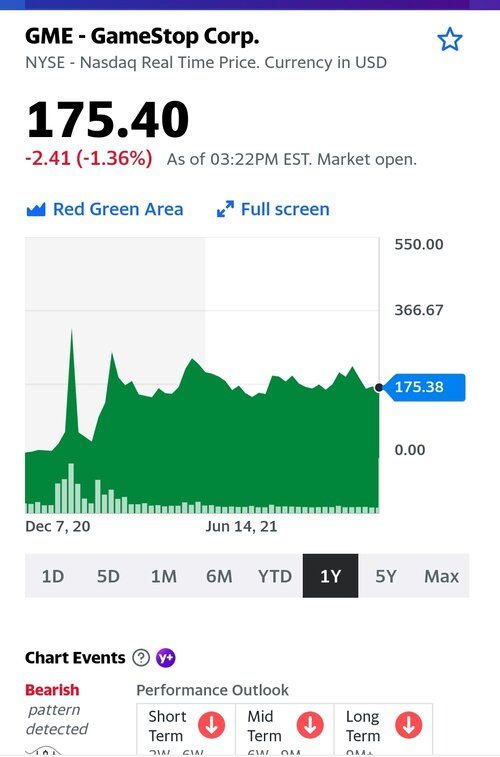

So the DOJ is investigating Hedge Funds for illegal short selling.

www.reuters.com

www.reuters.com

My tin foil thinking is that the SEC was investigating and had a holy crap moment. All the SEC can do is pretty much just issue fines. I wonder if it’s possible that they said “Nope, nothing going on here. Thanks GameStop and others for providing documents”. But just handed over everything to the DOJ and said - you’d outta look at this.

Fun fact - one of the deputies that helped take down Enron is leading this one.

U.S. Justice Dept launches expansive probe into short-selling -sources

The U.S. Department of Justice has launched an expansive criminal investigation into short selling by hedge funds and research firms, according to three people familiar with the matter.

My tin foil thinking is that the SEC was investigating and had a holy crap moment. All the SEC can do is pretty much just issue fines. I wonder if it’s possible that they said “Nope, nothing going on here. Thanks GameStop and others for providing documents”. But just handed over everything to the DOJ and said - you’d outta look at this.

Fun fact - one of the deputies that helped take down Enron is leading this one.