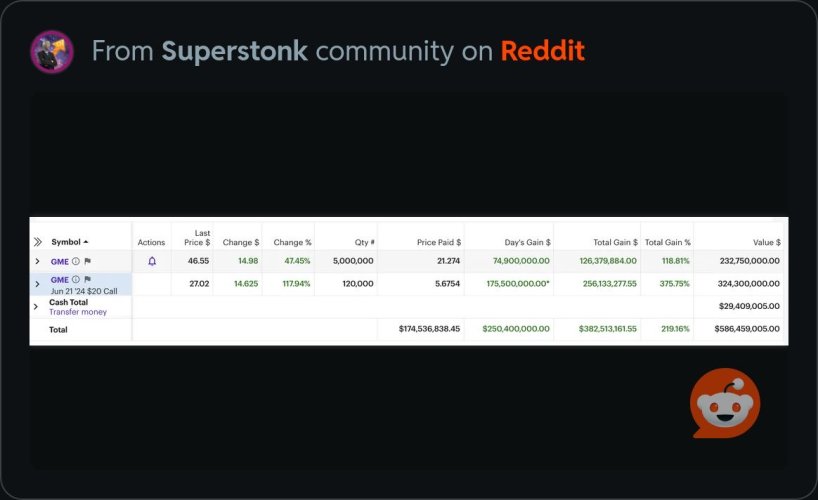

The big question I have is how he went from 800,000 shares to 5 million shares while being silent for 3 years.

He went silent June 21 2021 until this past May. At the time he had 200K shares. Then with the stock split that would turn into 800K shares.

We can’t find where any whale went that big during his his meme tweets in those two weeks in May.

One idea is he sold his 800K shares when it was around $50 a share in late June 2021. Then if he just played the market safely for a couple of years and went back all in when GameStop hit $10 a share shortly after Q1 earnings. But that’s just an idea. Who knows what he did.

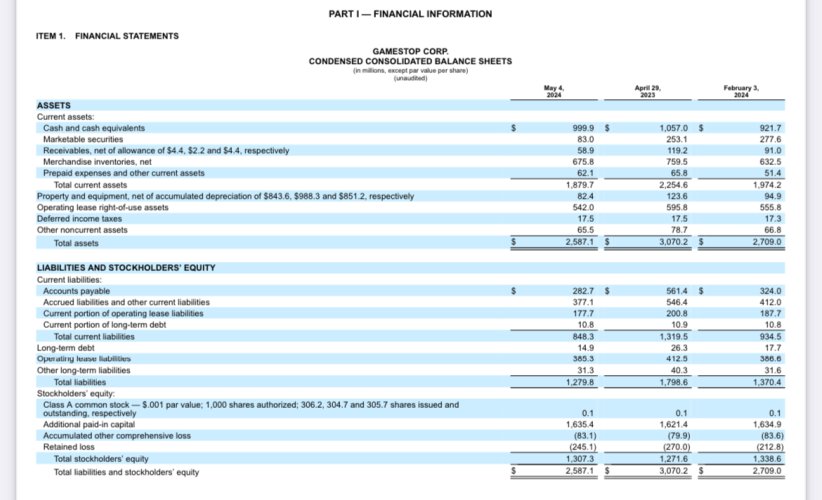

Interestingly, had GameStop not diluted 45 million shares recently, then if DFV found a way to exercise his call options then he would be at exactly 5% ownership of a multibillion dollar company and would have had to file a 13D.

I get all the takes on this situation and I’m sure I’m biased. But this is just incredible how one dude in his basement turned a 50K yolo into more than a 200 million dollars in net worth.

So, Citron just went loud and proud themselves (but on the short side), now believes there is no way DFV was able to build this capital himself, and suggests there is a 2nd shooter from the grassy knoll.