Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The Investment Thread (11 Viewers)

- Thread starterSaint_Ward

- Start date

- Latest activity Latest activity:

Offline

Wasn't Goldman Sachs the "too big to fail" company from 2008 or whenever?

There was a group of eight companies deemed too big to fail after Lehman Bros failed.

Goldman was one of them.

- Moderator

- #9,858

Offline

That was such a crazy time. And to think, I worked as a financial advisor with my dad and brother at the time. Interesting memories. There were some difficult discussions with clients for sure. I remember when we were hours from contagion.There was a group of eight companies deemed too big to fail after Lehman Bros failed.

Goldman was one of them.

Lehman was definitely a shock to the system, but man, it could have been so, so much worse, lol.

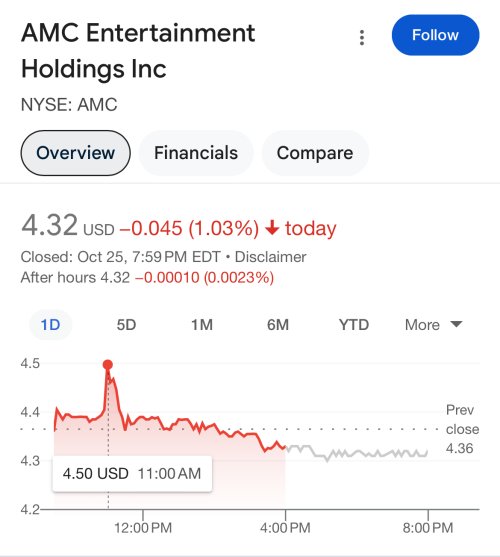

All these years later. These same stocks often do the exact same thing at the exact same time. I could only find these 3 stocks that had a shot of volume and a relatively big green candle at exactly 11:00am.

All the major indexes and ETFs were flat or down at this exact time. Even the major retail ETF (XRT) was flat or down.

It remains one of the most interesting things in the market to me.

- Admin

- #9,861

Offline

This past month hasn't been great for the market. Overall the year is up a lot.

AMZN popped today. Up around 7%. Hovering close to $200/share. I sold off a small amount to lock in profits. I'll buy back in on their next good dip.

I haven't been paying attention as much, because I was caught flat footed on CVI doing poorly. So poorly, they aren't paying their dividend, which is the main reason I have them.

AMZN popped today. Up around 7%. Hovering close to $200/share. I sold off a small amount to lock in profits. I'll buy back in on their next good dip.

I haven't been paying attention as much, because I was caught flat footed on CVI doing poorly. So poorly, they aren't paying their dividend, which is the main reason I have them.

That being said, AI isn't done by a long shot. And Intel has been dumping tons of cash into ramping up capacity. They pay a decent dividend.

They're still a blue chip Dow company.

That being said, I'm long on Intel, so if you sold them short, you'd probably do fine.

Offline

How’s everyone feeling about the Fed meeting today? Think a rug pull is coming?

Rug pull as in no rate cut? all signals point to a rate cut so not sure why they wouldnt keep with the cut.

its been widely public that a .25 cut was coming- i dont think that if it doesnt happen will be a rug pull. If it were .50 pts - maybe so.

But all im reading is that Powell will stay the course and do .25

Offline

On investing side- chip/AI computing is racing.

- Admin

- #9,866

Offline

I got into Dutch Bros a few months back. They popped today. It's dropping, but still up like 28%. I sold off a bit to lock in some profits. Up about 50% since I bought in.

Offline

I just moved some into defense and bought more IONQ

All these years later. These same stocks often do the exact same thing at the exact same time. I could only find these 3 stocks that had a shot of volume and a relatively big green candle at exactly 11:00am.

All the major indexes and ETFs were flat or down at this exact time. Even the major retail ETF (XRT) was flat or down.

It remains one of the most interesting things in the market to me.

Called it. Bet on it. Nice chunk of money. That blip on the radar on all 3 at the exact same time on the exact same day. Even tho it finished red on the day itself,

October 25th I saw it. And it was literally on the month low. But the signal was there.

Pounded it. Up 32% since.

- Joined

- Aug 6, 2011

- Messages

- 40,711

- Reaction score

- 65,733

- Age

- 39

Offline

Have you guys looked at rebalancing your portfolios since Trumps win?

I saw a blurb that folks who had 60/40 (fixed equities/fixed income) portfolios in 2020, and didn’t touch them now have 80/20 portfolios. Seems like we are all ripe for a rebalancing. I’m personally wondering how I should shift my portfolio after the win. Thinking more small to mid-caps.

I saw a blurb that folks who had 60/40 (fixed equities/fixed income) portfolios in 2020, and didn’t touch them now have 80/20 portfolios. Seems like we are all ripe for a rebalancing. I’m personally wondering how I should shift my portfolio after the win. Thinking more small to mid-caps.

- Moderator

- #9,870

Offline

I haven’t really done a deep dive or anything, but a starting point could be looking at what the movers were during his first administration before Covid hit. Obviously there’s a lot more global headline risk, so you’ll need to factor that in since there was no Ukraine/Israel conflict going on at that time.Have you guys looked at rebalancing your portfolios since Trumps win?

I saw a blurb that folks who had 60/40 (fixed equities/fixed income) portfolios in 2020, and didn’t touch them now have 80/20 portfolios. Seems like we are all ripe for a rebalancing. I’m personally wondering how I should shift my portfolio after the win. Thinking more small to mid-caps.

Also, interest rates and inflationary conditions will have an impact even after the recent 25 basis point cut.

Users who are viewing this thread

Total: 7 (members: 0, guests: 7)