Offline

Well-known Wall Street Bear David Rosenberg?

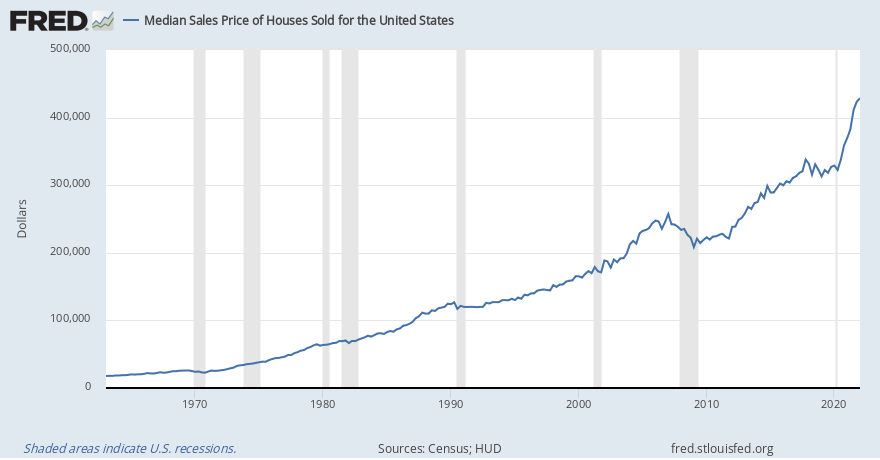

I'm not saying he's wrong, there's a lot of evidence pointing that way, but David Rosenberg is still David Rosenberg. But again all I'm saying is look at the housing chart over the past 50 years. The times when the line turns downward don't last very long and they don't go that far down.

And the basics (the supply of houses versus the number of people wanting to buy houses) remain price-supportive to me. So some air gets let out for a bit. Seems reasonable but it's not going to last.

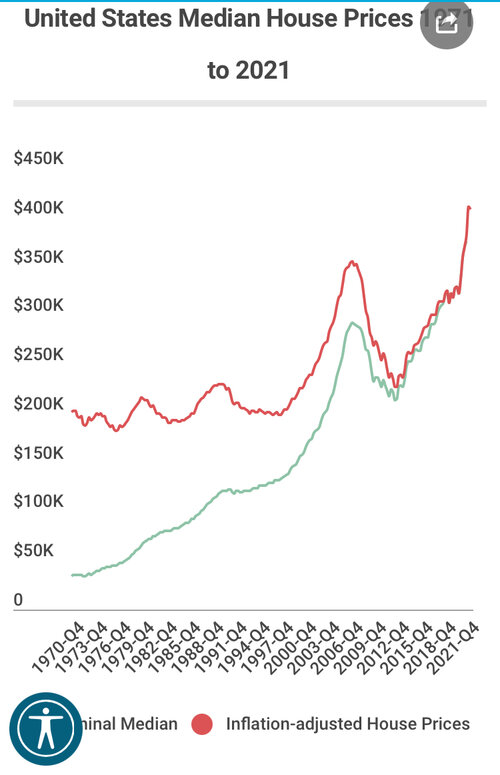

I agree in a sense that the downturns are short-lived, and i hope its a "stair-step" effect akin to gas prices ( where steps back arent as steep as jumps up and they settle, but always seem to settle at a number higher than the last cycle )

I just hope that the housing market follows that pattern so as not to wipe out equity in a short span for many. In turn, putting pressure on the overall market and valuations.