- Admin

- #2,236

Offline

I'm going to throw this in here for now. Interesting stats.

www.investopedia.com

www.investopedia.com

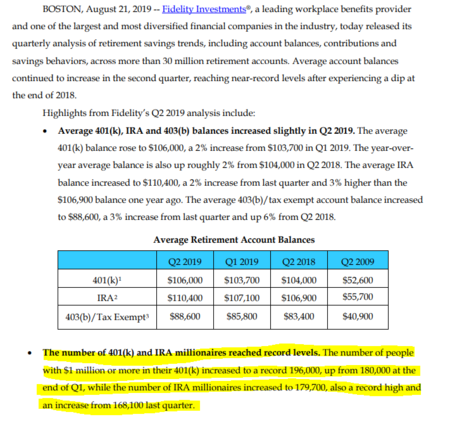

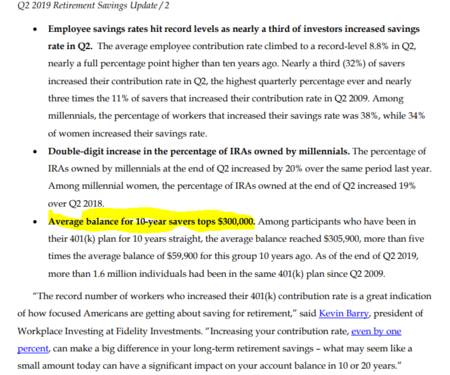

Then the link to Fidelity has this added information.

The Average 401(k) Balance by Age

How much money people have put away for retirement naturally varies by age. See how your savings stack up.

How does that break down, more specifically? Here's how Fidelity crunches the numbers:

Twentysomethings (Age 20–29)

Average 401(k) balance: $11,800

Median 401(k) balance: $4,300

Contribution rate (% of income): 7%

Thirtysomethings (Age 30–39)

Average 401(k) balance: $42,400

Median 401(k) balance: $16,500

Contribution rate (% of income): 7.8%

Among millennials (which Fidelity defines as those born between 1981–1997), 38% of workers increased their savings in Q2 2019. This generation is the most likely to contribute to a Roth 401(k), too.

Fortysomethings (Age 40–49)

Average 401(k) balance: $102,700

Median 401(k) balance: $36,000

Contribution rate (% of income): 8.5%

The jump in the account balance size for Gen Xers could reflect the fact that these folks have logged a good decade or two in the workforce, and have been contributing to plans that long. The slightly larger contribution rate may reflect that many are in their peak earning years.

Fiftysomethings (Age 50–59)

Average 401(k) balance: $174,100

Median 401(k) balance: $60,900

Contribution rate (% of income): 10.1%

Then the link to Fidelity has this added information.