- Moderator

- #7,156

Offline

Hmm, so, they're (Congress members) getting even wealthier off the backs of the general public (TikTokers)? Figures.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

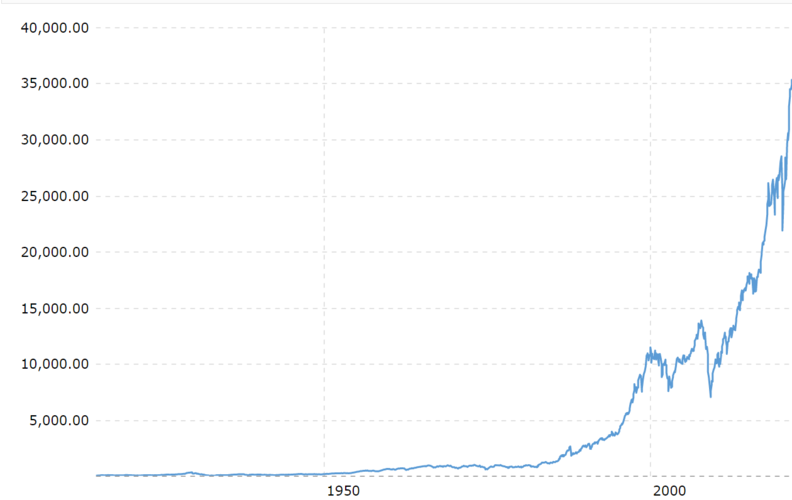

I just don't see how a full correction will manifest. There's so much Fed liquidity and global investment in the US securities markets - and as long as rates stay low, there's just nowhere else for the money to go. And rates will stay low because inflation has stayed in check and there's no other reason to raise them in a precarious economy.

I think that provides such a strong tailwind to markets that selloffs are likely to remain limited in scope.

So yeah.

I find this so interesting.

So because households are worth the most they ever have been, does it mean that companies are worth more than their already inflated prices suggest? Does it mean my business is worth more now that my neighbor has more money? Does the average person have more money or is the divide between the people with money and those without it are just becoming more extreme?

I certainly understand household wealth means more consumer spending. Except, the household wealth was built through government subsidies and reduced spending. Do Americans realize they don't need to eat out, they don't have to go to movie theatres and sporting events and they like having more money as a result? Was consumer behavior changed from Covid? Lol, hell nah.

I’m curious about inflation. Inflation is going up right now as the markets are still near ATHs and household debt seems to be at an ATH (or at least highest this century).I find this so interesting.

So because households are worth the most they ever have been, does it mean that companies are worth more than their already inflated prices suggest? Does it mean my business is worth more now that my neighbor has more money? Does the average person have more money or is the divide between the people with money and those without it are just becoming more extreme?

I certainly understand household wealth means more consumer spending. Except, the household wealth was built through government subsidies and reduced spending. Do Americans realize they don't need to eat out, they don't have to go to movie theatres and sporting events and they like having more money as a result? Was consumer behavior changed from Covid? Lol, hell nah.

Numbers show the household debt has started to increase faster than it was prior to the pandemic. How do you have more debt and more savings in both the public and corporate side of things? Answer is easy, expansion of government debt. We've been on this cycle for a long time now. Crisis happens, we throw money on the embers of the economy like gas on a fire and create this giant fire ball that uses all the oxygen and easy fuels but the second the gas stops pouring it goes right back to embers creating the next crisis where we rinse and repeat. Each time we do this it seems like the time between economic crisis is less and the money balls thrown on the fire is bigger and faster than ever before.

I don't know what the answer is. Ride the wave I guess but once the economy starts hittting those record numbers again in 2022 and all the recent stimulus starts to run through the vein of the economy you better be on your toes. Our addict of an economy will get really sick without it's next hit. The day that debt bubble pops the markets may not see new highs again for 30 years.

I know I keep pounding this same argument home but at the same time I don't think anyone will argue about sustainability.

Inflation is most impacted by two things, supply and demand of products and services and strength of currency. Currencies are all inflating debt at record rates so comparing the dollar to the Euro isn't really a good measure for currency based inflation. It's better when comparing it to commodities or basic staple goods.I’m curious about inflation. Inflation is going up right now as the markets are still near ATHs and household debt seems to be at an ATH (or at least highest this century).

If things start to go downhill- will inflation skyrocket or go down (deflation?).

And then there is the debt ceiling deadline that is approaching. Wish I knew more about all of this.

Oh I completely agree and understood the point. I think the markets fly the next few years. Just saying it isn't going to last long. From the time the fed starts tightening to the time of the next crisis will be less than 3 years and I'd wager more money on that than I would any stock. The last time we went more than 3 years of fed tightening rates without a crash was in the 1960's. The good news is the only time the fed has started a tightening process is when the economy was about to go nuts and it did every time afterwards with huge gains and it usually lasts two years. So get it while you can because 2024 is almost certainly going to be a birch.I think the point about household wealth in this context relates only to investable dollars. A great deal of dollars aren't likely to sit in passive cash - they're going to be spent or invested, mostly likely the latter when it comes to the bigger portion. This is what is driving asset prices and putting such a tailwind in securities. It's hard to see how a true correction is possible when selloffs trigger buying in the algorithms that control when many EFTs, MFs, and other investment vehicles buy, and they have so much buying power that it creates really strong price support. It's also driving home prices, second home markets, art and other investment-grade asset prices.

There's really too much money out there actually, at least from the perspective of healthy dynamics - like you point out, hundreds of millions of investable dollars sitting on the sideline waiting to invest don't mean that companies are going see higher revenues. The investment economy and the actual economy can be divergent with these forces in action. The worst part is that those massive hordes of money aren't distributed across the economy in any sort of healthy way - they are concentrated in a relatively small minority. And the hunger for investment drives other unhealthy forces, such as REITs and other real-estate investment vehicles that are wreaking havoc on the US housing situation, which is becoming dire in many locations.

In the 90's we had this massive economic boom combined with some responsibility of government spending and reasonable tax levels and were able to erase a huge debt in matter of a few years. Our debt levels have gone well past that now, we collect far less tax revenue and have gone so far with spending that we would have to make massive cuts just to get back on track. Since that time we've had the dot com bust, 9/11, the financial crisis, the debt crisis and covid crisis. Technically, we haven't fixed the problems from the financial crisis and that is going to come to a head with debt at all levels.

I think we have been in a period of high inflation that has been masked by technological advances such as energy efficiency, cheap consumer goods, agriculture output gains combined with engineered food (plant and animal), plus the introduction of globally competitive marketplace (internet). Technology is probably going to keep these advances going for a very long time so at least we have that.

Also, it's a whole lot easier to make money in the market over the last decade if you don't know any of this stuff.

I actually think the housing industry is going to start cooling and level off as rates increase and supply chains normalize.Housing crisis as well.

And im seeing it again, but in a different light - more to the supply/demand you spoke of earlier.

I built my home in 2019 for roughly $130 a sq ft ( $158 if you add the land price ) - 4 months ago, my neighbor behind me sold for $187/sq ft.

Monday, my neighbor put home up...$225/sq ft. Now it probably wont sell for exactly that, but even if over $200, thats almost a 30% appreciation in 2 years for my home. Thats simply insane and unsustainable. Someone will grossly over pay for that house ( and possibly mine because if they fetch $210-220 - i dont think i have much choice lol ) and when the dust settles, many many people will be upside down to the tune of tens of thousands of dollars. The only bright side is that mortgage companies arent pushing 5/1 or 10/1 ARMs, and i dont think writing mortgages for folks who simply cannot afford- at least i hope.

Inflation is most impacted by two things, supply and demand of products and services and strength of currency. Currencies are all inflating debt at record rates so comparing the dollar to the Euro isn't really a good measure for currency based inflation. It's better when comparing it to commodities or basic staple goods.

Inflation has been running wild because of supply and demand over the past 6 months. It's been a sudden push because both the demand side and supply sides are seeing pressure for different but related issues. The demand side, particularly in tech related (computer chips), travel related industries and construction industries. The construction materials shot up due to a surge in building that happened due to low interest rates as part of the FED dumping money over the market after the covid crash combined with supply shortages since so many companies cut production or weren't running at full capacity during covid. The cpu chips had a huge surge in demand due to people buying devices to work from home, increased demand due to crytpo mining and supply shortages due to factories being shut down from covid. Travel was just a rush of people wanting to get out of their homes all at once after the vaccine hit causing a huge shock in demand. For rental car companies it all really came together. The rental car companies were among the hardest hit from covid. In order to stay in business they had to sell a large percentage of their fleets. They figured once demand came back they would just buy new cars. The car industry can't make cars because of the chip shortages. When you have 200 people looking for 1 rental car, then suddenly the car rental place can ask for $400/day and get it.

The debt ceiling isn't normally a big deal, I think it's been raised 75 or so times, the majority under Republican control. The debt ceiling has to be raised as the economy grows, population increases and spending increases. However, the last two times the Republicans lost power they have weaponized the debt ceiling to intentionally cause harm to the economy for political gain. It's basically a loop hole to object to spending that couldn't be stopped during the legislative process. It can have massive and long lasting impacts including credit defaults and downgrades. It would have been considered treason a few decades ago.

It could go either way. Odds are the next crash will go towards deflation as most do and we will throw even more money at the market to prop it back up. We continue to rinse and repeat until we hit inflation like in the 70's then we better hope we have a leader in office and at the FED that will have the balls to do what is needed (hike rates at the expense of the market) but it is career suicide for a politician (see Jimmy Carter). Most countries hit this point and default as the currency crashes leading to a bunch of really bad things. The third option is stagflation. A country hits this wall of economic gain it simply can not get past. Throwing money on it doesn't help, dropping interest rates don't help and the economy just gets stuck in place where it can not grow while dealing with persistant above average inflation and above average unemployment. It can't hike rates without causing a depression, it can't drop rates because it is already at 0 and unemployment gets stuck at abnormally high levels. This typically happens about the same time as a country has an aging population, population decline and the economy becomes extremely dependant on the governent. This is what happened in both Japan and Europe. At this point you start to see a mass migration of capx moving to other countries or continents. All the signs are pointing this way for the US economy. Ironically, it is likely moving from one crisis to the next that is probably preventing stagflation from setting in.

In the 90's we had this massive economic boom combined with some responsibility of government spending and reasonable tax levels and were able to erase a huge debt in matter of a few years. Our debt levels have gone well past that now, we collect far less tax revenue and have gone so far with spending that we would have to make massive cuts just to get back on track. Since that time we've had the dot com bust, 9/11, the financial crisis, the debt crisis and covid crisis. Technically, we haven't fixed the problems from the financial crisis and that is going to come to a head with debt at all levels.

I think we have been in a period of high inflation that has been masked by technological advances such as energy efficiency, cheap consumer goods, agriculture output gains combined with engineered food (plant and animal), plus the introduction of globally competitive marketplace (internet). Technology is probably going to keep these advances going for a very long time so at least we have that.

Also, it's a whole lot easier to make money in the market over the last decade if you don't know any of this stuff.

Nationally i think so.I actually think the housing industry is going to start cooling and level off as rates increase and supply chains normalize.

I bet we are about to see a huge run on credit card debt and everyone can get a credit card in the coming months. More than likely though, it's going to be something we don't see coming.

It's not just a short term pattern in areas. It's a long term pattern in SE Tx, coastal La and in areas of the Sierras. The constant storms in La and the wildfires in California are pushing people out. That is going to accelerate and spread to other areas along the South and East coasts but it should be a relatively slow paced, very small number type of thing for the next decade or two. Places like Idaho, Utah, Montana are booming as it warms up as well.Nationally i think so.

locally ( micro level ) - we just had the river parishes razed by Ida and storm surge- The mass migration north after Katrina is about to happen again from those in the River Parishes. Not on the scale of Katrina but it will happen...many will go more toward Hammond/BR - but there will still be a large contingent moving into St. Tammany area once again. Willing to pay a premium to get out of harms way. Especially if they apply/receive the SBA 1% loans that will be readily available to many of them.

My fear locally, is we will be behind the national curve by 6 months and when it finally does come home to roost, it will be tough for many because that will drag economy , in turn drag down income, and now its two-fold pressure on the homeowner.

It's not just a short term pattern in areas. It's a long term pattern in SE Tx, coastal La and in areas of the Sierras. The constant storms in La and the wildfires in California are pushing people out. That is going to accelerate and spread to other areas along the South and East coasts but it should be a relatively slow paced, very small number type of thing for the next decade or two. Places like Idaho, Utah, Montana are booming as it warms up as well.

I'm actually really liking property in Cheyenne, Wy. It's a city that has seen real estate values decline over a long period, no state income tax and everything just south of it in Colorado is exploding in price. It's likely in the early stages of a long term boom. Those cold winters are only getting warmer.

Boise is another place of interest. Surrouded by mountains and limited available real estate, growing fast with a huge tech sector. It's got the makings of a big boom place as well, particularly if you pick up land cheap south of the City now. I think land in key areas is a good investment long term regardless of the situation with everything else. I really think we are going to see a big migration into those areas over the next two decades.

My plan is to move that way in the next 10 years honestly.It's not just a short term pattern in areas. It's a long term pattern in SE Tx, coastal La and in areas of the Sierras. The constant storms in La and the wildfires in California are pushing people out. That is going to accelerate and spread to other areas along the South and East coasts but it should be a relatively slow paced, very small number type of thing for the next decade or two. Places like Idaho, Utah, Montana are booming as it warms up as well.

I'm actually really liking property in Cheyenne, Wy. It's a city that has seen real estate values decline over a long period, no state income tax and everything just south of it in Colorado is exploding in price. It's likely in the early stages of a long term boom. Those cold winters are only getting warmer.

Boise is another place of interest. Surrouded by mountains and limited available real estate, growing fast with a huge tech sector. It's got the makings of a big boom place as well, particularly if you pick up land cheap south of the City now. I think land in key areas is a good investment long term regardless of the situation with everything else. I really think we are going to see a big migration into those areas over the next two decades.