Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The Investment Thread (9 Viewers)

- Thread starterSaint_Ward

- Start date

- Latest activity Latest activity:

- Joined

- Jul 8, 2000

- Messages

- 27,016

- Reaction score

- 57,200

- Age

- 45

Online

Sorry if already posted, but I believe this Reddit poster has figured out why we are seeing such massive spikes pretty much every three months with the over-shorted stocks (a.k.a. the so-called meme stocks).

I had been saying for a while now to people that something was happening every 90 days, but I had no idea what it could be. I think we now know.

I had been saying for a while now to people that something was happening every 90 days, but I had no idea what it could be. I think we now know.

- Moderator

- #7,098

Offline

Sorry if already posted, but I believe this Reddit poster has figured out why we are seeing such massive spikes pretty much every three months with the over-shorted stocks (a.k.a. the so-called meme stocks).

I had been saying for a while now to people that something was happening every 90 days, but I had no idea what it could be. I think we now know.

Is there a TL;DR version?

Sorry if already posted, but I believe this Reddit poster has figured out why we are seeing such massive spikes pretty much every three months with the over-shorted stocks (a.k.a. the so-called meme stocks).

I had been saying for a while now to people that something was happening every 90 days, but I had no idea what it could be. I think we now know.

I have been keeping up with this from Simulate and Trade from YouTube, he has been trying to break the Reddit post down. Im guessing with the more exposure of the wrong doings someone is going to have to act because you can only play blind for so long. The focus of the pandemic has really helped the snakes as stories like this do not get the exposure they deserve.

Sorry if already posted, but I believe this Reddit poster has figured out why we are seeing such massive spikes pretty much every three months with the over-shorted stocks (a.k.a. the so-called meme stocks).

I had been saying for a while now to people that something was happening every 90 days, but I had no idea what it could be. I think we now know.

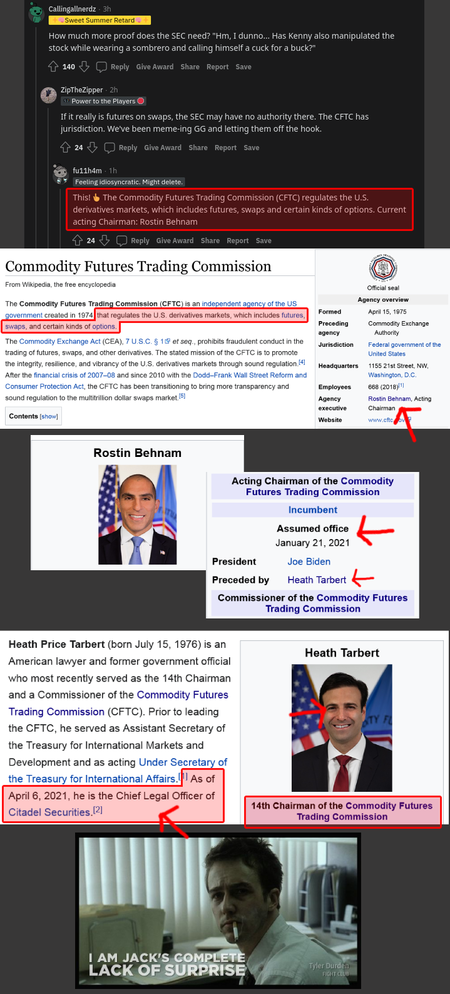

And this. Reddit figured out that the SEC has no jurisdiction in the derivatives market/scam.

Look at this rabbit hole:

This entire thing is getting blown wide open. It wouldn’t shock me if some real smart knowledgeable people have been anonymously spoon feeding the details of this organized crime to Reddit.I have been keeping up with this from Simulate and Trade from YouTube, he has been trying to break the Reddit post down. Im guessing with the more exposure of the wrong doings someone is going to have to act because you can only play blind for so long. The focus of the pandemic has really helped the snakes as stories like this do not get the exposure they deserve.

- Joined

- Jul 8, 2000

- Messages

- 27,016

- Reaction score

- 57,200

- Age

- 45

Online

- Joined

- Jul 8, 2000

- Messages

- 27,016

- Reaction score

- 57,200

- Age

- 45

Online

TL;DR:Is there a TL;DR version?

Act now, or forever hold your peace!

Barring some new level of fudgery, I could see massive gamma ramps for GME, AMC, BBBY, BB, and EXPR. This could be a big one. Im hoping this incites margin calls and liquidation to the bad players.Bought some $15 strike BB calls for 09/10 based on the above DD and the fact that they seem to be on the same 90 day cycle as AMC/GME, and those are already flying.

I bought them between $0.14 and $0.17 each.

- Joined

- Jul 8, 2000

- Messages

- 27,016

- Reaction score

- 57,200

- Age

- 45

Online

Barring some new level of fudgery, I could see massive gamma ramps for GME, AMC, BBBY, BB, and EXPR. This could be a big one. Im hoping this incites margin calls and liquidation to the bad players.

Yep...a lot of new regulations, like 010/803 coming online right now too. It may not be a coincidence that they're all pretty much expected to be in place here all around the same timeframe this DD points to.

Tough to envision a scenario where these funds are not in some deep trouble if this thing runs again.

- Joined

- Jul 8, 2000

- Messages

- 27,016

- Reaction score

- 57,200

- Age

- 45

Online

Just looked into this more. Today SPRT had a trading volume of 166 million.SPRT up 160%. Wow

Just under 25 million shares exist of this company.

Am I the only one seeing this???????

Users who are viewing this thread

Total: 3 (members: 0, guests: 3)