- Joined

- Jul 8, 2000

- Messages

- 27,067

- Reaction score

- 57,357

- Age

- 45

Offline

Here is one of the videos he made about the cycles/fractal theory. This is all algorithmic.

The buying pressure on these stocks, in a normal, organic world, would result in a continues upward trend, day after day, but because that would absolutely wreck hedge funds and market makers, they're instead sending it to the same destination, but rather in a consistent pattern that involves large dips with huge spikes every three months when they have to rollover their futures positions.

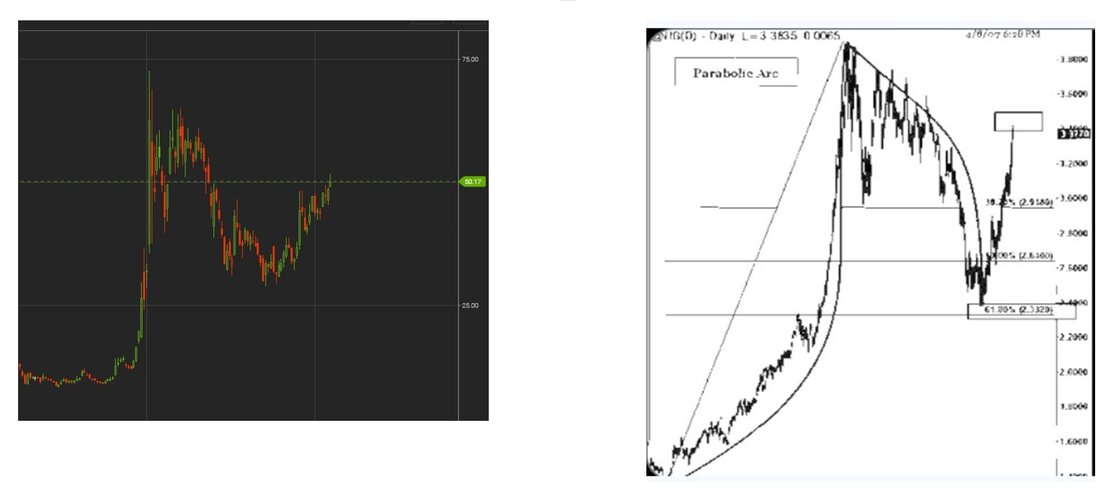

It's literally just one consistent parabolic arc pattern after another, over and over. This is AMC from late August to today, compared to literally a simply googled chart pattern...

The buying pressure on these stocks, in a normal, organic world, would result in a continues upward trend, day after day, but because that would absolutely wreck hedge funds and market makers, they're instead sending it to the same destination, but rather in a consistent pattern that involves large dips with huge spikes every three months when they have to rollover their futures positions.

It's literally just one consistent parabolic arc pattern after another, over and over. This is AMC from late August to today, compared to literally a simply googled chart pattern...