SaintInBucLand

Veteran Starter

- Joined

- Jun 30, 2014

- Messages

- 2,564

- Reaction score

- 3,331

Offline

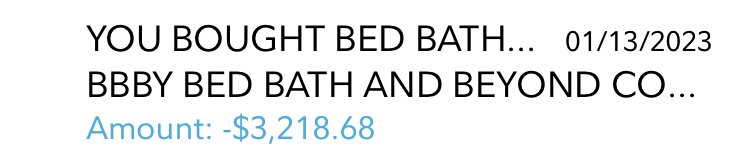

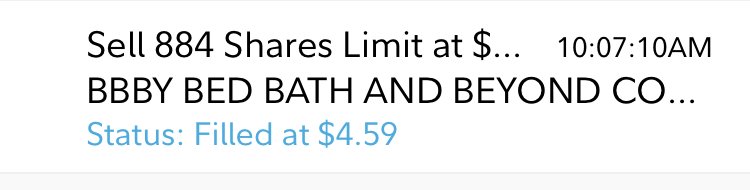

Funny enough. WSB actually banned anyone who mentioned GME or BBBY. That ban seemed to have been lifted recently.

They banned GME because more and more people are not doing options on that stock and mention direct registration. WSB maintained that this was a subreddit for option bets and not not term holders of GME.

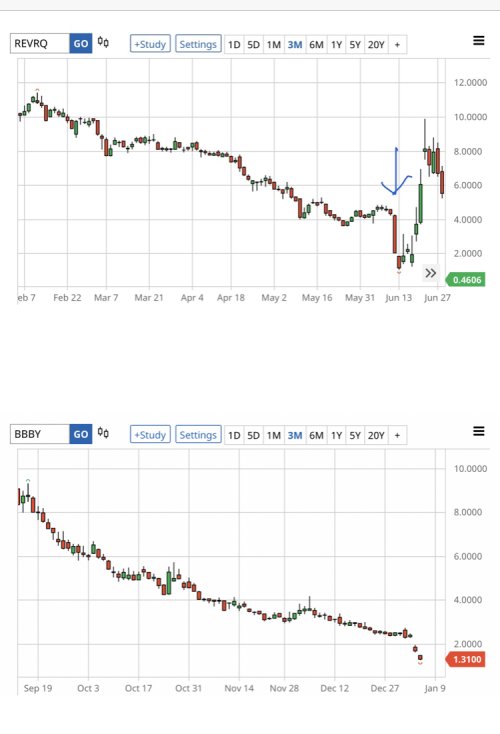

BBBY was banned because it fell below 500 million in marketcap.

It's a smart policy to ban mentions of companies with market cap under $500 million, easy to manipulate.

The days of company fundamentals being important seem to be over.