn't be surprised if it was a shady deal.I tried, can't buy it on E-Trade.

- Joined

- Oct 12, 2001

- Messages

- 8,616

- Reaction score

- 11,713

Offline

What happened with the stock market today? It was almost a 3% swing to close down.

Thoughts?

finance.yahoo.com

finance.yahoo.com

U.S. Money Supply Is Doing Something No One Has Witnessed Since the Great Depression, and It Foreshadows a Big Move to Come in Stocks

M2 money supply hasn't made a move this pronounced since the early 1930s.

Maxp

High Plains Drifter

Offline

Looks to me like people moved money into CDs and Money Market accounts, plus T Bills because they finally were no longer worthless. Then they moved their money back into the market because the indexes are on fire. Just my guess.

Users who are viewing this thread

Total: 5 (members: 0, guests: 5)