I didn’t. I need to get approved by E*TRADE. I do have shares that I got on Friday. This stock is one that I watch daily. It was doing some crazy things lately that peaked my interest. Namely strange out of the blue spikes and dips and barcoding in between.Saw that! Did you act on the $2 calls? I'm sure those are already looking nice.

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The Investment Thread (2 Viewers)

- Thread starterSaint_Ward

- Start date

- Latest activity Latest activity:

Just hit a penny!! My farm stocks are producing yield today.NSPX was a penny that was mentioned several months ago. Decided to throw some beer money at it at 0.0061. The 1 month RSI is at 22. The lowest since at least 2018. I just hope they don’t do a stock split soon. The company is supposedly real and did file there SEC report on May 17th. Nothing really stuck out in that report.

- Joined

- Jul 8, 2000

- Messages

- 26,934

- Reaction score

- 56,977

- Age

- 45

Online

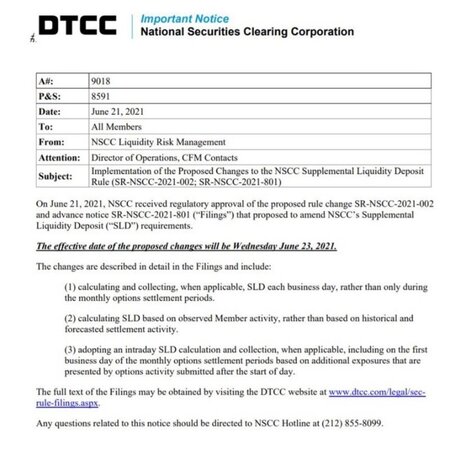

Rule 002 just got approved"on an accelerated basis"...Goes into effect Wednesday.

This gives the DTCC the right to initiate intraday checks to make sure institutions are not over-leveraged on their positions, and automates the margin call process if they're not in compliance/deemed to be too risky of a position.

This gives the DTCC the right to initiate intraday checks to make sure institutions are not over-leveraged on their positions, and automates the margin call process if they're not in compliance/deemed to be too risky of a position.

Attachments

So it’s not automatic that they produce the data and has to be initiated? So the Melvin Capital board member for the DTCC, can scratch some backs?Rule 002 just got approved"on an accelerated basis"...Goes into effect Wednesday.

This gives the DTCC the right to initiate intraday checks to make sure institutions are not over-leveraged on their positions, and automates the margin call process if they're not in compliance/deemed to be too risky of a position.

- Joined

- Jul 8, 2000

- Messages

- 26,934

- Reaction score

- 56,977

- Age

- 45

Online

So it’s not automatic that they produce the data and has to be initiated? So the Melvin Capital board member for the DTCC, can scratch some backs?

In theory, however they would not have pushed this rule through so quickly if they had no intentions to use it. At the end of the day, it's the DTCC's $67 trillion insurance that they're trying to protect; all that's happening right now with these price action delays is that the DTCC's portion of the bill is being run up, since the hedge funds involved will be out of money well before the end of their shares being covered.

bclemms

More than 15K posts served!

Offline

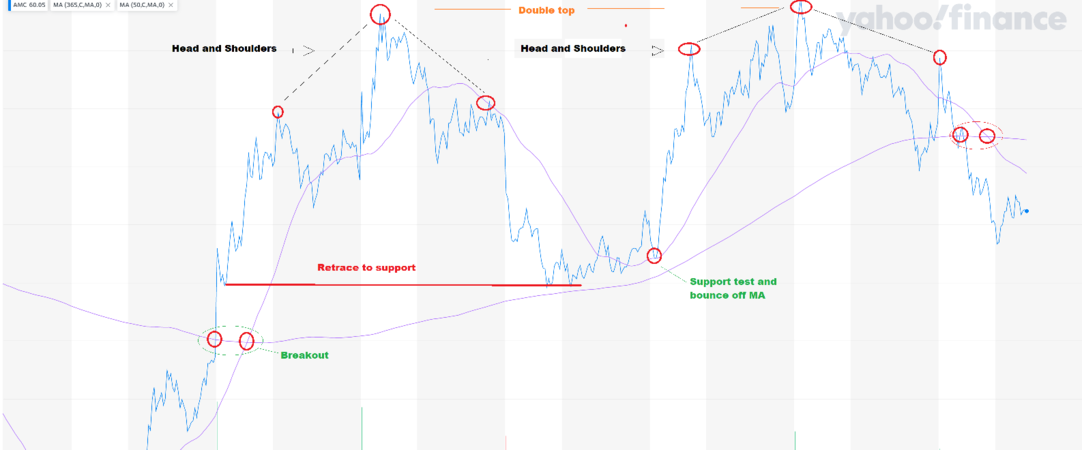

Hedges or technicals? Very obvious double top pattern on AMC. If it breaks below $52, technicals will drive it to $40. From there it could be a buying opportunity or collapse.Hedges hammering GME/AMC

- Joined

- Jul 8, 2000

- Messages

- 26,934

- Reaction score

- 56,977

- Age

- 45

Online

It's hedgies. 6 million shorts have been used today.Hedges or technicals? Very obvious double top pattern on AMC. If it breaks below $52, technicals will drive it to $40. From there it could be a buying opportunity or collapse.

The buyer vs. seller ration is 98% to 2%.

Technical data does not apply to this stock. All price action involving it is market makers and hedge funds trying to shake people out of their positions. Fundamentals don't matter at this stage due to the short interest, synthetic shares, and the fact that retail owns the float.

bclemms

More than 15K posts served!

Offline

I have to disagree with you. The last 5 days AMC has been like a posterboy in technicals. Technicals driving a stock void of any real news is about as old as the stock market and AMC is pretty ideal. Excuse the paint work but really good examples.It's hedgies. 6 million shorts have been used today.

The buyer vs. seller ration is 98% to 2%.

Technical data does not apply to this stock. All price action involving it is market makers and hedge funds trying to shake people out of their positions. Fundamentals don't matter at this stage due to the short interest, synthetic shares, and the fact that retail owns the float.

bclemms

More than 15K posts served!

Offline

In fact, I'd bet all those shorts got issued today because of the double top and technicals. If it breaks below $52, then look for all those shorts to cover around $40 which should drive a really sharp swing back up.

- Joined

- Jul 8, 2000

- Messages

- 26,934

- Reaction score

- 56,977

- Age

- 45

Online

Ok bud. How are those puts you bought back in the $10 range doing?

bclemms

More than 15K posts served!

Offline

I had calls on AMC, puts on GME.Ok bud. How are those puts you bought back in the $10 range doing?

- Joined

- Jul 8, 2000

- Messages

- 26,934

- Reaction score

- 56,977

- Age

- 45

Online

In fact, I'd bet all those shorts got issued today because of the double top and technicals. If it breaks below $52, then look for all those shorts to cover around $40 which should drive a really sharp swing back up.

Not trying to be difficult, but please understand you're talking to someone that has watched this specific stock's price fluctuations and news every single day for months now. This is not a normal stock that you can rely on technical data to predict.

- Joined

- Jul 8, 2000

- Messages

- 26,934

- Reaction score

- 56,977

- Age

- 45

Online

I had calls on AMC, puts on GME.

You've been calling AMC specifically a pump and dump scheme since March lol

bclemms

More than 15K posts served!

Offline

Nope, I trust your opinion. I can tell you have done the research and you aren't in here posting conspiracy youtube links or memes. Just looking at the 5 day chart, there is no denying that AMC has been following technicals perfectly. Not saying that will continue, certainly not saying it is a normal stock but right now, it is in a very clear technical pattern. I'm not a technical expert by any stretch but the patterns are so bold I even recognize it.Not trying to be difficult, but please understand you're talking to someone that has watched this specific stock's price fluctuations and news every single day for months now. This is not a normal stock that you can rely on technical data to predict.

Users who are viewing this thread

Total: 3 (members: 0, guests: 3)