bclemms

More than 15K posts served!

Offline

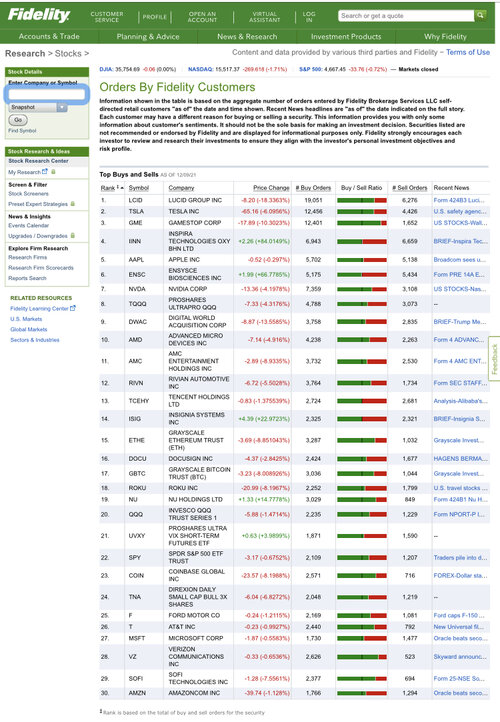

Just made a killing on my $160 GME puts, closed them out. Probably should have held because if that last little support doesn't hold at $150 it could be headed for double digits fast.

Got in the money on my TSLA calls yesterday, closed them out. My puts don't expire until January and still holding those but up a chunk on those today but never count paper gains with options.

Got in the money on my TSLA calls yesterday, closed them out. My puts don't expire until January and still holding those but up a chunk on those today but never count paper gains with options.