Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The Investment Thread (2 Viewers)

- Thread starterSaint_Ward

- Start date

- Latest activity Latest activity:

SaintInBucLand

Veteran Starter

- Joined

- Jun 30, 2014

- Messages

- 2,562

- Reaction score

- 3,329

Offline

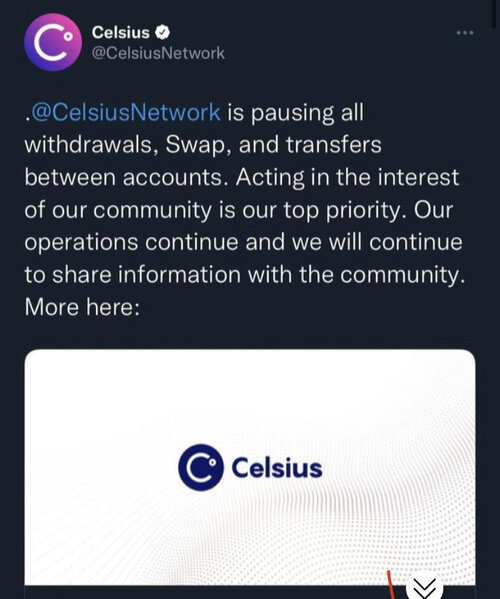

Sounds like a way to keep it veiled that you don't have the money to satisfy sell orders.

SaintInBucLand

Veteran Starter

- Joined

- Jun 30, 2014

- Messages

- 2,562

- Reaction score

- 3,329

Offline

Care to make a friendly wager?

You don't even need to make a wager with him. If you have confidence the market will rise in the coming months then buy stock or long call options on the indexes and ETFs on those indexes.

SaintInBucLand

Veteran Starter

- Joined

- Jun 30, 2014

- Messages

- 2,562

- Reaction score

- 3,329

Offline

I am wondering how solvent some of these crypto wallets and crypto exchanges are(yes I know poor grammar).

Could we see a virtual run on them with so many people dumping their crypto and trying to get out and get the cash deposited into their banks? Binance has also halted any kind of selling buying or transfers.

Could we see a virtual run on them with so many people dumping their crypto and trying to get out and get the cash deposited into their banks? Binance has also halted any kind of selling buying or transfers.

- Joined

- Jan 22, 2000

- Messages

- 26,310

- Reaction score

- 14,556

Offline

I am wondering how solvent some of these crypto wallets and crypto exchanges are(yes I know poor grammar).

Could we see a virtual run on them with so many people dumping their crypto and trying to get out and get the cash deposited into their banks? Binance has also halted any kind of selling buying or transfers.

I think that's certainly possible. I'm still not really sure how you can do proper valuations on crypto currencies. They seem to me to be largely speculation driven with little intrinsic value, surviving on hope and perception. So, for some of these cryptos with low adoption rate, it seems not only possible, but likely that they will collapse entirely.

SaintInBucLand

Veteran Starter

- Joined

- Jun 30, 2014

- Messages

- 2,562

- Reaction score

- 3,329

Offline

Going to Cornwall Capital some cypto wallets and see what happens.

Offline

- Admin

- #8,694

Offline

I'm no t sure the classic PE ratio is as useful for the S&P500, unless it's been the last few years. PE ratios haven't really explained tech, and their growth compounding is insane. Tech makes up like 8 of the top 12 stocks (2 are Alphabet).I find this line of thinking odd because the deficit increases the fastest when you have Republicans in the White House and Congress. That's been the case since the 1980's. The deficit has decreased under the current administration (not because of any particular policy really, and it would have decreased faster without the infrastructure bill, but the point being that the last administration, had a far more "liberal" fiscal policy than the current one).

As far as finances goes... the stock market is starting to approach rational valuations. Typically, the mean PE ratio for the S&P 500 is around 15... it's currently at 19. It had hit as high as the upper 30's during the pandemic. It might go down a bit more, but it's approaching a decent level of support right now.

AMZN is getting beat down a bit, and is looking more attractive.

The airlines are getting hammered and they had good news. I think people are freaking out and just pulling their money. It will make a good time to buy a few premium companies.

bclemms

More than 15K posts served!

Offline

All the sheet coins are going under. Crypto is going to be a good investment once it gets cut in half again and all the bogus coins with no real function are washed out the market.

SaintInBucLand

Veteran Starter

- Joined

- Jun 30, 2014

- Messages

- 2,562

- Reaction score

- 3,329

Offline

I'm no t sure the classic PE ratio is as useful for the S&P500, unless it's been the last few years. PE ratios haven't really explained tech, and their growth compounding is insane. Tech makes up like 8 of the top 12 stocks (2 are Alphabet).

AMZN is getting beat down a bit, and is looking more attractive.

The airlines are getting hammered and they had good news. I think people are freaking out and just pulling their money. It will make a good time to buy a few premium companies.

It's not done dropping. We have QT starting this week as well as inflation numbers on cost of production goods, then it's looking more likely that we get 75 basis points instead of 50.

bclemms

More than 15K posts served!

Offline

Major support levels broke this morning so yeah. Also means we are probably going quite a bit lower.I'm no t sure the classic PE ratio is as useful for the S&P500, unless it's been the last few years. PE ratios haven't really explained tech, and their growth compounding is insane. Tech makes up like 8 of the top 12 stocks (2 are Alphabet).

AMZN is getting beat down a bit, and is looking more attractive.

The airlines are getting hammered and they had good news. I think people are freaking out and just pulling their money. It will make a good time to buy a few premium companies.

The classic PE ratio doesn't look useful when in a bubble and it is being ignored. It becomes very useful when that bubble pops. It's why the highest PE ratio stocks are taking the biggest dive over the last 6-7 months.

bclemms

More than 15K posts served!

Offline

Binance too now.

Binance blocks bitcoin withdrawals as crypto prices crater

The world's largest cryptocurrency exchange, Binance, instituted a pause on withdrawals of bitcoin Monday morning

- Joined

- Jan 22, 2000

- Messages

- 26,310

- Reaction score

- 14,556

Offline

I'm no t sure the classic PE ratio is as useful for the S&P500, unless it's been the last few years. PE ratios haven't really explained tech, and their growth compounding is insane. Tech makes up like 8 of the top 12 stocks (2 are Alphabet).

AMZN is getting beat down a bit, and is looking more attractive.

The airlines are getting hammered and they had good news. I think people are freaking out and just pulling their money. It will make a good time to buy a few premium companies.

I fundamentally disagree with the notion that PE rations mean less for tech stocks. Yes, you have to take into account their growth potential, but at the end of the day, a company's value is driven by their profit margins and ability to grow those margins.

So, while a PE ratio of 15 might be low for a tech stock, one with a PE ratio of 60 is probably way out of whack. It assumes exponential growth for many years, which is unrealistic given that major economic shocks tend to happen every 7-10 years.

Offline

The G

It was needed.

Government can kick the can, markets cannot.

The Great Reset 2022.I fundamentally disagree with the notion that PE rations mean less for tech stocks. Yes, you have to take into account their growth potential, but at the end of the day, a company's value is driven by their profit margins and ability to grow those margins.

So, while a PE ratio of 15 might be low for a tech stock, one with a PE ratio of 60 is probably way out of whack. It assumes exponential growth for many years, which is unrealistic given that major economic shocks tend to happen every 7-10 years.

It was needed.

Government can kick the can, markets cannot.

Users who are viewing this thread

Total: 2 (members: 0, guests: 2)