Catalyst given and than taken away....@Saintaholic you should love this one (8 min video explaining) with the blatant corruption. "Meet Kevin" played a fine line with the MEME stocks, now that he is heavily invested he is calling them out.

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The Investment Thread (4 Viewers)

- Thread starterSaint_Ward

- Start date

- Latest activity Latest activity:

Offline

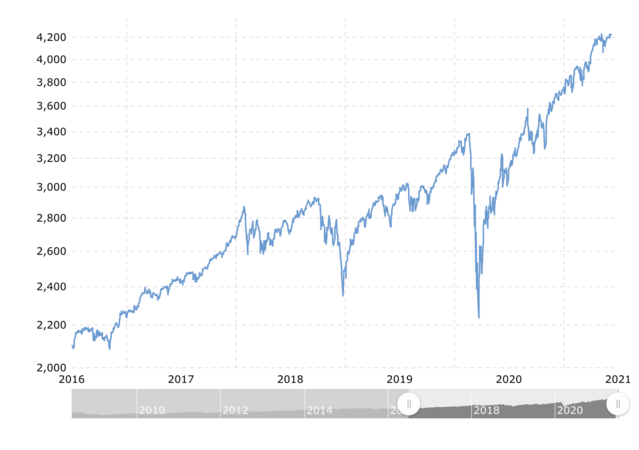

There is a massive bubble about to get popped. Way too much margin lending has occurred in the past year, due to short-sighted relaxing of SLR policies that have just gone offline. Too much of it was used.

It would be like giving someone $10 million to go gamble at the casino, and they absolutely MUST pay back all $10 million. But instead of being conservative and only gambling with say, $500k to $1m, you gamble with $9 million of it all at once, and lost on too many bets, so now you're in deep trouble.

It’s interesting but the chart isn’t necessarily demonstrative. Margin is a function of total asset value, so a raw number in billions isn’t as meaningful as margin/total. Lay the S&P over that chart and you can get a sense of whether they’re in sync. But it does look like the margin chart takes a higher trajectory at the end on the right (current) so the premise could still be true.

- Joined

- Jul 8, 2000

- Messages

- 27,046

- Reaction score

- 57,282

- Age

- 45

Online

It’s interesting but the chart isn’t necessarily demonstrative. Margin is a function of total asset value, so a raw number in billions isn’t as meaningful as margin/total. Lay the S&P over that chart and you can get a sense of whether they’re in sync. But it does look like the margin chart takes a higher trajectory at the end on the right (current) so the premise could still be true.

I guess the only counter to this is that the post-COVID bounce back looks a little too sharp. People/tutes taking advantage of the recovery plays and inflating them prematurely perhaps?

Offline

I guess the only counter to this is that the post-COVID bounce back looks a little too sharp. People/tutes taking advantage of the recovery plays and inflating them prematurely perhaps?

Yeah was looking at that too.

- Joined

- Jul 8, 2000

- Messages

- 27,046

- Reaction score

- 57,282

- Age

- 45

Online

Catalyst given and than taken away....@Saintaholic you should love this one (8 min video explaining) with the blatant corruption. "Meet Kevin" played a fine line with the MEME stocks, now that he is heavily invested he is calling them out.

Hedgies know when and how to throw water on good news to make sure it doesn't create a cataclysmic surge they fear.

They also know how to over-inflate news to make it sound more important than it is, for their weekly pump and dump scam type stocks, the latest examples being CLOV, WKHS, and AEMD. There's also my new favorite tactic they used that I have caught on to just recently - them pretending that Elon Musk crypto tweets are what is causing the rises and falls of those holdings. And just to make myself clear, I am saying Musk is involved in providing these tweets, the latest being the "Cumrocket" fiasco from this past weekend.

- Joined

- Jul 8, 2000

- Messages

- 27,046

- Reaction score

- 57,282

- Age

- 45

Online

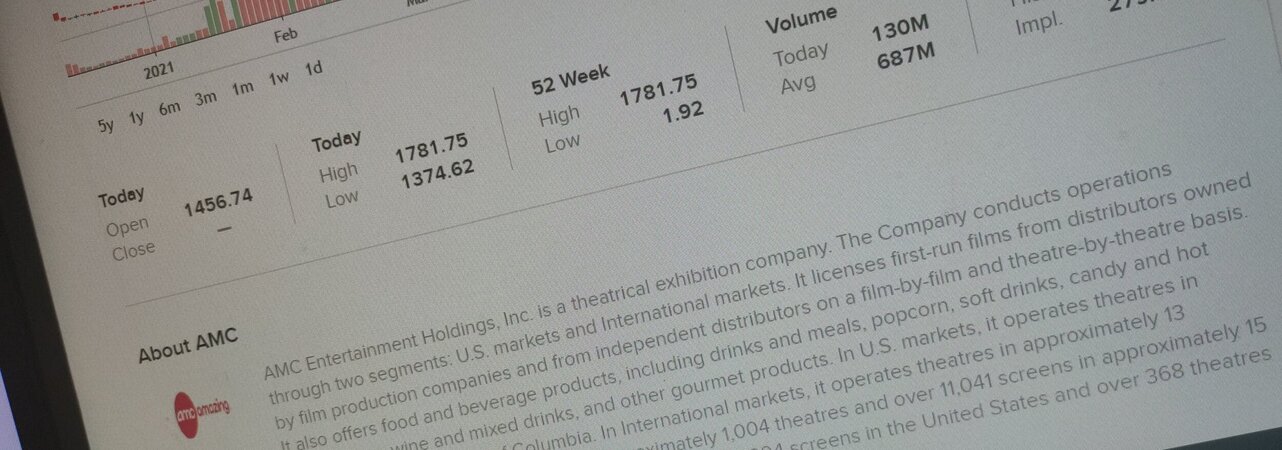

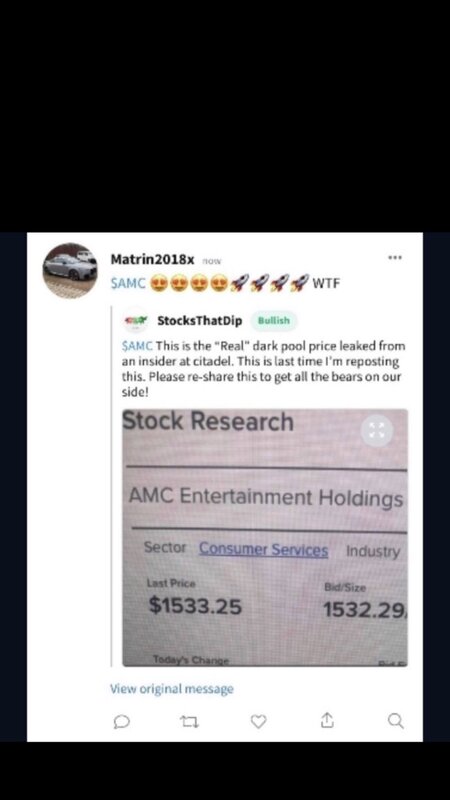

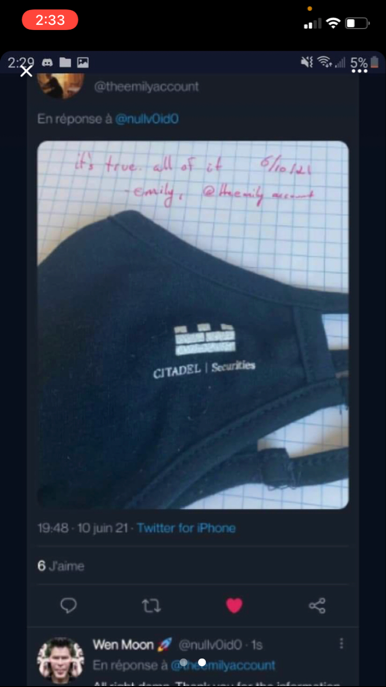

Been seeing screenshots like this going around today, indicating that this is the real price of AMC right now that only brokerages have access to. Not sure if authentic, so take it with a grain of salt. But this is at least the third one I have seen like this from three different sources and three different screengrabs.

Attachments

That DTCC 005 document was BS. They removed it due to “formatting issues” a few months ago and haven’t returned it since. GME guys have tried to create more awareness about that.Definitely have to expect massive dips at this stage, and they will only get worse. It's been their game for years now. Thankfully, most people have learned that the best way to combat them is to simply hold and not give them what they want (for you to sell).

I will admit that I did not foresee us breaking through that $45 support level today, but that was clearly an unnatural set of red candles from a chart standpoint and it appears things are heading back up now. I thought if we got under $42 today, we'd likely go as low as $37-39, which was where we landed briefly after the run to $70, but we did not.

At the end of the day though, as indicated, this is all psychological games at this point, with some fairly significant catalysts coming over the next 5 to 8 trading sessions, including the approval of DTCC-2021-002/005? on 06/21, which will give the SEC/DTCC the authority to force margin calls on these over-leveraged institutions.

EDIT: Looks like we actually DID go to $39.71 briefly. I must've missed that while I was away for a little while.

From my understanding the DTCC 005 will prevent hedges and big banks from kicking the FTDs further down the road.

- Joined

- Jul 8, 2000

- Messages

- 27,046

- Reaction score

- 57,282

- Age

- 45

Online

002 is the one I believe.That DTCC 005 document was BS. They removed it due to “formatting issues” a few months ago and haven’t returned it since. GME guys have tried to create more awareness about that.

From my understanding the DTCC 005 will prevent hedges and big banks from kicking the FTDs further down the road.

- Joined

- Jul 8, 2000

- Messages

- 27,046

- Reaction score

- 57,282

- Age

- 45

Online

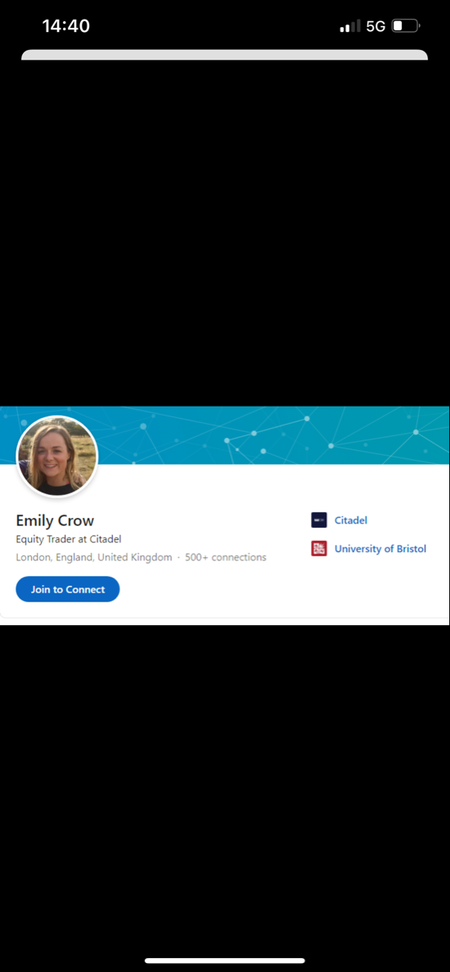

Take with a grain of salt, but seems legit enough to me.

- Moderator

- #6,625

Online

The only thing that gets me is she's only been in the business 3 years.

Take with a grain of salt, but seems legit enough to me.

- Joined

- Sep 9, 2001

- Messages

- 7,019

- Reaction score

- 10,302

Offline

And, she obviously doesn't want to stay in the business by posting that. If she is actually with CitSec.The only thing that gets me is she's only been in the business 3 years.

When I first seen the proof picture, I said to myself "who the hell issues bras as company swag", than my ding dong light went off, "oh, it's a mask".

- Joined

- Jul 8, 2000

- Messages

- 27,046

- Reaction score

- 57,282

- Age

- 45

Online

When I first seen the proof picture, I said to myself "who the hell issues bras as company swag", than my ding dong light went off, "oh, it's a mask".

Haha...same here.

On another note, GME is tanking hard right now, down almost $100.

These guys are DESPERATELY trying to get us to sell these shares. I think the stuff's about to hit the fan here in the next week or two.

- Joined

- Jul 8, 2000

- Messages

- 27,046

- Reaction score

- 57,282

- Age

- 45

Online

The only thing that gets me is she's only been in the business 3 years.

Attachments

Users who are viewing this thread

Total: 4 (members: 0, guests: 4)