Offline

My TSLA’s up the highest it’s been in months, did I miss some news

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

They exceeded delivery expectations which was a big surprise given chip shortages.My TSLA’s up the highest it’s been in months, did I miss some news

So this was a nothing burger. They clearly toyed with GME apes in how they went about this. I'll keep holding. And waiting.

bird in handBorrowing 300K for house. 30 year loan. We have the option for locking in our interest rate at 3.25%. Or pay $5,700 to lock in at 2.875%.

OR - wait another 10 days to receive new options.

My thinking is that interest rates are going to go up in the near future. Your thoughts?

Just refi because I have been hearing/reading that rates are about to jump, two weeks ago I locked in @ 2.9% and just the signed the papers as of last Friday.Borrowing 300K for house. 30 year loan. We have the option for locking in our interest rate at 3.25%. Or pay $5,700 to lock in at 2.875%.

OR - wait another 10 days to receive new options.

My thinking is that interest rates are going to go up in the near future. Your thoughts?

bird in hand

I just invested a significant (for me, anyway) amount in Fundrise.. ive been considering them for over a year and a half, then lately ive seen multiple articles like the one I’m linking below- showing that institutional investors and those with ‘deep pockets’ are outbidding the average person/couple bidding on homes for sale around the US (the article headline is a little misleading since it blames ‘pension funds’ when in fact it’s mostly large investors and REITs).. in some cases, they are buying entire neighborhoods/developments and turning them into rentals.. while i think that this is sh**ty overall for society, i recently sold my home in NOLA and am now renting for the time being.. with the hot sellers’ market now, my prospects for buying are not looking very good, so my thought process is ‘If you cant beat ‘em, then join ‘em’…. Instead of letting the $$ i made from the sale of my house sit and lose value, at least I’ll hopefully derive some profit from what companies like Fundrise are doing, and won’t totally be left out in the cold.

Pension funds are outbidding middle class families raising home prices

John Burns Real Estate Consulting has said pensions and private-equity firms are competing with young homebuyers which will make home costs 'permanently more expensive.'www.dailymail.co.uk

.

So just an update, it’s only been 4 months since i invested in Fundrise, but i really like it so far.. my investment has already grown by about 12.5% , and that doesnt include the small dividends that were distributed to me at the end of the first (fractional) quarter after i invested, and then just this week from Q3.. yall may want to look into it, it’s a good way (for me, at least) to make some money off of real estate , while sitting out the market myself in terms of buying another home til things cool off.

from their website:

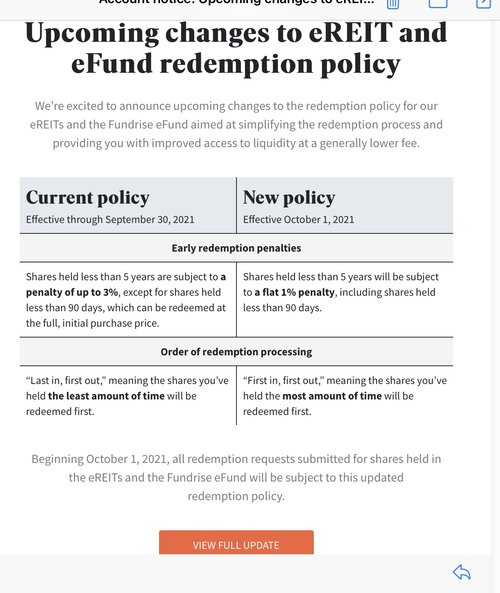

While Fundrise should be viewed as a long-term investment, we understand that investors may want or need to prematurely liquidate (or "redeem") their shares. Accordingly, our investors may request to redeem shares at any time, although such redemption cannot be guaranteed — especially in times of economic uncertainty — and there may be costs associated with premature redemption.

pump that $1000 into SPG - 5% divi and you can get out anytime, regardless of "economic uncertainty" ( which they dont offer a clear definition of what they deem "economic uncertainty" lol)

Seems like a nice idea for crowdfunding investing but im too conservative lol.