- Admin

- #6,973

Offline

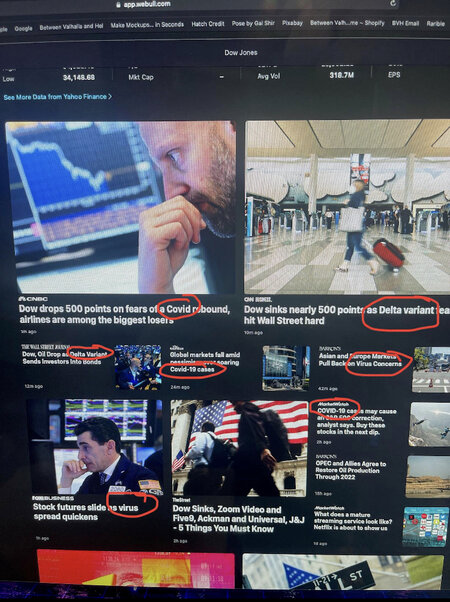

Big market nosedive.

All Delta strain related? Travel getting hammered.

All Delta strain related? Travel getting hammered.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

All Delta strain related? Travel getting hammered.

its a pull back on Delta fears sprinkled with some inflationary pressures. ( since that will not abate til 2022 )Listening to CNBC this morning, it seems like trepidation over the Delta, and the general rise in numbers, seems to be the biggest factor.. which is weird to me, since the height of Covid in 2020 saw one of the biggest bull markets in history..

Also interestingly , at least to me- is that TSLA is actually slightly *up* today.

I bought RKT at 16.83 this morning. We’ve seen 2 months of articles about falling mortgage demand. This refinance fee cut is going to lower rates and demand will pick up. People are flush with cash so I can see people eating fee costs to lock a super low rate.Mortgage refinance fee dropped by regulator, lowering costs for borrowers

Fannie Mae and Freddie Mac are dropping a fee on mortgage refinances that was instituted during the pandemic.www.cnbc.com

I think this is the point I cash out refi. I’m seeing 30-yr 2.65% for no fees lowering my PI by $150 or $40k cash out for 2.75% for no fees on Bankrate. I refinanced May 2020 dropping my payment by $200 with a 12mo break even.

Very nice day. I wonder if this the start of a nice run or if the shorts tighten it up again.AMC and GME are running hard this afternoon

Very nice day. I wonder if this the start of a nice run or if the shorts tighten it up again.

I honestly trust an internet guy who follows this stuff more than the media. Almost every media outlet blamed yesterday’s drop on Covid concerns. Crazy how 24 hours later things rebound and Covid is no longer a concern.There are countless television networks and websites devoted to this very question… Lemme know if you figure it out.

I think it's gonna be some volatile, choppy trading, which will go sideways until we get a better handle on this thing.I dont know yall, i have a feeling that the fricktards who refuse to get vaccinated are about to cause another surge/wave/whatever you want to call it, and in the process bring the economy down with them…. Granted, it’s simply a ‘feeling’ right now, based on what we are anecdotally seeing (but also what health officials and science are telling us)…. And i most certainly hope that i am wrong.