- Joined

- Jul 8, 2000

- Messages

- 28,370

- Reaction score

- 61,564

- Age

- 45

Online

I am new to the option game, and I have a question that I hope someone could answer. If it is a virtual certainty that AMC is going to squeeze at some point in the next several months, what would be the downfall of shaving off a few shares to instead load up on January 2023 $40 call options, which are currently trading at about $2 a pop?

The maximum downfall of any option is losing the price of the position.

The premise of the play would be that you think there's a reasonable chance that AMC is a >$40 stock in January 2023. It's never been a $40 stock and was hovering around $15 between 2017 and 2019. I don't know AMC's specific fundamentals but I understand the company to have large debt (though good management would be using this gift of short squeeze price action to restructure its debt) and in a sector with huge question marks about American consumer behavior post-pandemic.

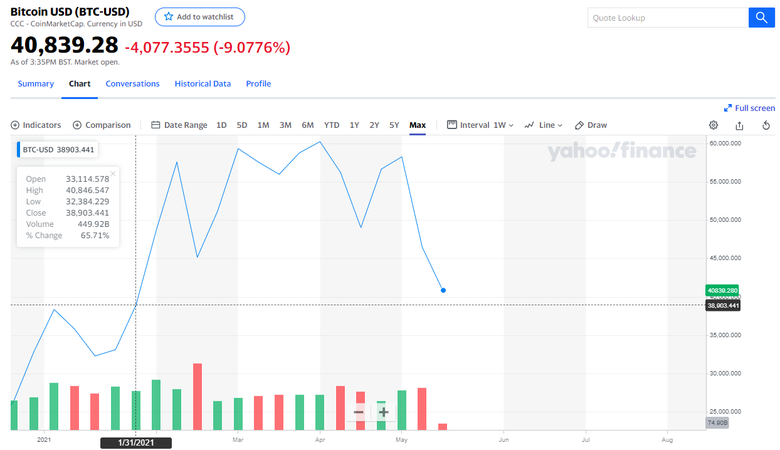

Quick update here - I went ahead and made this move, and it has been an absolute game-changer for me. I sold off about 40% of my common stock shares two weeks ago, and put the money into a mixture of June, September, and January $40 calls, and the gains I am seeing are unreal.

My timing could not have been better, because I bought them pretty much near the bottom just before this recent 8 day green streak that has seen the stock price go from sub-$9 to $14+ in the past week.

I will closely monitor them to make sure nothing crazy happens if the price drops, but so far so good. These are seeing increases at a far better rate than the shares themselves, relatively. The June 18th calls are the most worrisome, so I may need to slowly sell those off and move them to September as the date gets closer. But if this thing squeezes in the next week or two, I literally have likely increased my gains by 10x, if not more.