Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The Investment Thread (9 Viewers)

- Thread starterSaint_Ward

- Start date

- Latest activity Latest activity:

Offline

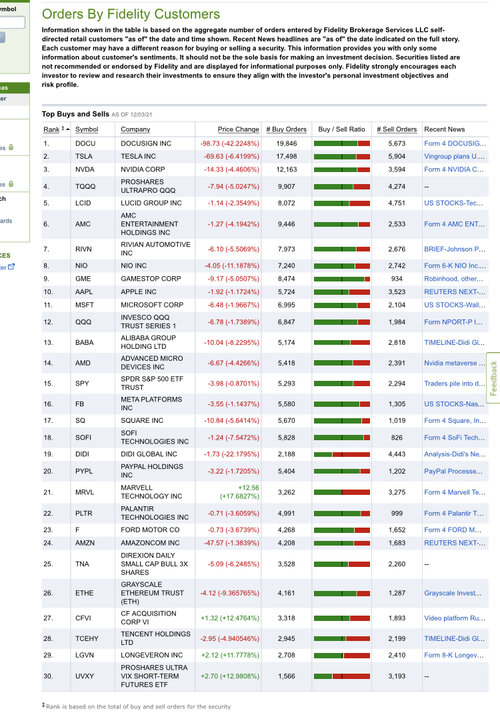

That's just Fidelity brokerage correct?

So folks with Fidelity accounts bought more vs sold, but overall.

Be careful as I think we are heading into upcoming week with some mad volatility. I'm already feeling the pain, and I'm fully expecting more to come and trying to figure what to unload to load up on cash for buying.

bclemms

More than 15K posts served!

Offline

Yeah, I think next week will be more volatile than last week. Crypto had a bit of a flash crash overnight after the sell off on Friday and the volatility there will be a good indicator on what Monday may bring.That's just Fidelity brokerage correct?

So folks with Fidelity accounts bought more vs sold, but overall.

Be careful as I think we are heading into upcoming week with some mad volatility. I'm already feeling the pain, and I'm fully expecting more to come and trying to figure what to unload to load up on cash for buying.

As an investor, I'm hoping for a 50-60% decline in total market value. I'm hoping the debt bubble pops and the inefficient companies that have been able to survive over the last decade are finally allowed to fail. I'm hoping the insane PE ratios come down, that a huge host of crypto coins run to 0. Need the tech bubble to burst and have companies that actually make money becomes a necessity to stock price growth. That's when you will see a monster wave of money move in off the sidelines and a real recovery that hasn't really been allowed to take place since the financial crisis. Unfortunately the speculative retail investors will be the ones that get wiped out.

As a business owner, I hope this bubble keeps blowing. I might as well have a printer in the living room churning out $100's. If you can't make money or find a good job in the current environment you should take a really long look in the mirror.

- Joined

- Jul 8, 2000

- Messages

- 27,312

- Reaction score

- 58,156

- Age

- 45

Offline

Yeah, I think next week will be more volatile than last week. Crypto had a bit of a flash crash overnight after the sell off on Friday and the volatility there will be a good indicator on what Monday may bring.

As an investor, I'm hoping for a 50-60% decline in total market value. I'm hoping the debt bubble pops and the inefficient companies that have been able to survive over the last decade are finally allowed to fail. I'm hoping the insane PE ratios come down, that a huge host of crypto coins run to 0. Need the tech bubble to burst and have companies that actually make money becomes a necessity to stock price growth. That's when you will see a monster wave of money move in off the sidelines and a real recovery that hasn't really been allowed to take place since the financial crisis. Unfortunately the speculative retail investors will be the ones that get wiped out.

As a business owner, I hope this bubble keeps blowing. I might as well have a printer in the living room churning out $100's. If you can't make money or find a good job in the current environment you should take a really long look in the mirror.

Crypto sell-offs, especially to this degree, have typically been foreshadow to significant price spikes on the heavily-shorted/over-sold securities. It becomes more and more clear every time it happens that crypto pumping is being used for liquidity, in my opinion (hopefully the last guy that took offense to this doesn't crush me again for my take lol).

- Moderator

- #7,445

Offline

Well, sooner or later, people will need liquidity for whatever reason, and when people need it to cover margin or rotate to other investments, crypto will face downward price pressures because of that. It's sort of baked into most other investments, but not so much in crypto imo.Crypto sell-offs, especially to this degree, have typically been foreshadow to significant price spikes on the heavily-shorted/over-sold securities. It becomes more and more clear every time it happens that crypto pumping is being used for liquidity, in my opinion (hopefully the last guy that took offense to this doesn't crush me again for my take lol).

That's just Fidelity brokerage correct?

So folks with Fidelity accounts bought more vs sold, but overall.

Be careful as I think we are heading into upcoming week with some mad volatility. I'm already feeling the pain, and I'm fully expecting more to come and trying to figure what to unload to load up on cash for

I’ve noticed that too. This one seems different tho. Don’t know why. Normally the crypto dumps happened closer to Monday morning than Friday night. I could be very wrong though.Crypto sell-offs, especially to this degree, have typically been foreshadow to significant price spikes on the heavily-shorted/over-sold securities. It becomes more and more clear every time it happens that crypto pumping is being used for liquidity, in my opinion (hopefully the last guy that took offense to this doesn't crush me again for my take lol).

- Joined

- Jul 8, 2000

- Messages

- 27,312

- Reaction score

- 58,156

- Age

- 45

Offline

Well, sooner or later, people will need liquidity for whatever reason, and when people need it to cover margin or rotate to other investments, crypto will face downward price pressures because of that. It's sort of baked into most other investments, but not so much in crypto imo.

I believe "people" should be changed to "institutions" in your post, but I do agree overall.

- Moderator

- #7,448

Offline

True, I think there's a good mix of both retail and institutional in there, but yeah, I would agree it's mostly institutional driven.I believe "people" should be changed to "institutions" in your post, but I do agree overall.

- Joined

- Jul 8, 2000

- Messages

- 27,312

- Reaction score

- 58,156

- Age

- 45

Offline

True, I think there's a good mix of both retail and institutional in there, but yeah, I would agree it's mostly institutional driven.

I am of the personal belief that retail buying and selling has little effect on the day to day movements of stocks; dark pools are used to grab that buying, and every few months, around quarterly futures expirations, a portion of that pent-up buying pressure gets released.

What gets me is non hedge fund institutions purchasing meme stocks and it does NOTHING for the stock, ala California Teachers Retirement which is the 2nd largest public pension asset in the U.S. purchasing nearly 700k of AMC stocks. Swiss National Bank 800k of AMC stocks.

www.barrons.com

www.barrons.com

www.barrons.com

www.barrons.com

Giant U.S. Pension Bought AMC, Snowflake, and Tilray. It Sold Berkshire Hathaway.

California State Teachers’ Retirement System bought AMC Entertainment, Snowflake, and marijuana stock Tilray in the third quarter. It sold Berkshire Hathaway stock.

Swiss National Bank Scooped Up AMC Stock. It Also Bought Uber and Lyft.

Switzerland’s central bank more than quadrupled its stake in AMC Entertainment stock, bought more Uber shares, initiated a stake in Lyft, and sold McDonald’s stock in the second quarter.

- Joined

- Jul 8, 2000

- Messages

- 27,312

- Reaction score

- 58,156

- Age

- 45

Offline

What gets me is non hedge fund institutions purchasing meme stocks and it does NOTHING for the stock, ala California Teachers Retirement which is the 2nd largest public pension asset in the U.S. purchasing nearly 700k of AMC stocks. Swiss National Bank 800k of AMC stocks.

Giant U.S. Pension Bought AMC, Snowflake, and Tilray. It Sold Berkshire Hathaway.

California State Teachers’ Retirement System bought AMC Entertainment, Snowflake, and marijuana stock Tilray in the third quarter. It sold Berkshire Hathaway stock.www.barrons.com

Swiss National Bank Scooped Up AMC Stock. It Also Bought Uber and Lyft.

Switzerland’s central bank more than quadrupled its stake in AMC Entertainment stock, bought more Uber shares, initiated a stake in Lyft, and sold McDonald’s stock in the second quarter.www.barrons.com

I believe there are some long institutions out there with MM status that are hoarding shares to suppress the price, likely for the perceived greater good of not crashing the economy. BlackRock, Fidelity, and Vanguard are three that I don't fully trust.

- Joined

- Jul 8, 2000

- Messages

- 27,312

- Reaction score

- 58,156

- Age

- 45

Offline

I have such a corrupted mindset. I think you are half way right. If retail (or PFOF brokerages) puts upwards pressure on a stock then that gets put on dark pools. If retail sells….then that’s subjected to the lit exchange.I am of the personal belief that retail buying and selling has little effect on the day to day movements of stocks; dark pools are used to grab that buying, and every few months, around quarterly futures expirations, a portion of that pent-up buying pressure gets released.

Yep yep yep. I think that Fidelity isn’t as nice as we think. I’m pulling a lot of my shares out of FUDelity and into ComputerShare. They are starting to kick and scream about that lately.I believe there are some long institutions out there with MM status that are hoarding shares to suppress the price, likely for the perceived greater good of not crashing the economy. BlackRock, Fidelity, and Vanguard are three that I don't fully trust.

- Joined

- Jul 8, 2000

- Messages

- 27,312

- Reaction score

- 58,156

- Age

- 45

Offline

I have such a corrupted mindset. I think you are half way right. If retail (or PFOF brokerages) puts upwards pressure on a stock then that gets put on dark pools. If retail sells….then that’s subjected to the lit exchange.

Agreed. They also time these events with supposed "catalysts" and earnings data, and will even sometimes do the exact opposite of what SHOULD happen with these things, just to subvert expectations and shake out retail.

It's all an accumulation game. Most of the market is an exercise in parabolic arcs and Wyckoff accumulations.

Users who are viewing this thread

Total: 3 (members: 0, guests: 3)