- Joined

- Jul 8, 2000

- Messages

- 23,455

- Reaction score

- 47,032

- Age

- 44

Online

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: this_feature_currently_requires_accessing_site_using_safari

I mean, it was one of the worst earning reports and guidance I've seen from a tech stock in years on a stock that is considered a high valuation growth stock and one of the most crowded plays in the market. That's a really terrible combination. Netflix will be lucky if the fall stops at $200.Or it could simply be a market maker under duress needing to liquidate a large portion of their most heavy and profitable positions.

Of note - Netflix's largest stakeholder is The Citadel.

I mean, it was one of the worst earning reports and guidance I've seen from a tech stock in years on a stock that is considered a high evaluation growth stock and one of the most crowded plays in the market. That's a really terrible combination. Netflix will be lucky if the fall stops at $200.

And a massive massive candle in thereRite Aid had a strong 11% day today.

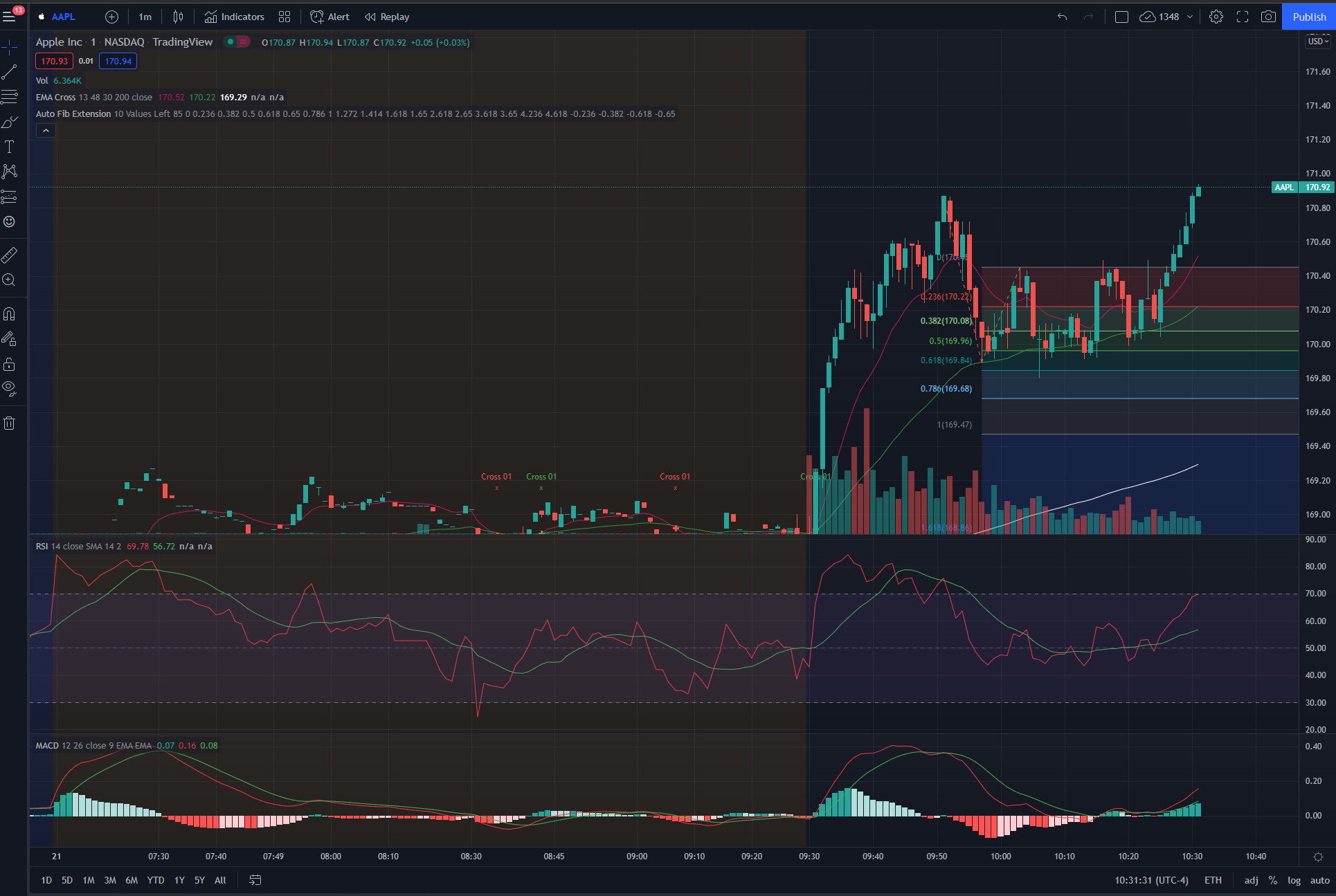

A little birdy just told me to load up on AAPL, fyi. Short term.

I know they have earnings next week. Didn't get much detail, but the person I got it from has given me three tips in the past that I didn't take him up on, and a massive run followed.

Literally within seconds of him giving me that info, at around 12:45, a big spike started.

Probably should have waited a bit more on BBBY. My CB is 16.97. I thought the gap down was around 16-17. But it might be that lower leg to 13-14.

Tons of bearish articles on it right now. Supply chain issues. Store closures. It’s been red for 12 straight days (longest in BBBY history) and looking like 13 red days in a row after today.

I think that late-May to June run up will be great. That said, there are a lot of Elliott Wave TA believers that think we will have a mini boom soon and then a hard dip shortly there after.I think all these so called "mEME sTOCKS" are going to flat-line here for the next 3 weeks or so. They'll get the typical early week run to sucker people into buying weeklies, then slowly bleed the rest of the week.

That won't change until we are closer to the quarterly options expiry 06/17. It'll run leading up to that day, starting as early as late May, or if they do what they did last time and wait until the very last day to do their rollover, it'll run on the T-2 settlement date of that date at the very latest.